What is Vertical Integration?

Vertical Integration involves the merger of two or more companies that serve different functions in the supply chain. In such a case, the entire (or most) of the supply chain is controlled by the company. Thus, the company receives increased oversight and control over the internal processes, which should theoretically eliminate operating inefficiencies.

How Does Vertical Integration Work?

Vertical integration consists of a company taking control over at least two steps in a given value chain, such as the production, distribution, or selling of the finished good or service, as opposed to outsourcing certain tasks.

The vertical integration of a supply chain implies that each step of the process is owned and closely controlled by a combined entity.

If a company publicly announces its plans to control and own aspects of its supply chain rather than relying on external suppliers as it did in the past, the shift is called “vertical integration”.

Furthermore, the merged company possesses a greater proportion of the total market share, which directly causes its buyer power to increase and gives it more negotiating leverage over its suppliers and distributors.

The end goal for pursuing vertical integration is to streamline the operational process from start to finish, i.e. having more ownership over all the various stages in a production process.

Companies often opt to outsource or rely on external 3rd parties in an effort to reduce spending, yet sub-par production and quality issues can cause real damage to the branding of the company and diminish the trust of their customer base.

Therefore, vertical integration consists of a company possessing ownership over most, if not all, stages of the production cycle, including the suppliers and distributors.

Suppose an electronics company decided to purchase a supplier with whom they have worked closely in the past, and those suppliers’ parts (and components) are crucial inputs to the device.

If the electronics company decides to acquire the supplier to reduce manufacturing costs and streamline its operations, the acquisition would be an example of vertical integration.

Additionally, another example of vertical integration includes purchasing trucks and fleets of vehicles to transport the parts, i.e. the company is now in control of the entire distribution process.

What are the Pros and Cons of Vertical Integration?

- Greater Control + Less Reliance on 3rd Parties ➝ Normally, the supply chain process starts with purchasing raw materials from suppliers – followed by a wide range of potential steps depending on the context – until the final product reaches the customer. The strategy of vertical integration implies that the company controls multiple stages in its supply chain, thereby reducing or even eliminating the need for reliance on third parties.

- Improved Operating Efficiency ➝ Vertical integration can lead to the production process becoming more efficient with reduced costs (and higher profit margins).

- Initial Outlay ➝ However, the drawback is that there are a great number of initial costs required to build the infrastructure and purchase the necessary equipment. Until the company recoups the initial cost, the integration would remain unprofitable.

- Increase in Responsibilities ➝ Obtaining ownership of the supply chain from start to finish might initially sound appealing, but more control over the process does not necessarily lead to higher quality. While factors such as communication may be improved, the management team must have a thorough plan to manage every step of the production process. Having an inept management team responsible for overseeing the complex supply chain can be risky.

Nike Vertical Integration Strategy Example

Nike (NYSE:NKE), one of the leading companies in sports apparel and equipment with a brand recognized across the globe, applied vertical integration in its business strategy to further establish itself as the market leader.

The core focus of Nike has been product differentiation, cost leadership, and of course, branding.

While product innovation and continued development (R&D) to remain up-to-date with market trends is a priority of Nike, the margins on product sales distinguishes the Oregon-based company from the competition.

To reiterate from earlier, vertical integration provides a company with control over its supply chain, starting from raw materials to the final product (after-market).

Therefore, Nike implemented vertical integration by forming an in-house design team that creates innovative product designs and collaborates with athletes (and celebrities) to develop new product lines.

In particular, Nike is attentive on spotting developing trends and capitalizing on trends, which entails partnering with brand ambassadors with the potential to contribute toward sales.

Formerly, Nike outsourced a significant portion of its manufacturing overseas, but now the company maintains a tight control over the entire production process to ensure the highest product quality for its customers.

The company announced initiatives to closely monitor the quality of its products, including announcing the detailed specifications to set the standard for quality.

Nike also established a global distribution network via wholesale and direct-to-consumer (DTC) channel, but connected the new initiatives to its existing retail stores (i.e. omnichannel marketing).

Therefore, Nike’s e-commerce store and mobile apps control the distribution of its products and interact directly with customers, creating a seamless shopping experience, such as in-store pickup.

In summation, Nike’s vertical integration strategy ensures consistency in product quality, capitalizing on up-and-coming market trends (and changes in consumer preferences or behavioral patterns), and maintains control over its brand image — which all contribute toward improved operating efficiency, more customer loyalty and trust, and higher margins over the long run.

Forward vs. Backward Integration: What is the Difference?

