What is Short Interest?

Short Interest is the percentage of a particular company’s total stock float that has been shorted, i.e. short-positions that have not yet been covered or closed.

How to Calculate Short Interest?

The short interest metric represents the number of shares sold short (“shorted”) by short-sellers that have not yet been closed out, expressed as a percentage.

Simply put, the short interest is the ratio between the number of shares sold short and the float of the shares, as of the present date of the analysis.

Fundamental investors and technical traders alike reference the short interest metric to gauge the level of pessimism surrounding a specific stock and the underlying company.

Calculating the short interest on a company’s publicly-traded stock involves dividing the number of shares sold short by the total float (i.e. total number of publicly traded shares) of the shares.

Learn More → Hedge Fund Primer

Short Interest Formula

The formula for calculating short interest is as follows.

The short interest is typically expressed in percentage form, so the resulting figure must then be multiplied by 100.

- Number of Shares Sold Short → The number of shares shorted represents the short positions still outstanding, while the float refers to the number of shares available in the public markets for purchase.

- Stock Float → One misconception is that the terms stock float and number of shares outstanding are interchangeable. But while shares outstanding refer to the total number of shares held by public investors and insiders, the stock float is defined as the total shares available for trading on public markets.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayShort Interest Calculation Example

For example, suppose a company has 100 million shares of stock float and 4 million shares sold short.

- Stock Float = 100 million

- Shares Sold Short = 4 million

If we enter the following two inputs into our formula, the company’s shares sold short, as a percentage of its total float is 4%.

- Short Interest (%) = 4 million ÷ 100 million = 4%

Since the short interest is expressed as a percentage, the 4% can then be compared to industry peers to evaluate how the company fares against its competitors (or if the negative sentiment applies to all industry participants).

What is a Good Short Interest Percentage?

Short interest is a sentiment indicator, and the interpretation is as follows:

- High Short Interest (%) → Bearish Sentiment

- Low Short Interest (%) → Bullish Sentiment

Generally, if short interest exceeds 10% of a company’s float, that can be a concerning signal.

However, there is one exception, which applies to companies with a disproportionate percentage of short interest.

If a heavily-shorted company were to perform better than expected, a minor share price rise could soon turn into a sharp upward spike — which is a phenomenon known as a “short squeeze.”

As short-sellers look to close out their short positions, the crowded number of buyers attempting to exit by repurchasing shares at once causes a shortage (and share prices to increase).

From the viewpoint of short-sellers, there are two interpretations of seeing significant shorting activities on certain stocks.

- The high percentage of short positions confirms that many other investors in the markets share a similar thesis.

- The high number of short positions represents a substantial risk, as the stock is susceptible to a short squeeze.

Note that the potential downside for short positions is unlimited, so losses are not capped at 100%.

Short Interest Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Short Interest Calculation Example

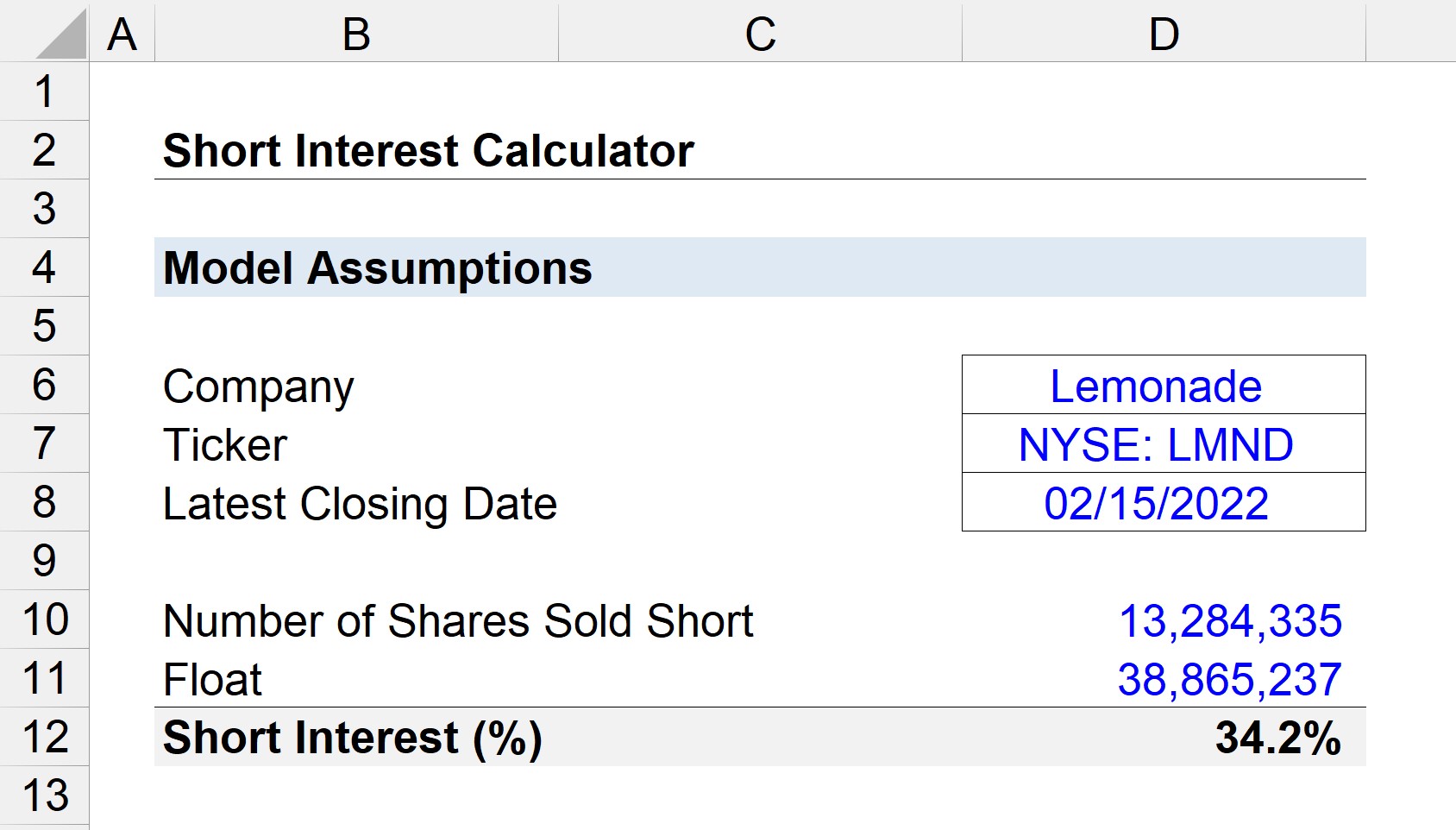

Lemonade (NYSE: LMND) is an InsurTech company that provides homeowners and renters insurance using AI and behavioral economics.

Currently, Lemonade is among the leading companies with regard to short interest.

As of February 15, 2022, Lemonade has a short interest of ~13,284,335 and a float of ~38,865,237.

- Short Interest (%) = 13,284,335 / 38,865,237 = 34.2%

As such, 34.2% of Lemonade’s stock float is currently held in short positions.