What is Take Rate?

The Take Rate refers to the fees collected by a third-party service platform, such as an eCommerce marketplace or payment services provider.

How to Calculate Take Rate

The take rate is the percentage of a seller’s sales that a third party collects as part of an agreed-upon arrangement.

Namely, there are three different marketplace types where the “take rate” term is common:

- eCommerce Product Marketplace → e.g. Amazon, Shopify, Etsy, eBay

- Fintech Payment Provider → e.g. PayPal, Stripe, Block (Cash App), Zelle

- Service Marketplace Platform → e.g. Airbnb, Uber (and UberEats), Lyft, Grubhub, DoorDash

For marketplaces and payment providers, their primary — or one of their main sources — of revenue is from the fees earned on the sales and transactions processed on their platforms.

Conceptually, the take rate functions like a commission fee charged by a product affiliate, but the difference is that these business models are much more scalable, and the value-add is the platform/service itself.

Take Rate Formula

Specific to an eCommerce product marketplace (e.g., Amazon), the formula for calculating the take rate is as follows.

The earnings received from the platform’s perspective are determined by the GMV and take rate.

By rearranging the formula, we can arrive at the following formula for the take rate.

Similarly, the formula for payment providers is as follows.

The only difference is that rather than the GMV, the total payment volume (TPV) is used.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayTake Rate Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

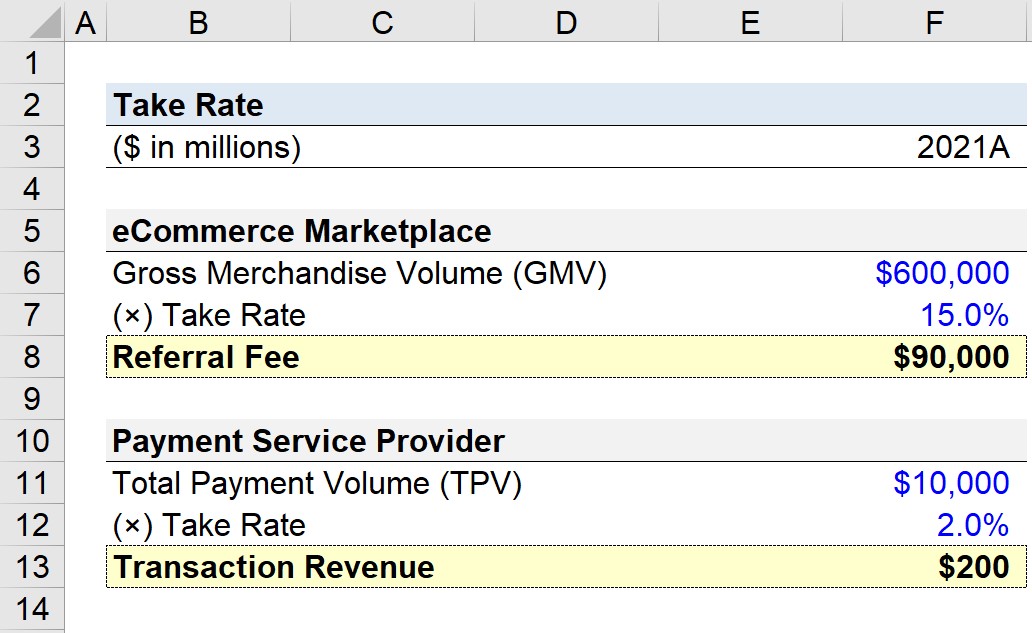

1. eCommerce Marketplace Take Rate Calculation Example

Suppose an eCommerce platform’s business model involves taking a percentage of a third-party seller’s revenue in exchange for the right to sell on their platform.

Given the product category and selling price, the average referral fee incurred by the third-party sellers active on the platform is priced at 15% of its gross merchandise volume (GMV).

If the GMV in 2021 was $600 million, how much would the eCommerce company receive in total referral fees?

The product of the $600 million in GMV and the 15% take rate is $90 billion, which represents the revenue stemming from the take rate.

- Referral Fee = $600 billion × 15% = $90 billion

2. Payment Service Provider Take Rate Calculation Example

For the next part of our exercise, we’ll calculate the transaction revenue received by a payment service provider.

In exchange for managing a company’s online payment processing system (e.g., checkout platform, security, identify verification), the participants must pay a 2% fee on the total payment volume (TPV).

Assuming the TPV was $10 billion in 2021, we can multiply that amount by the 2% take rate to arrive at a transaction processing revenue of $200 million for the payment service provider.

- Transaction Revenue = $10 billion × 2% = $200 million

Fixed Take Rate Fee vs. Variable Service Fee: What is the Difference?

The business models of marketplace companies tend to consist of two core components:

- Fixed Take Rate Fee

- Variable Service Fee

While the former is relatively straightforward, the variable service fee is contingent on numerous factors such as the product category, weight, and average order value (AOV).

The more active the marketplace is in facilitating the transaction between the consumer and the producer, the higher the take rate (and vice versa).

For product-oriented marketplaces, the take rates can range between 5% to 25% (but most pay ~15% on average), whereas service-oriented marketplaces are usually priced marginally higher.

The process of calculating the take rate is straightforward, as the amount charged (i.e. the revenue inflow to the marketplace) equals the product of the tax rate and the applicable volume metric.

For example, gross merchandise volume (GMV) or total payment volume (TPV) could be the metric.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll Today