What is Working Capital Turnover?

The Working Capital Turnover is a ratio that compares the net sales generated by a company to its net working capital (NWC).

How to Calculate Working Capital Turnover

The working capital turnover ratio compares a company’s net sales to its net working capital (NWC) in an effort to gauge its operating efficiency.

In practice, the working capital turnover metric is a useful tool for evaluating how efficiently a company uses its working capital to produce more revenue.

To calculate the turnover ratio, a company’s net sales (i.e. “turnover”) must be divided by its net working capital (NWC).

While the working capital metric can be used – i.e. current assets minus current liabilities – the net working capital (NWC) is a more practical measure, since only operating assets and liabilities are included.

- Non-Operating Assets → Cash and cash equivalents like marketable securities are excluded in the calculation of NWC.

- Non-Operating Liabilities → Debt and any interest-bearing securities are also removed because they represent financial liabilities.

Working Capital Turnover Formula

The formula for calculating the working capital turnover is as follows.

The sales of a business are reported on its income statement, which tracks activity over a period of time.

To match the time period of the numerator with the denominator, using the average NWC balances between the beginning and ending periods is recommended.

However, unless the company’s NWC has changed drastically over time, the difference between using the average NWC value and the ending balance value is rarely significant.

What is a Good Working Capital Turnover Ratio?

The NWC turnover ratio can be interpreted as the dollar amount of sales created for each dollar of working capital owned.

- High Turnover → Since a higher turnover ratio implies the company’s working capital management is more efficient, most companies aim to increase the number of “turns.”

- Low Turnover → On the other hand, a lower turnover ratio would suggest the opposite, i.e. the company’s working capital spending and day-to-day management are inefficient.

If a company’s turnover ratio is trailing behind its peers, this may be a sign it may need to further optimize its operational practices, as its sales are insufficient compared to the amount of working capital put to use.

For instance, an NWC turnover ratio of 3.0x indicates that the company generates $3 of sales per dollar of working capital employed.

The turnover ratio portrays the efficiency at which a company’s operations can create sales, which supports the statement from earlier about net working capital (NWC) being preferable over working capital.

In order words, assets such as cash and liabilities such as debt are financial assets that are not necessarily tied to the core operations of a company.

In particular, comparisons among different companies can be less meaningful if the effects of discretionary financing choices by management are included.

Working Capital Turnover Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Working Capital Turnover Calculation Example

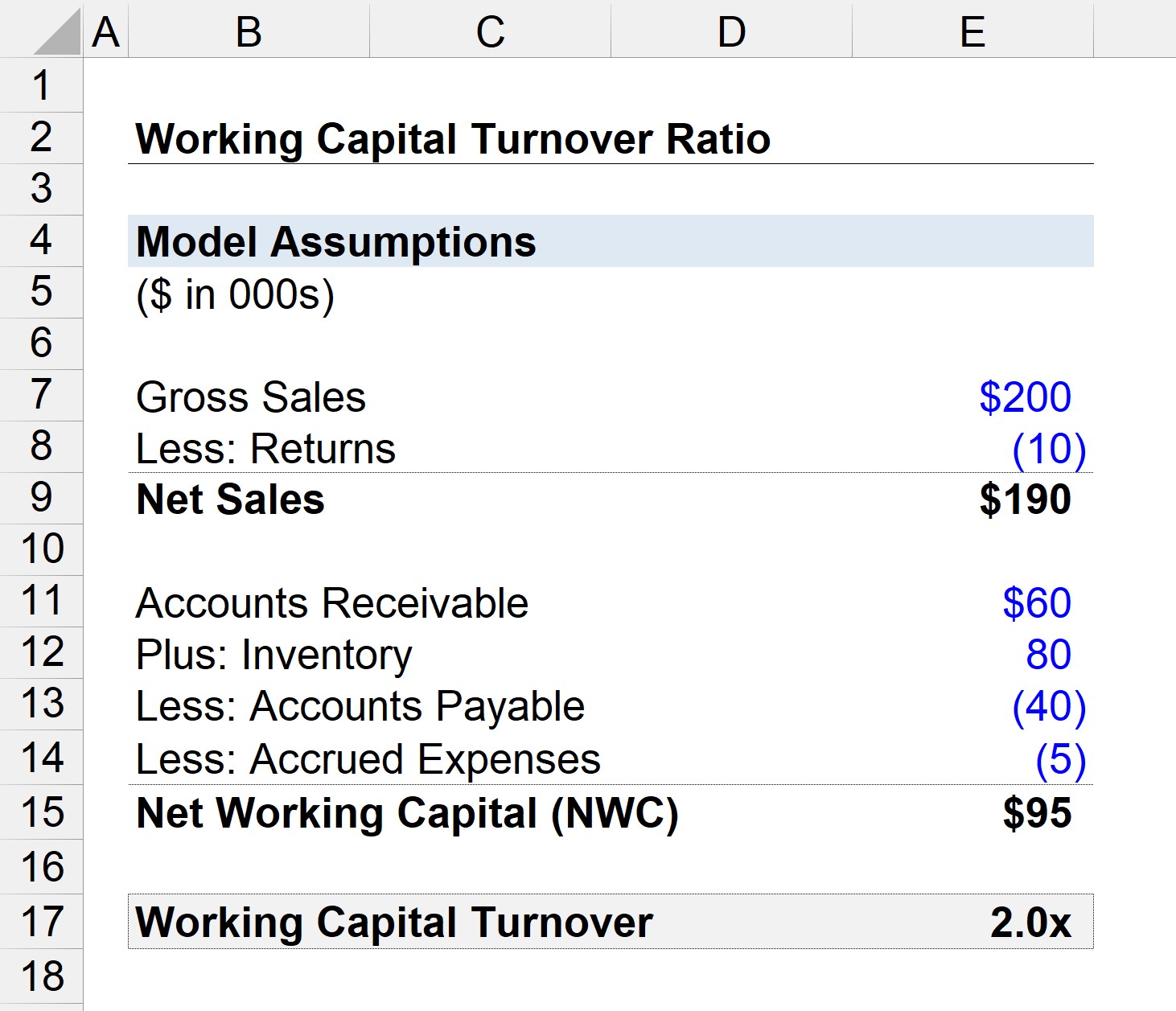

Suppose a business had $200,000 in gross sales in the past year, with $10,000 in returns.

That said, the business made $190,000 in net sales.

- Net Sales = $200,000 – $10,000 = $190,000

The average balances of the company’s net working capital (NWC) line items – i.e. calculated as the sum of the ending and beginning balance divided by two – are shown below.

- Accounts Receivable = $60,000

- Inventory = $80,000

- Accounts Payable = $40,000

- Accrued Expenses = $5,000

Using the assumptions above, the net working capital (NWC) equals the difference between operating current assets minus operating current liabilities, which comes out to be $95,000.

- Net Working Capital (NWC) = ($60,000 + $80,000) – ($40,000 + $5,000) = $95,000

Since we now have the two necessary inputs to calculate the turnover ratio, the remaining step is to divide net sales by NWC.

- NWC Turnover = $190,000 / $95,000 = 2.0x

The 2.0x working capital turnover ratio we arrived at implies that the business generates $2.00 in net sales for each dollar of net working capital (NWC) employed.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today