What is NOI Margin?

The NOI Margin is a profitability ratio that compares a real estate property’s net operating income (NOI) to its revenue, expressed as a percentage.

- The NOI margin is a profitability ratio that evaluates a real estate property’s net operating income (NOI) relative to its total revenue, expressed as a percentage.

- The NOI Margin is calculated by dividing the net operating income (NOI) by the total revenue generated by the property, which includes rental income and other ancillary sources.

- NOI serves as a critical metric in real estate, unaffected by financing decisions or tax variations, providing an unlevered measure of operating profitability.

- NOI is derived from the effective gross income (EGI) after accounting for vacancy and credit losses, and it is further reduced by direct operating expenses, such as property management fees and maintenance costs.

- The standardized NOI margin facilitates the comparison of profitability across similar properties, allowing investors to assess performance relative to industry benchmarks.

How to Calculate NOI Margin?

The NOI margin measures the profitability of a property investment by comparing its net operating income (NOI) to the total revenue it generates over a specific time period.

The net operating income, or “NOI”, is a fundamental metric used in the real estate sector to determine the potential profitability of property investments.

Like EBITDA, net operating income (NOI) is frequently used in practice because the metric is unaffected by discretionary financing decisions or differences in tax policies based on the jurisdiction.

Since net operating income (NOI) is calculated before financing costs, interest and income taxes paid to the government, the NOI metric is an unlevered measure of operating profitability.

By standardizing the net operating income (NOI) metric – i.e. dividing NOI by total revenue – the implied NOI margin can be utilized for purposes related to comparability, wherein a property’s NOI margin can be analyzed side-by-side relative to comparable properties.

NOI Margin Formula

The formula to calculate the NOI margin divides a property’s net operating income (NOI) by its total revenue.

Where:

- Net Operating Income (NOI) → The net operating income (NOI) starts with the property’s total potential income, namely rental income, followed by adjustments for other side sources of ancillary income, as well as deductions for vacancy and credit losses. From there, the direct operating expenses incurred as part of managing a particular property (or portfolio of properties) must be subtracted, such as payroll, general & administrative costs, maintenance costs, utilities, property taxes and property insurance.

- Rental and Other Property Revenue → The total revenue amounts to the sum of the property’s rental income and other sources of revenue, including adjustments for reimbursements.

The net operating income (NOI) metric measures the profits generated by a property after adjusting for vacancy and credit losses and deducting the incurred direct operating expenses.

- Effective Gross Income (EGI) → The effective gross income (EGI) represents a property’s potential gross income (PGI), net of any adjustments related to vacancy and credit losses (i.e. collection issues).

- Vacancy and Credit Losses → The incurred vacancy and credit losses represent the rental income NOT collected from tenants, which is often caused by tenants refusing to fulfill their payment obligations per their lease agreements, either by choice or from unexpected financial difficulties in which the mandatory payment obligations cannot be met on time.

From the effective gross income (EGI) metric, any direct operating expenses are subtracted to determine the annual net operating income (NOI).

Common Property Operating Expenses

- Property Management Fees

- Property Taxes

- Property Insurance

- Repairs and Maintenance

- Utilities

Note: The operating expenses deducted are contingent on the context of the analysis. For instance, estimating the pro forma property-level NOI on a per-segment basis requires a more granular calculation to identify the direct operating expenses and apply the right adjustments.

The Wharton Online and Wall Street Prep Real Estate Investing & Analysis Certificate Program

Level up your real estate investing career. Enrollment is open for the Feb. 10 - Apr. 6 Wharton Certificate Program cohort.

