What is the Retention Rate?

The Retention Rate measures the percentage of customers that continued to use a company’s products or services across a specified period.

How to Calculate the Customer Retention Rate

The retention rate is the proportion of customers that a company was able to retain over a given period, expressed in the form of a percentage.

Since the sustainability of SaaS and subscription companies is contingent on generating long-term recurring revenue, the retention rate is a critical KPI.

The inverse of the retention rate is the churn rate, which refers to the percentage of a company’s existing customers that opted to cancel their subscriptions – i.e. discontinue being a customer – in a given time horizon.

- High Retention Rate ↔ Low Churn Rate

- Low Retention Rate ↔ High Churn Rate

With that being said, it would be in the best interests of a company to work on increasing its retention rate (and reducing its churn rate).

The higher the retention rate, the more customers a company has retained within a specific period, whereas the lower the retention rate, the more customers have churned.

Therefore, the customer retention rate is an objective “cause-and-effect” metric for companies to understand how their decisions impact customer behavior.

Retention Rate Formula

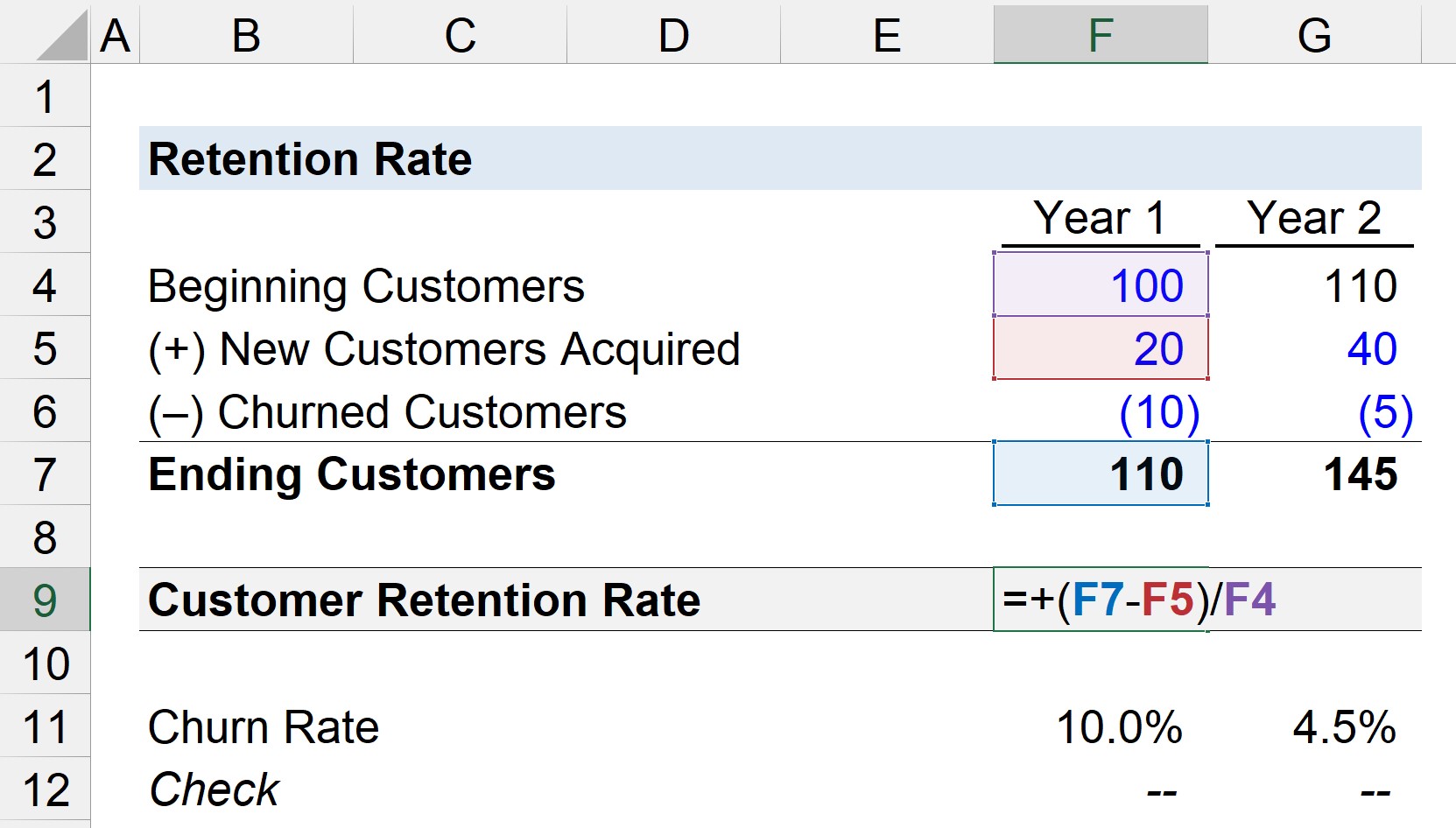

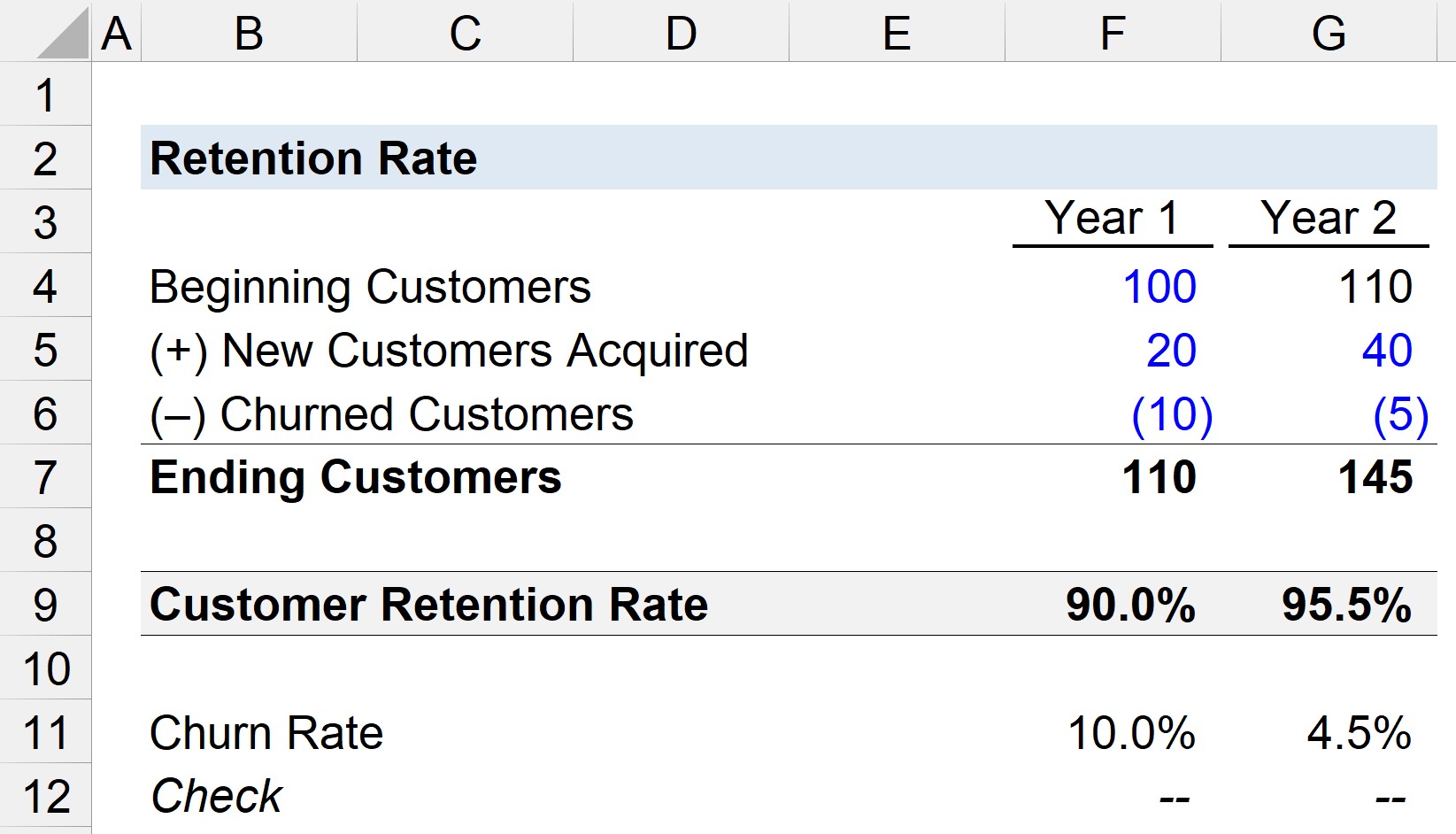

The process of calculating the retention rate requires three inputs:

- Beginning Customers: Number of Customers at Start of Period

- New Customers: Number of New Customer Acquisitions in Current Period

- Ending Customers: Number of Customers at End of Period

The retention rate formula subtracts the number of new customers from the number of ending customers, which is then divided by the number of beginning customers.

Retention Rate Formula

- Retention Rate = (Ending Customers – New Customers) ÷ Beginning Customers

Because the retention rate is the inverse of the churn rate, it can also be calculated by subtracting the churn rate from one.

Retention Rate Formula

