What are the Tiger Cubs?

Tiger Cubs describe the hedge funds that were founded by the former employees of Julian Robertson’s firm, Tiger Management. Before the firm was shut down, Tiger Management was considered one of the industry’s most prominent hedge funds. Many former employees that were trained directly by Robertson eventually set up their own hedge firms, which are now collectively termed “Tiger Cubs”.

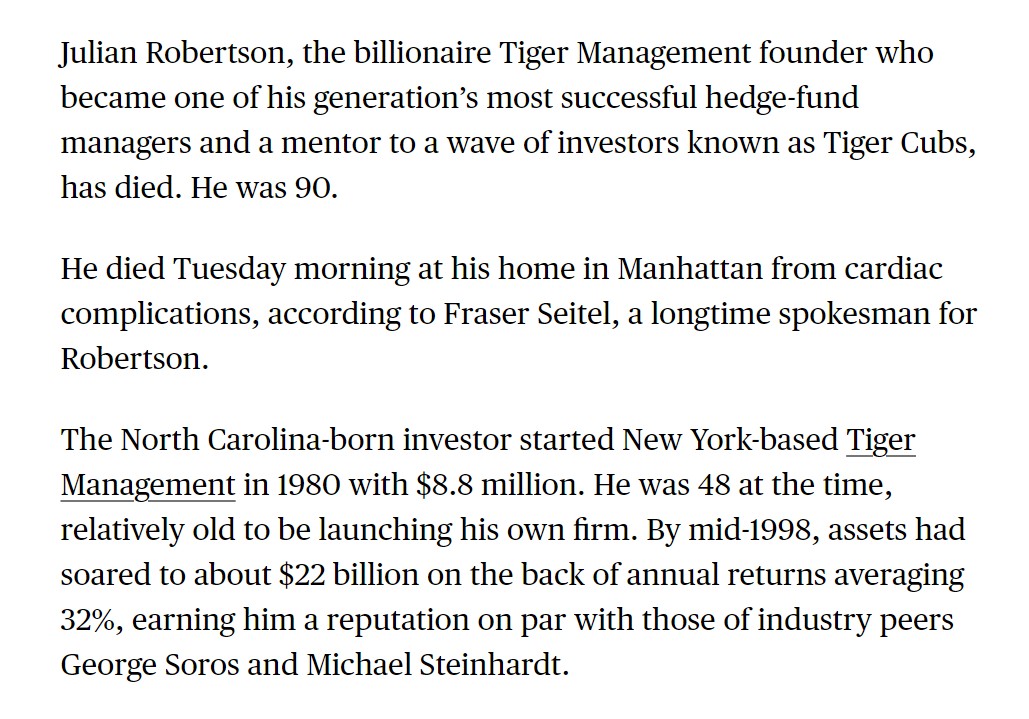

Tiger Management – History of Julian Robertson

Tiger Management was founded in 1980 by Julian Robertson, who started his firm with $8.8 million in assets under management (AUM).

From the fund’s inception to the late 1990s, Tiger Management’s AUM grew to approximately $22 billion, with an average annual return of 32%.

Following multiple years of underperformance and disappointing returns, after which the firm’s AUM declined to $6 billion, Robertson decided to shut down the firm, to the surprise of many.

Despite earning outsized returns for two decades, Robertson stated he could no longer make sense of the current markets, specifically the trends that led to the “dot-com bubble”.

In a letter to his investors, Robertson wrote that there was no reason for him to continue “subjecting to risk in a market which I frankly do not understand.”

The firm’s legacy has continued to the present day, however, as numerous former employees of Tiger Management have since set up their own firms.

As part of shutting down his firm, Robertson provided the seed funding for most of these newly formed hedge funds, coined “Tiger Cubs”.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayList of Tiger Clubs: Hedge Fund Examples

While it is often cited that there are around thirty hedge funds that can be considered Tiger Cubs, more than 200 hedge funds trace their roots to Tiger Management, according to LCH Investments.

Not all the firms listed in the table below are so-called “first-generation” Tiger Cubs.

Certain firms are those with origins that trace back to Tiger Management, which is frequently called “Tiger Heritage”, “Grand Cub,” or “Second Generation” Tiger Cubs.

| Firm Name | Founder |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Learn More → Hedge Fund Quick Primer

Top Hedge Funds by AUM – Excel Template

Interested in accessing our comprehensive database of 400 hedge funds and investment firms in the public equities market?

Fill out the form below to download the Excel spreadsheet at no cost.

What is the Investment Strategy of Tiger Management?

Julian Robertson’s Tiger Management employed a long/short strategy designed to profit from correctly picking the right stocks to take a long position and the worst stocks to short-sell.

Initially, the core investment strategy was oriented around finding undervalued and overvalued stocks mispriced by the market, but the number of opportunities soon diminished as the firm’s assets under management (AUM) grew.

Around 1999, Robertson publicly acknowledged that his past strategy of picking undervalued stocks (”cheap” stocks) while shorting overvalued stocks was no longer as effective.

In the later stages of Robertson’s career, his firm began trading more frequently (e.g. betting on commodities) and investing in themes based on the global economy and political developments, an investing strategy often called “global macro.”

Julian Robertson Quote

“The mistake that we made was that we got too big.”

– Julian Robertson: A Tiger in the Land of Bulls and Bears (Source: Biography)

What is the Fund Strategy of Tiger Cubs?

