What is Venture Capital Valuation?

In Venture Capital Valuation, the most common approach is called the Venture Capital Method by Bill Sahlman, which we’ll provide an example calculation in our tutorial.

Venture Capital Valuation Tutorial (VC)

In the following example tutorial, we’ll demonstrate how to apply the VC method step-by-step.

Valuation is perhaps the most important element negotiated in a VC term sheet.

While key valuation methodologies like discounted cash flow (DCF) and comparable company analysis are often used, they also have limitations for start-ups, namely because of the lack of positive cash flows or good comparable companies. Instead, the most common VC Valuation approach is called the Venture Capital Method, developed in 1987 by Bill Sahlman.

Venture Capital Valuation Method: Six-Step Process

The venture capital (VC) method is comprised of six steps:

- Estimate the Investment Needed

- Forecast Startup Financials

- Determine the Timing of Exit (IPO, M&A, etc.)

- Calculate Multiple at Exit (based on comps)

- Discount to PV at the Desired Rate of Return

- Determine Valuation and Desired Ownership Stake

Venture Capital Valuation (VC) – Excel Template

Use the form below to download our sample VC Model:

Startup Valuation Example

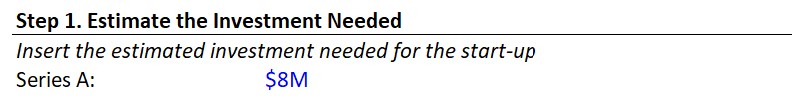

To start, a start-up company is seeking to raise $8M for its Series A investment round.

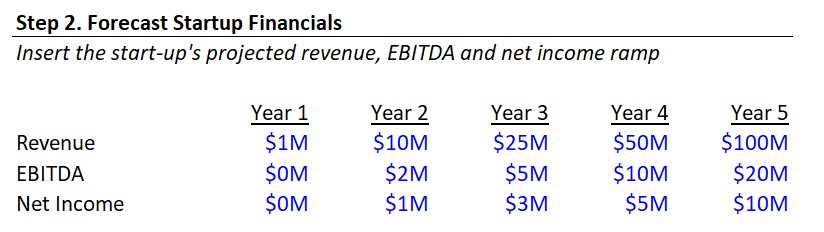

For the financial forecast, the start-up is expected to grow to $100M in sales and $10M in profit by Year 5

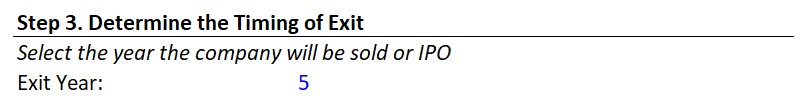

In terms of the expected exit date, the VC firm wants to exit by Year 5 to return the funds to its investors (LPs).

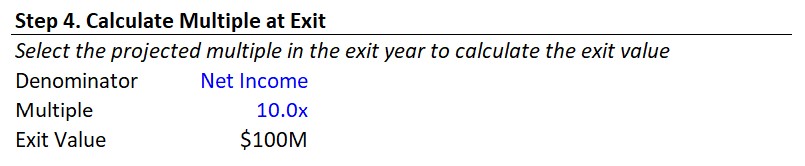

The company’s “comps” – companies comparable to it – are trading for 10x earnings, implying an expected exit value of $100M ($10M x 10x).

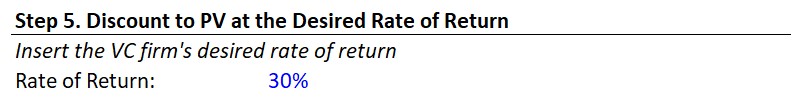

The discount rate will be the VC firm’s desired rate of return of 30%. The discount rate is usually just the cost of equity since there will be zero (or very minimal) debt in the capital structure of the start-up company. Furthermore, it will be very high relative to the discount rates you’re used to seeing in mature public companies while performing DCF analysis (i.e. to compensate the investors for the risk).

This 30% discount rate would then be applied to the DCF formula:

- $100M / (1.3)^5 = $27M

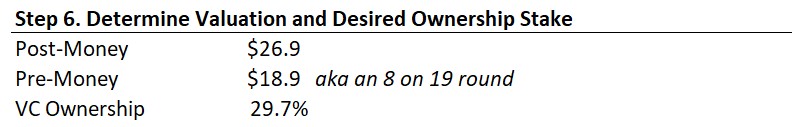

This $27M valuation is known as the post-money value. Subtract the initial investment amount, the $8M, to get to the pre-money value of $19M.

After dividing the initial investment of $8M by the post-money valuation of $27M, we arrive at a VC ownership percentage of approximately 30%.

Pre-Money vs. Post-Money Valuation

The pre-money valuation simply refers to the value of the company before the financing round.

On the other hand, the post-money valuation will account for the new investment(s) after the financing round. The post-money valuation will be calculated as the pre-money valuation plus the newly raised financing amount.

Following an investment, the VC ownership stake is expressed as a percentage of the post-money valuation. But the investment can also be expressed as a percentage of the pre-money valuation.

For example, this would be referred to as an “8 on 19” for the exercise we just went through.

The Wharton Online and Wall Street Prep Private Equity Certificate Program

Level up your career with the world's most recognized private equity investing program. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll Today

what if there was a dilution of 30% over this period as well?

Why are the discounted cash flows from years 1 through 4 ignored in the post-money value calculation? The $27 million post-money valuation only includes the present value of the terminal value calculation so I’m assuming it’s a product of using a known exit date?