What is Yield on Cost?

The Yield on Cost (YoC) represents a real estate property’s stabilized net operating income (NOI) divided by its total cost, expressed as a percentage.

Conceptually, the yield on cost measures of the risk/return profile of a property investment. The metric compares the potential return earned on a property investment to the total cost incurred by the real estate investor.

How to Calculate Yield on Cost (YoC)

The yield on cost (YoC), often used interchangeably with the term “development yield,” is a real estate investing metric used to determine if the potential return is worth the cost of developing a property.

The yield on cost is frequently used as a benchmark by real estate investors to weigh the potential returns against the expected cost of a project, most frequently regarding property development investments.

Since the yield on cost is the ratio between the potential reward to the risk, the metric is a practical method to confirm the expected return on investment exceeds the total cost incurred.

The pro forma annual return is the stabilized net operating income (NOI). In real estate finance, the NOI metric is by far one of the important measures to analyze the potential profitability of a property investment.

The NOI of a rental property can be determined by calculating the sum of the property’s total income (e.g. rental and ancillary income) minus operating expenses.

Specific to the context of computing the yield on cost of a property investment, note that the NOI is expressed on a pro forma basis.

Yield on Cost vs. Cap Rate: What is the Difference?

The capitalization rate (or “cap rate”) and yield on cost (YoC) are two of the more common metrics used by real estate investors to analyze property investments.

- Cap Rate → The cap rate is the ratio between the net operating income (NOI) and the fair market value (FMV) of a property.

- Yield on Cost (YoC) → In contrast, the yield on cost is the ratio between the net operating income (NOI) and the total development cost, rather than the market value of the property.

Given the distinction in the denominator – i.e. fair market value (FMV) vs. total development cost – the yield on cost can be interpreted as the forward-looking cap rate.

The cap rate and yield on cost are each pro forma metrics, but the latter carries more uncertainty (and thus risk), since the NOI must be stabilized, and the development work, such as construction, has not yet started in most cases.

Hence, another practical method to analyze a potential real estate investment is the development spread, which is the difference between the yield on cost (“going-in” cap rate) and market cap rate (“going-out” cap rate).

The Wharton Online and Wall Street Prep Real Estate Investing & Analysis Certificate Program

Level up your real estate investing career. Enrollment is open for the Feb. 10 - Apr. 6 Wharton Certificate Program cohort.

Enroll TodayWhat is a Good Yield on Cost?

Generally speaking, a higher yield on cost is perceived more positively by real estate investors.

However, an investor must also compare the yield of the target property to the yields on comparable properties as of the present date.

In particular, the commercial real estate market (CRE) relies on the yield on cost metric as a “back-of-the-envelope” method to determine if the risk/return trade-off on a potential property development investment is worthwhile.

If the return on the development project does not far exceed that of acquisition projects, it would be reasonable to assume that most rational property developers would pass up on the opportunity.

- Development Projects → Considering the fact that development projects start from scratch (“ground up”) and require a significant monetary investment, the returns must compensate the investor for the time commitment, resources, and initial outlay, i.e. the property can take decades before reaching stabilization.

- Acquisition Projects → If the investment is a property acquisition – such as a value-add or opportunistic investment on an existing property – rather than a property development – most of the capital spending comprises maintenance and renovation costs. The initial spending post-acquisition is intended to stabilize the property and expand its capacity for future profits. For instance, modernizing an outdated building is a common strategy where the property owner leases out the improved properties at higher prices post-stabilization. Beyond the initial stage, the acquisition can eventually generate steady income streams from tenants over the long-term.

Yield on Cost Formula

The formula to calculate the yield on cost (YoC) is the ratio between a property’s stabilized net operating income (NOI) and total cost.

Where:

- Stabilized Net Operating Income (NOI): The stabilized NOI refers to the expected annual NOI once the construction and developmental work on the property investment (or the maintenance and renovations) are complete. i.e. the property is fully functional and operating. The stabilized net income is when the renovation is complete, and units are leased.

- Total Cost: The composition of the total cost is contingent on the property investment type, as mentioned earlier. For property development investments, the total cost will consist of the purchase price and the cost of developing the property (i.e. construction, capital expenditures). In contrast, most of the spending will be maintenance, renovations, fixtures, and discretionary upgrades in the case of acquisitions.

Yield on Cost Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

1. Real Estate Property Development Investment Assumptions

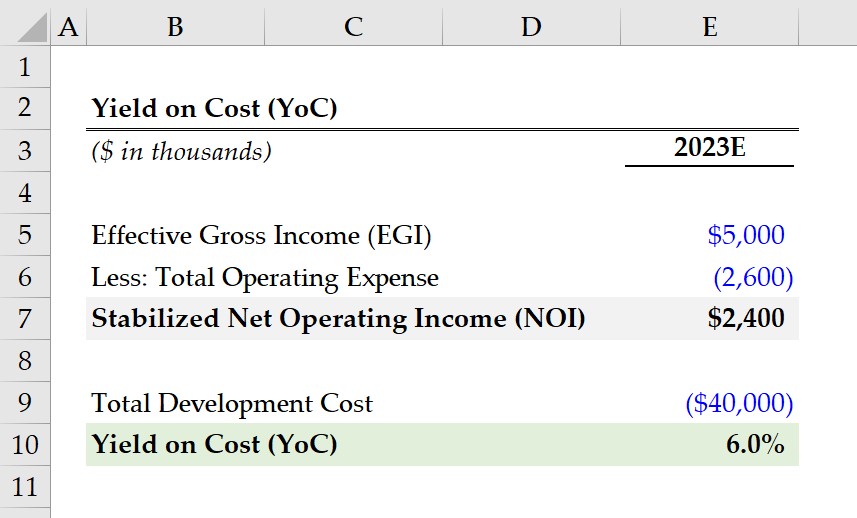

Suppose a commercial real estate investor is considering an opportunity to purchase land to develop a rental property.

The total cost of the project – inclusive of the purchase price and the development costs – amounts to $40 million.

- Total Cost = $40 million

Upon analyzing the future rental income potential of the property on a pro forma basis, the effective gross income (EGI) is projected to be around $5 million at stabilization, while the operating expenses are projected to be $2.6 million.

- Effective Gross Income (EGI) = $5 million

- Total Operating Expense = $2.6 million

The stabilized net operating income (NOI) comes out to $2.4 million, which we determined by deducting the EGI by the total operating expense.

- Stabilized Net Operating Income (NOI) = $5 million – $2.6 million = $2.4 million

2. Yield on Cost Calculation Example

Since we have the two inputs needed to calculate the yield on cost, we can divide our stabilized net operating income (NOI) by the total cost of the development project to arrive at an implied yield on cost of 6.0%.

- Yield on Cost (YoC) = $2.4 million ÷ $40 million = 6.0%

Ultimately, the real estate investor’s decision on the property development investment comes down to where the 6.0% yield on cost stands relative to comparable opportunities of similar risk – not just compared to other development projects, but also to potential acquisitions.

Under the hypothetical scenario where the development yield on a property investment is deemed insufficient, a rational real estate investor is unlikely to continue pursuing the development project since the total cost (and the risk undertaken) outweighs the potential returns.

But of course, the yield on cost (YoC) is only one factor a real estate investor considers, among various others such as the cap rate, development spread, and external market considerations.

Love this breakdown! Phenomenal!