Each of the Tiger Cubs led by proteges mentored by Robertson utilize their unique strategies, but one common theme is that they focus on performing in-depth diligence into a company’s fundamentals.

For instance, many Tiger Cubs are known for continuing the practice of highly-collaborative, time-consuming team meetings where potential investments are pitched and discussed internally among team members.

However, these meetings are specifically intended to encourage vigorous debates.

Once an investment proposal received the green light, Tiger Management took substantial bets on the position, even if it was highly speculative and risky, which the firm’s long-short strategy helped offset.

Robertson was also weary of the growing technology sector, and his refusal to invest in early dot-com companies was among the factors that ultimately led his firm to close.

However, many Tiger Cubs, such as Tiger Global and Coatue, have become leading technology-oriented investors.

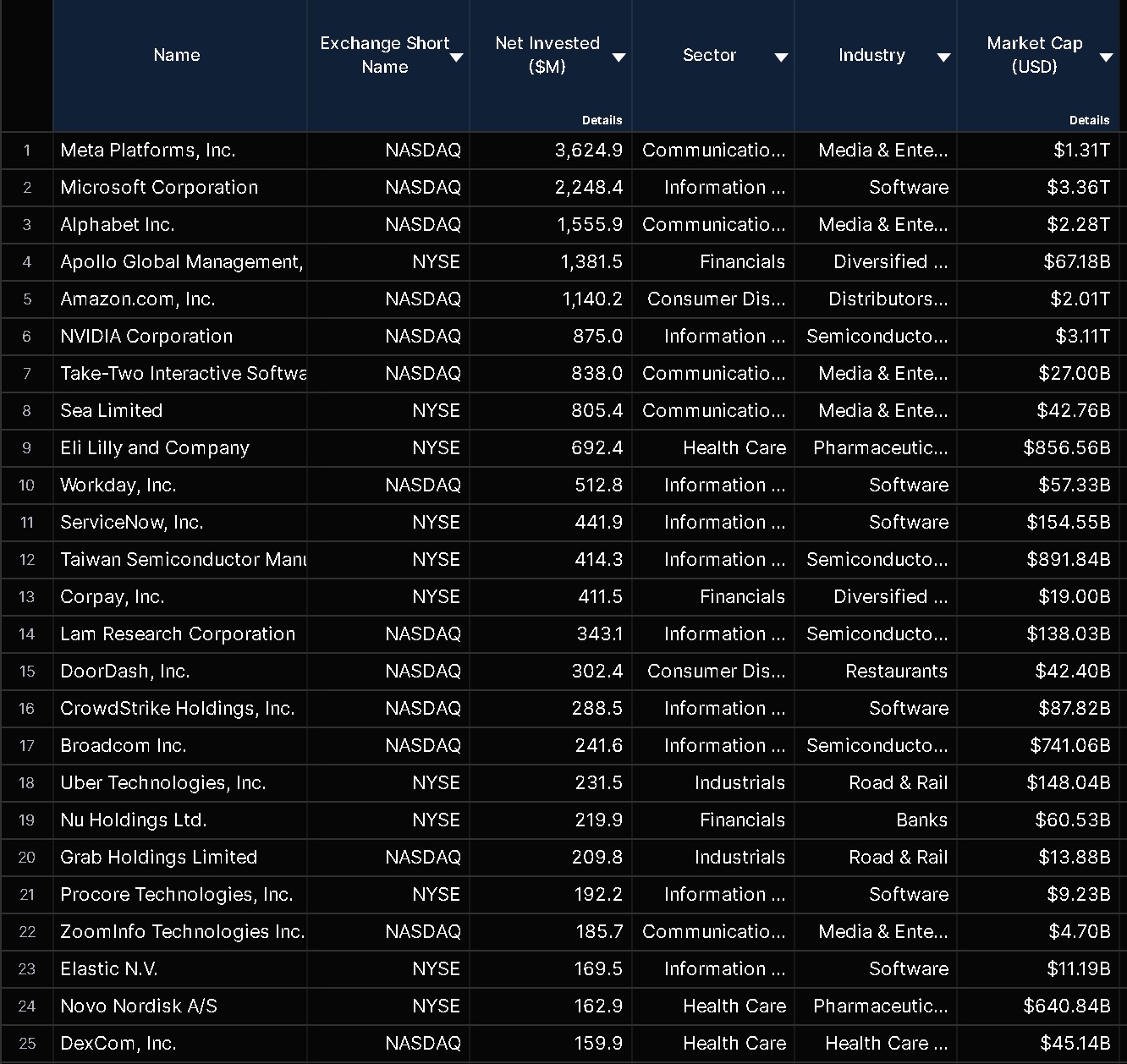

For instance, the following chart pulled from risk data platform Arcana lists the top holdings with the portfolio construction of Tiger Global Management, per 06/26/24.

Tiger Global Management Portfolio Construction (Source: Arcana)

Collapse of Archegos Capital – Bill Hwang

While Tiger Cubs are highly regarded in the hedge fund industry, not all have fared well.

In fact, many of the firms stand accused of predatory short-selling, insider trading, and more.

In particular, Bill Hwang, the founder of Archegos Capital Management, saw his firm collapse in 2021, resulting in around $10 billion in total losses incurred by banks.

The collapse of Archegos prompted federal prosecutors to charge Bill Hwang with conspiracy to commit fraud and market manipulation.