Enroll TodayNOI Margin Calculator — Excel Template

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

1. REIT Operating Assumptions

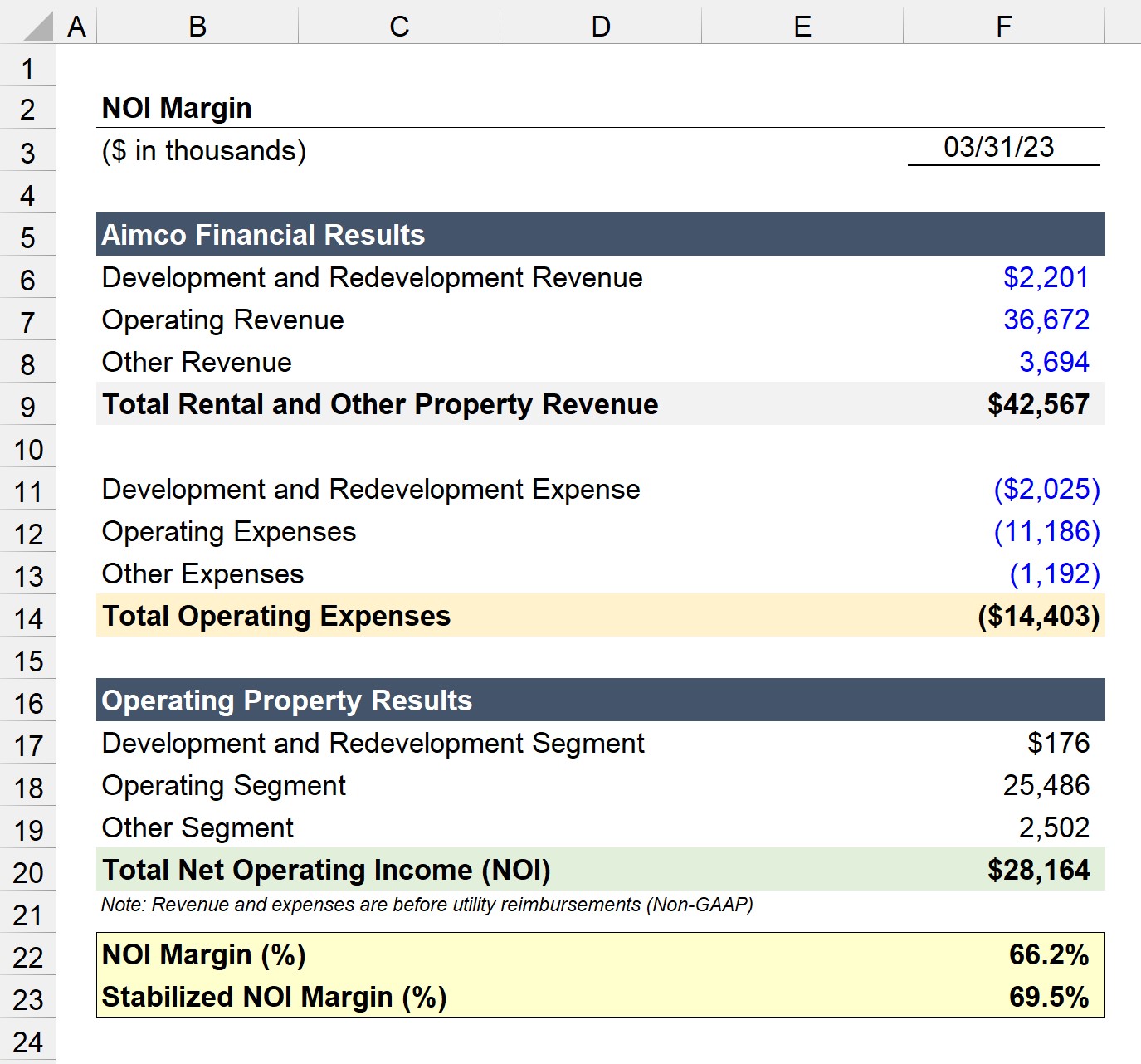

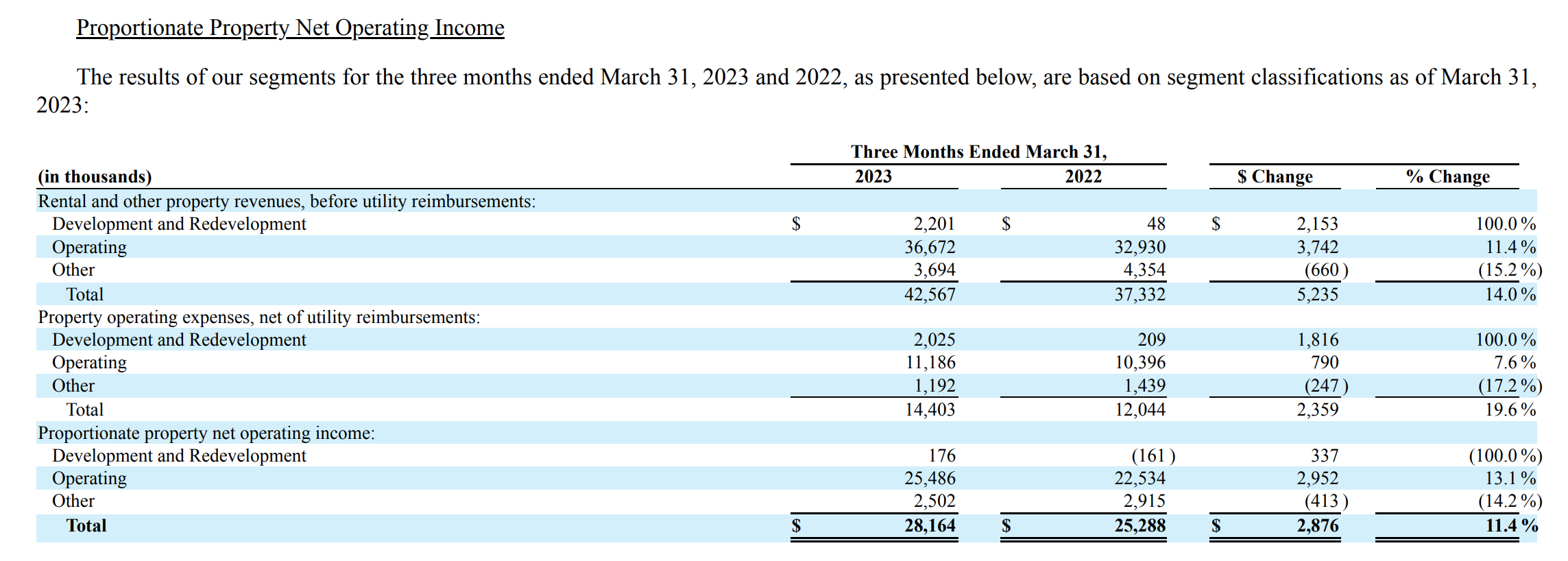

Suppose we’re tasked with calculating the NOI margin of Aimco (NYSE: AIV), a publicly traded real estate investment trust (REIT).

In the latest reporting period, Q-1 of fiscal year 2023, Aimco announced the following financial results.

Quarterly Results (Q1-23)

- Development and Redevelopment Revenue = $2.2 million

- Operating Revenue = $36.7 million

- Other Revenue = $3.7 million

The sum of the revenue produced by the three segments is Aimco’s total quarterly revenue, which comes out to approximately $42.6 million.

- Total Rental and Property Revenue = $42.6 million

On the other hand, the property operating expenses in the corresponding period are as follows.

- Development and Redevelopment Expenses = $2.0 million

- Operating Expenses = $11.2 million

- Other Expenses = $1.2 million

REIT Quarterly Financial Results (Source: Q1-23 10-Q Filing)

2. Net Operating Income Calculation Example (NOI)

In the next part of our exercise, we’ll calculate the net operating income (NOI) per segment.

There are three business segments per Aimco’s financial filings:

- Development and Redevelopment

- Operating

- Other

By subtracting each segment’s revenue from the coinciding operating expenses, we can determine the net operating income (NOI) for each division of the REIT.