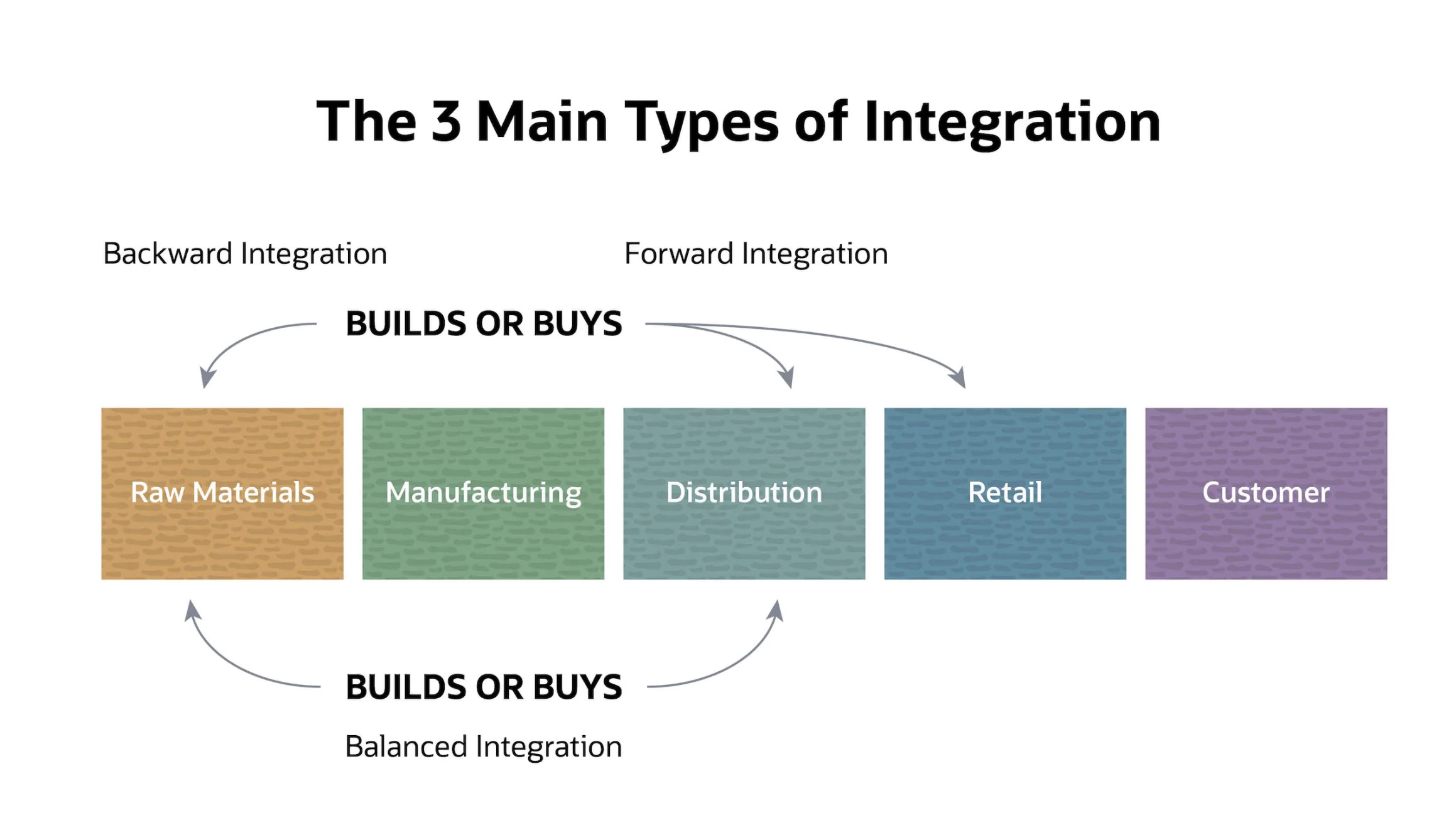

There are two types of vertical integration:

- Forward Integration → When an acquirer moves downstream; i.e. the company’s acquisition target moves them closer to the end customer, e.g. distributor or technical support.

- Backward Integration → When an acquirer moves upstream, the company purchases suppliers or product manufacturers (that are further away from the end customer).

A company undergoing backward integration is shifting its ownership and control of the process to an earlier point in the supply chain.

In contrast, a company pursuing forward integration is moving forward to own and control the production stages that interact more closely with the end customers, such as the distribution process.

Sometimes, a company will pursue a vertically integration strategy that is bidirection—upstream and downstream processes—rather than unidirectional.

The strategy is termed, “balanced integration”, which tends to be riskier and resource-intensive, especially for large-scale companies, but can pay-off significantly if executed properly.

The 3 Main Types of Integration (Source: NetSuite)

Vertical Integration vs. Horizontal Integration: What is the Difference?

Horizontal integration refers to a merger where competitors combine their operations (and asset base) to benefit from economies of scale, increased buyer power over suppliers and vendors, and expand their reach into new geographical locations (and end markets).

The differentiating factor between horizontal integration and vertical integration is that horizontal integration is the merger of close competitors operating in the same market.

On the other hand, vertical integration is between companies operating at different stages in the value chain and with distinct responsibilities in the production cycle.

In contrast to horizontal integration, vertical integration consists of a merger involving companies functioning at various levels of the value chain, such as either upstream or downstream activities.

Each company engaged in vertical integration has its own unique role at a specific stage of the production process.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today