- Retention Rate = 1 – Churn Rate

How to Improve Customer Retention Rate

In order to retain customers, a company must continuously improve upon its product offerings and its value proposition to its customers.

When a company’s retention is low, it may be necessary to question the effectiveness of the product offering (i.e. technical capabilities), pricing, sales & marketing, and customer support.

Particularly in highly competitive markets, customers are more susceptible to churn because competitors attempt to find weaknesses in the offerings of other competitors in the market to capitalize on (and steal market share with better products).

Market leaders will most often be the prime targets, so it is necessary to continually reinvest to improve product quality and make strategic adjustments based on historical data, as well as ensure that existing customer needs are being met (i.e. by measuring the net promoter score, or “NPS”).

Some other methods to increase customer retention are the following:

- Upselling / Cross-Selling: Revenue becomes “stickier” from selling more products to the customer, as the switching costs could disincentivize customers from leaving – i.e. it may be costly or inconvenient to move to a different provider, the product line is synergistic, higher likelihood of a customer developing brand loyalty

- Customer Loyalty Rewards: Long-term customers can be rewarded with discounts or reduced pricing for their continued loyalty to the brand, which further makes them less likely to churn.

- Multi-Year Contracts: Compared to a monthly billing plan, securing long-term contracts with customers can essentially lock in their commitment, but that can comes at the cost of needing to offer annual discounts.

- Customer Engagement: Customers frequently provide feedback to companies – either on their own accord or by company request, such as via surveys – but more important than customer engagement is the company’s implementation of their feedback, as that means customer concerns are actually being heard.