What is Vacancy Rate?

The Vacancy Rate refers to the percentage of unoccupied units relative to the total number of rental units available at a property over a specified period.

An unoccupied unit does not generate any rental income for the property owner, so the vacancy rate is closely tracked among participants in the real estate market.

How to Calculate Vacancy Rate

The vacancy rate measures the proportion of rental units that are unoccupied at a particular time and quantifies the dollar amount of rental income lost from unoccupied units throughout a certain time frame.

The rate of vacancy is a key driver of revenue in the following industries:

- Hospitality Industry (Hotels)

- Apartment Complex

- Healthcare Industry (Hospitals, Assisted Living Facilities)

- Rental Platforms (Airbnb)

Because vacancy is directly tied to rental revenue, the metric can be used to assess historical performance and market behavior (i.e. seasonality, cyclicality), as well as forecast future demand.

Backward-looking historical data collected by a property manager or real estate investor can help determine pricing and marketing strategies going forward.

Vacancy Rate Formula

The formula for calculating the vacancy rate on a rental property is as follows.

For example, if a single-family rental available for 365 days in a year was vacant for two months out of the twelve-month period, the rate of vacancy is 16.4% (60 Days ÷ 365 Days).

The Wharton Online and Wall Street Prep Real Estate Investing & Analysis Certificate Program

Level up your real estate investing career. Enrollment is open for the Feb. 10 - Apr. 6 Wharton Certificate Program cohort.

Enroll TodayVacancy Rate vs. Occupancy Rate: What is the Difference?

The vacancy rate is the inverse of the occupancy rate, so the formulas for calculating the occupancy rate on a particular date and annual basis are as follows.

- Occupancy Rate, Single Date = Number of Occupied Rental Units ÷ Total Number of Available Rental Units

- Occupancy Rate, Annual = Number of Days Occupied ÷ Total Number of Available for Rent

Moreover, the formula below is an alternative method to calculate the vacancy rate using the occupancy rate.

What is a Good Vacancy Rate?

To optimize operating efficiency and maximize rental income, properties should attempt to reduce their rate of vacancy over time, all else being equal.

- Lower Vacancy Rate → Higher Rental Income

- Higher Vacancy Rate → Lower Rental Income

While a higher occupancy rate is perceived as a positive sign if the underlying driver is related to increased demand from consumers, which allows the property owner to raise prices and become more profitable.

If the occupancy rate is increased by undercutting competitors’ prices, the effect on revenue and profits could actually be negative.

For property owners with a diverse portfolio of rental properties, vacancy is an important consideration when comparing performance between properties.

Understanding if the demand among renters is rising around a certain location can enable the property owner to set prices appropriately to pocket more profits and capitalize on these trends.

In contrast, becoming aware that renters are shifting away from an area is typically a red flag, which can lead to convincing an owner to sell the property before it loses more value.

Vacancy Rate Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

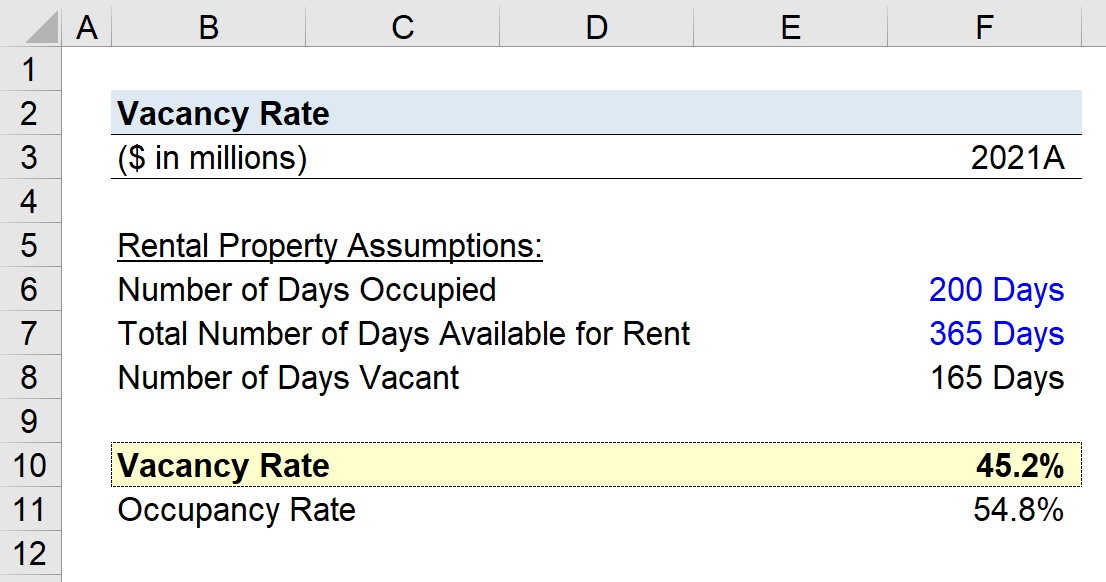

1. Airbnb Rental Property Assumptions

Suppose an Airbnb host is trying to calculate the vacancy rate of their rental property.

In 2021, the rental property was listed as available for rent each day of the entire year.

Of the 365 days the property was available, the number of days the room was occupied was 200 days.

- Number of Days Occupied = 200 Days

- Total Number of Days Available for Rent = 365 Days

2. Vacancy Rate Calculation Example

Given those two assumptions, we can calculate the number of days that the room was unoccupied as 165 days.

- Number of Days Vacant = 365 Days – 200 Days = 165 Days

By dividing the number of vacant days by the number of days available for rent, we arrive at 45.2%.

- Vacancy Rate = 165 Days ÷ 365 Days = 45.2%

From there, we can also back-solve the occupancy rate as 54.8% by subtracting the vacancy rate from one.

- Occupancy Rate = 1 – 45.2% = 54.8%