- What is Profitability Index?

- How to Calculate Profitability Index?

- Profitability Index Formula

- What is a Good Profitability Index (PI)?

- Profitability Index vs. NPV: What is the Difference?

- Profitability Index Calculator

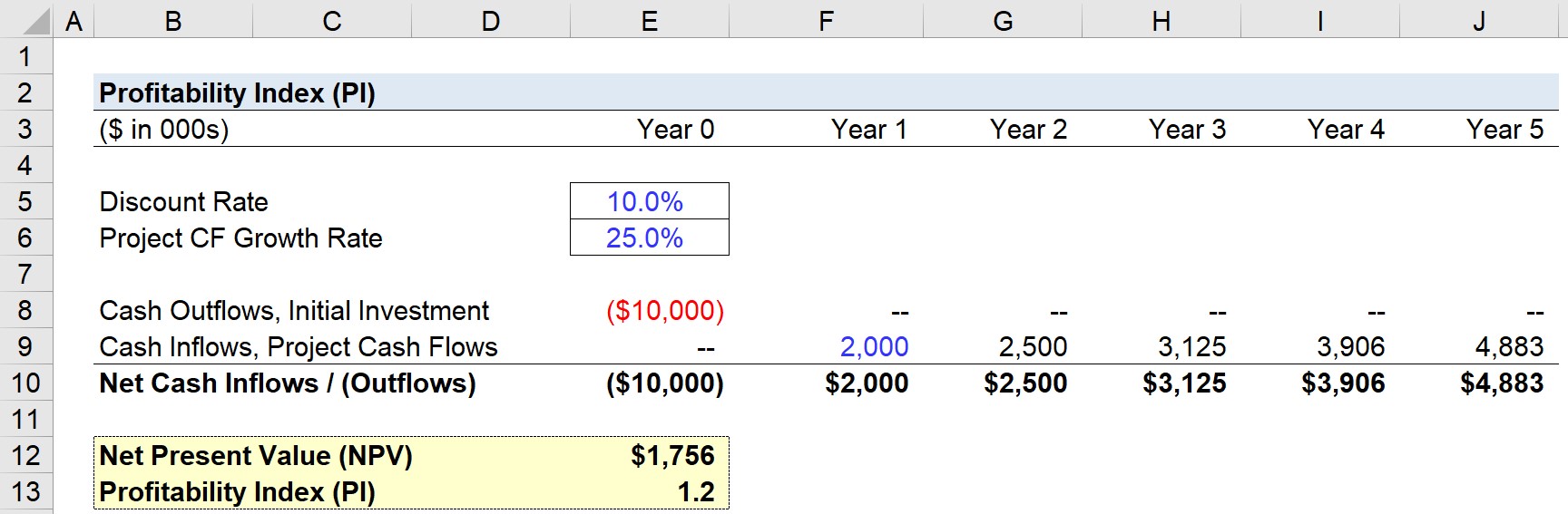

- 1. Project Assumptions

- 2. NPV Calculation Example

- 3. Profitability Index Calculation Example (PI)

What is Profitability Index?

The Profitability Index (PI) is the ratio between the present value of cash inflows and the present value of cash outflows.

How to Calculate Profitability Index?

The profitability index (PI) is a tool to measure the monetary benefits (i.e. cash inflows) received for each dollar invested (i.e. cash outflow), with the cash flows discounted back to the present date.

In short, the profitability index (PI) measures the attractiveness of a potential project or investment to guide decision-making.

More specifically, the PI ratio compares the present value (PV) of future cash flows received from a project to the initial cash outflow (investment) to fund the project.

Therefore, the metric quantifies the economic feasibility of a project (or investment), which can then be ranked to comparable opportunities to allocate capital toward the most profitable option.

Profitability Index Formula

The formula for calculating the profitability index is as follows.

Another variation of the PI formula adds the initial investment to the net present value (NPV), which is then divided by the initial investment.

What is a Good Profitability Index (PI)?

In corporate finance, the primary use case for the PI ratio is for ranking projects and capital investments.

The higher the profitability index (PI) ratio, the more attractive the proposed project is, and the more likely it will be pursued.

For some general guidelines on interpreting the PI ratio:

- PI =1 → Neutral or Acceptable

- PI >1 → Approve Project

- PI <1 → Reject Project

Profitability Index vs. NPV: What is the Difference?

The profitability index (PI) and net present value (NPV) are two closely related metrics.

- If PI Ratio is >1 → Positive NPV

- If PI Ratio is <1 → Negative NPV

The major distinction between the two is that the profitability index depicts a “relative” measure of value, whereas the net present value (NPV) represents an “absolute” measure of value.

With that said, for purposes of presenting a project or capital investment’s benefits on a per-dollar basis of the initial investment, the profitability index is more practical since it is standardized.

The PI metric can be used to compare projects. By contrast, comparisons of NPV between projects are not always functional (i.e. non-standardized metric).

Profitability Index Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

1. Project Assumptions

Suppose we’re evaluating a proposed five-year project with the following assumptions.

- Discount Rate: 10%

- Project CF Growth Rate: 25%

- Initial Investment: –$10,000,000

- Project Cash Flows (Year 1): $2,000,000

The cost of funding the project is $10 million, and the amount of cash flows generated in Year 1 is $2 million, which will grow by a growth rate of 25% each year.

2. NPV Calculation Example

We can now calculate the net present value (NPV) of the project using the NPV function in Excel:

The net present value (NPV) is $1,756,382.

- NPV = $1,756,382

In the subsequent step, we can now calculate the project’s PI given the NPV from the prior step.

3. Profitability Index Calculation Example (PI)

The profitability index formula consists of two parts:

- In the numerator, we’ll take the NPV and add back the initial investment.

- In the denominator, we’ll link to the initial investment cell with a negative sign in front (so both the numerator and denominator are positive figures).

Therefore, the formula divides the present value (PV) of the project’s future cash flows by the initial investment.

- Profitability Index = ($1,756,382 + $10,000,000) ÷ ($10,000,000) = 1.2

In conclusion, the profitability index of our five-year project is 1.2, so the project seems likely to be accepted unless there are other projects with higher NPVs and profitability indices that are also under consideration.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today