- What is Profit and Loss Statement?

- How to Read a Profit and Loss Statement

- How to Prepare Profit and Loss Statement (P&L)

- What is the Format of a P&L Statement?

- Profit and Loss Statement Example: Alphabet (GOOGL)

- Profit and Loss Statement Calculator — Excel Template

- Profit and Loss Statement Calculation Example

What is Profit and Loss Statement?

The Profit and Loss Statement (P&L) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period.

The P&L statement—or “Income Statement”—is a financial report that summarizes a particular company’s revenue, costs, and expenses across a stated period.

How to Read a Profit and Loss Statement

The profit and loss statement—or “P&L Statement”—is one of the three core financial statements that publicly traded companies are obligated to file with the SEC.

For public companies listed in the U.S., the 10-Q profit and loss statement (P&L), often used interchangeably with the term “Income Statement”, must be filed each quarter, with a 10-K annual filing due for the 4th quarter.

- Quarterly Filing (10-Q) ➝ 3x Per Year (and 4th is 10-K)

- Annual Filing (10-K) ➝ 1x Per Year

Together, alongside the cash flow statement (CFS) and balance sheet (B/S), the P&L statement provides a detailed depiction of the financial state of a company.

In particular, the P&L statement shows the operating performance of the company as well as the costs and expenses that impact its profit margins.

Upon assessing a company’s P&L statement, one can gauge the company’s ability to:

- Generate Revenue ➝ Improve Sales Growth (“Top Line”)

- Optimize Operating Structure ➝ Reduce Cost of Goods Sold (COGS) and Operating Costs (SG&A, R&D)

- Increase Profitability → Higher Gross Margin, Contribution Margin (CM), Operating Profit Margin, EBITDA Margin, and Net Profit Margin

How to Prepare Profit and Loss Statement (P&L)

The profit and loss statement (P&L) can be prepared by an accountant under two different methods:

- Accrual Accounting (U.S. GAAP) ➝ Under the revenue recognition principle (ASC 606), revenue is recognized when “earned” under GAAP standards (i.e. product or service delivered to the customer regardless of whether cash payment was received). Expenses are matched in the same period as the corresponding revenue they helped create, which is called the matching principle. The income statement filed with the SEC must abide by U.S. GAAP reporting standards.

- Cash Basis Accounting ➝ Under cash basis accounting, revenue is not recognized until the customer pays in cash to the company for the products or services received. Expenses under cash accounting, similar to revenue, are not recognized until the cash outflow occurs – meaning that the company has actually paid the third party in cash. The income statement prepared under cash-basis accounting are more common for private companies.

What is the Format of a P&L Statement?

The standard profit and loss statement (P&L) format will consist of the following line items:

| Income Statement | Line Items |

|---|---|

| Net Revenue |

|

| Less: Cost of Goods Sold (COGS) |

|

| Gross Profit |

|

| Less: Operating Expenses (Opex) |

|

| Operating Income (EBIT) |

|

| Less: Interest Expense |

|

| Pre-Tax Income (EBT) |

|

| Less: Income Taxes |

|

| Net Income |

|

Profit and Loss Statement Example: Alphabet (GOOGL)