Operating Property NOI

- Development and Redevelopment Segment = $176k

- Operating Segment = $25.5 million

- Other Segment = $2.5 million

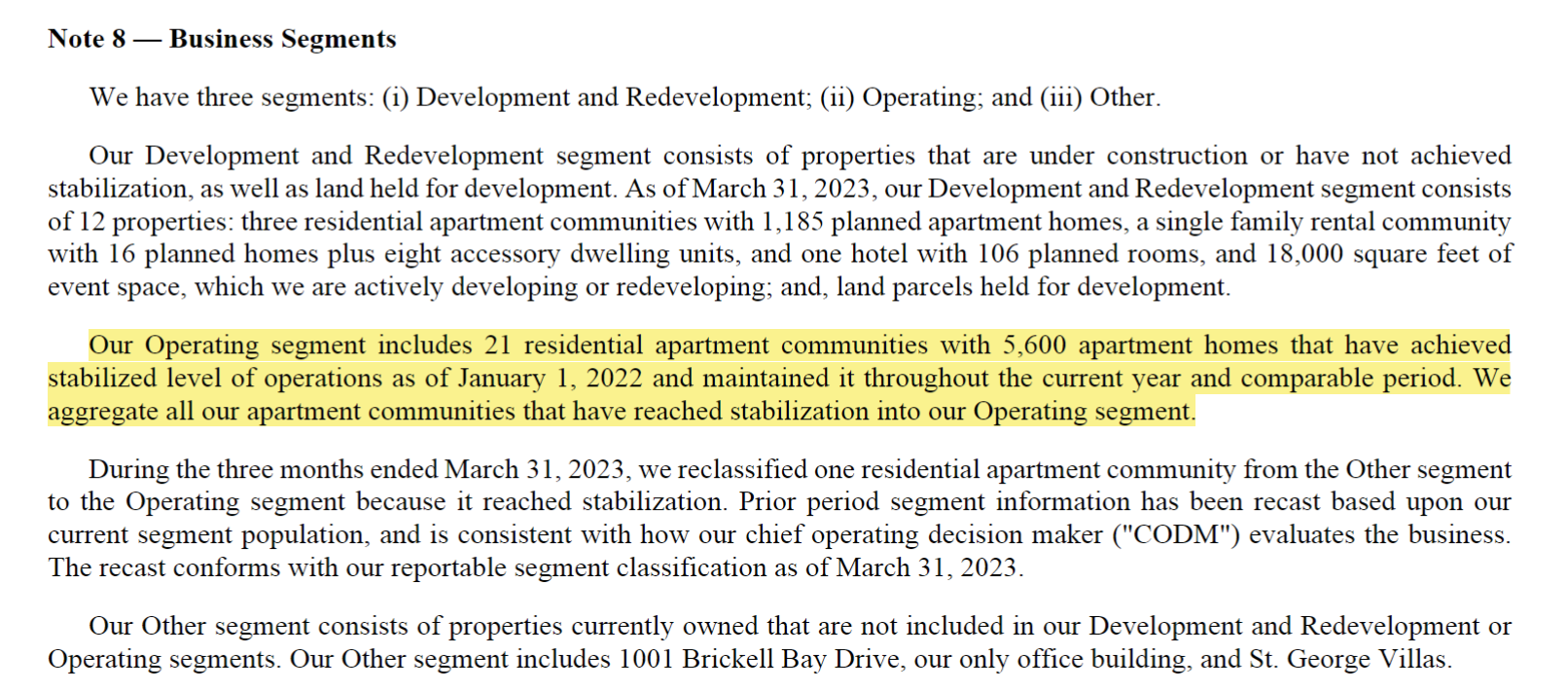

Notably, the second segment – the operating segment – contributes most of the revenue (and net operating income), whereas the first and third segments generate minimal profits in comparison.

This is because the operating segment is the core part of Aimco’s business model and has reached stabilization.

The financials of Aimco used here deviate slightly from the figures recorded on the income statement prepared under GAAP reporting standards.

Why? For REITs, it is rather standard to rely more on non-GAAP metrics to analyze an investment.

3. NOI Margin Calculation Example

In the final section, we’ll conclude by calculating the NOI margin on a total, all-inclusive basis and then on a stabilized basis.

To calculate the total NOI margin, we must divide the total net operating income (NOI) by the total rental and other property revenue metric, which yields 66.2%.

- NOI Margin (%) = $28.2 million ÷ $42.6 million = 66.2%

However, the total NOI margin that we just computed includes the revenue (or lack of revenue) from the properties still under development and not yet stabilized.

Therefore, a more practical method is the stabilized NOI margin, where we’ll divide the net operating income (NOI) generated by the operating segment by the operating revenue to arrive at an implied stabilized NOI margin of 69.5%.

- Stabilized NOI Margin (%) = $25.5 million ÷ $36.7 million = 69.5%