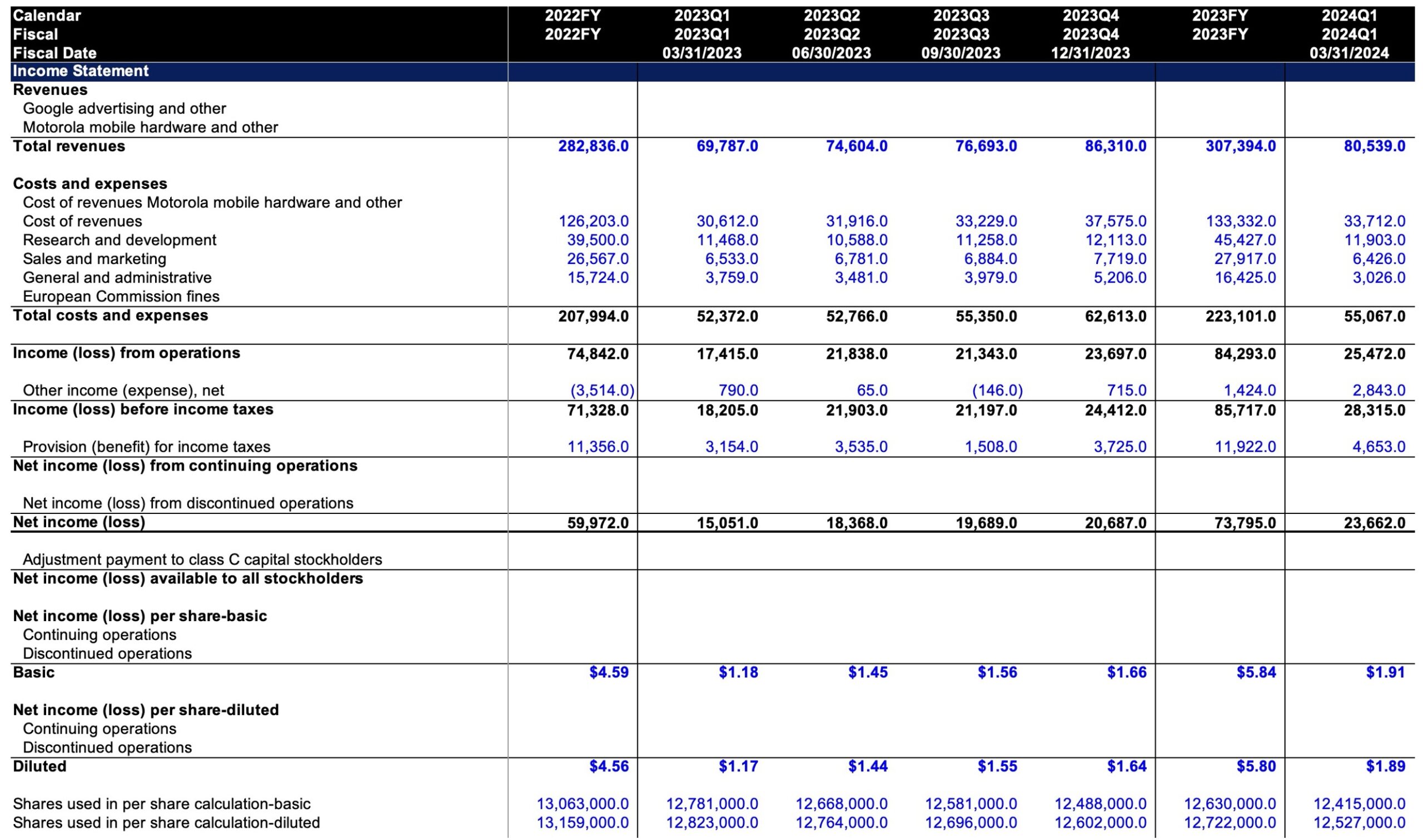

The profit and loss statement (P&L) of Alphabet (GOOGL)—derived from financial data platform Daloopa—is presented below to illustrate the format of an income statement.

Alphabet, Inc. Income Statement Example (Source: Daloopa)

Profit and Loss Statement Calculator — Excel Template

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Profit and Loss Statement Calculation Example

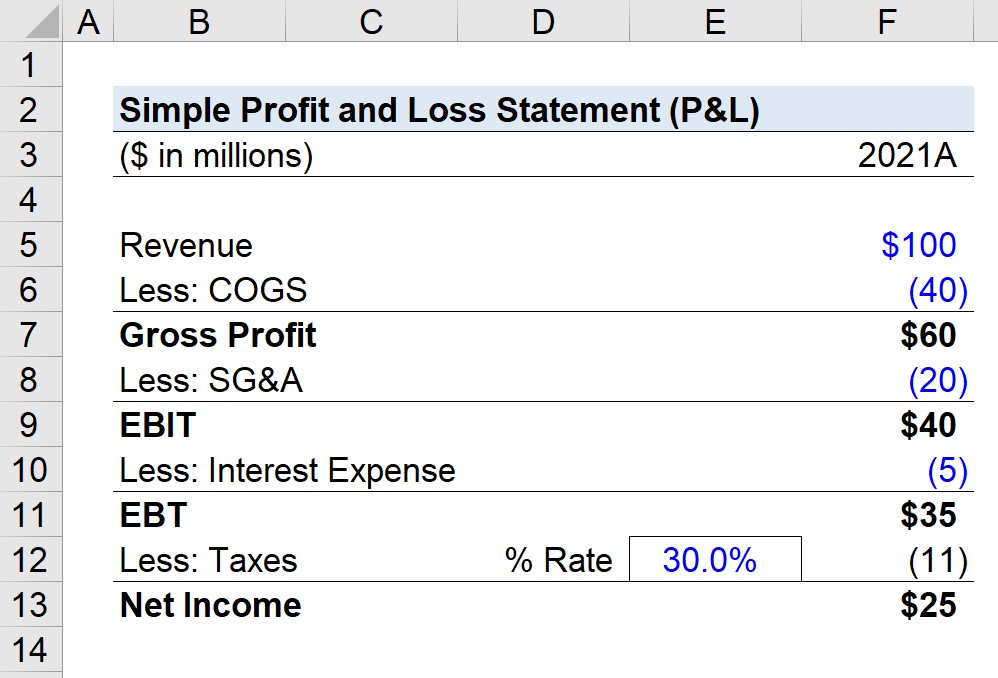

Suppose we’re tasked with creating a simple profit and loss statement (P&L) for a company with the following financial data.

- Revenue = $100 million

- COGS = $40 million

- SG&A = $20 million

- Interest Expense = $5 million

- Tax Rate = 30%

Given those assumptions, we can input each figure into our P&L statement in Excel while ensuring to abide by the industry standard formatting conventions (i.e. the financial modeling “best practices”).

Therefore, the assumptions will be formatted in blue font to denote that the figure is hard-coded input, whereas the calculation metrics are formatted in black font.

Furthermore, each cost and expense is entered as a negative figure to reflect that the line item represents an outflow of cash.

The formula for each profit metric on the profit and loss statement (P&L) is stated in the following list:

- Gross Profit = $100 million – $40 million = $60 million

- EBIT = $60 million – $20 million = $40 million

- Pre-Tax Income (EBT) = $40 million – $5 million = $35 million

- Net Income = $35 million – ($35 million × 30%) = $25 million

In closing, our hypothetical company’s gross profit, EBIT, and net income are $60 million, $40 million, and $25 million, respectively.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today