- What is Loan to Value Ratio?

- How to Calculate Loan to Value Ratio (LTV)

- Loan to Value Ratio Formula

- Illustrative Loan to Value Calculation Example

- What is a Good Loan to Value Ratio?

- How to Analyze LTV Ratio in Commercial Real Estate (CRE)

- LTV Ratio vs. CLTV Ratio: What is the Difference?

- Loan to Value Ratio Calculator (LTV)

- 1. Commercial Mortgage Financing Assumptions

- 2. Loan to Value Ratio Calculation Example

What is Loan to Value Ratio?

The Loan to Value Ratio (LTV) is a credit risk metric that compares the size of a mortgage loan to the appraised value of a property as of the present date.

Simply put, the formula to calculate the loan-to-value ratio (LTV) is the loan amount divided by the current appraised property value, expressed as a percentage.

How to Calculate Loan to Value Ratio (LTV)

The loan to value ratio (LTV) is a fundamental measure of risk in the commercial real estate market, most often used as part of loan sizing by lenders.

The loan to value ratio (LTV) is an underwriting metric frequently measured by financial institutions, such as banks and institutional lenders, to analyze credit risk, particularly when performing due diligence on residential and commercial mortgage applications.

The LTV ratio compares the size of a requested loan to the appraised value of the property securing the financing.

To elaborate, the underlying property pledged as collateral on which the lender possesses a lien can be seized in the event of default.

Commercial lenders frequently compare the total dollar value of the proposed loan to the percent contribution of the borrower (i.e. the equity investment), including the fair market value (FMV) of the property securing the loan.

The higher the down payment contributed by the real estate investor or home buyer, the lower the loan-to-value ratio (LTV) – all else being equal.

Generally, a “good” loan-to-value ratio (LTV) is perceived to be around 65% to 80% in the commercial real estate (CRE) market.

However, the prevailing economic conditions and cyclicality in market demand, among other external factors, can cause the target range to fluctuate.

But for the more risk-averse commercial real estate (CRE) lenders, the standard maximum loan-to-value ratio (LTV) is around 75%, which functions as a constraint to limit the loan size (i.e. upper parameter) and mitigate the risk of their lending portfolio.

The loan-to-value ratio (LTV) measures the relationship between two factors relevant to lenders from a risk standpoint.

- Secured Loan Amount ➝ The total amount of debt capital provided by the lender as part of the financing arrangement.

- Appraised Value of Pledged Asset ➝ The appraised fair value of the secured asset, such as a property, as of the current date.

Loan to Value Ratio Formula

The loan to value ratio (LTV) formula divides the loan amount by the appraised property value.

Where:

- Loan Amount → The total size of the loan provided by the lender, or the amount requested by the borrower.

- Appraised Property Value → The estimated fair market value (FMV) of the property on the present date.

Conversely, the property value can be switched out with the purchase price, assuming the variance between the two is marginal.

Since the loan to value ratio (LTV) is expressed as a percentage, the resulting figure should then be multiplied by 100.

The Wharton Online and Wall Street Prep Real Estate Investing & Analysis Certificate Program

Level up your real estate investing career. Enrollment is open for the Feb. 10 - Apr. 6 Wharton Certificate Program cohort.

Enroll TodayIllustrative Loan to Value Calculation Example

For example, suppose a commercial real estate (CRE) investor obtained a $525,000 mortgage loan to purchase a $875,000 office building.

- Commercial Mortgage Loan = $525,000

- Property Value = $875,000

The loan-to-value ratio (LTV) is 60.0%, which is on the lower end of the range in the standard LTV ratio in the commercial real estate market (CRE).

- Loan-to-Value Ratio (LTV) = $525,000 ÷ $875,000 = 60.0%

So, what does a 60% loan to value ratio mean?

The 60.0% loan to value ratio (LTV) means the commercial lender is structuring a secured loan that is 60.0% of the market value of the property.

Therefore, the real estate investor must contribute 40.0% of the required funding in the form of an equity contribution, i.e. the equity acts as a “plug” to fulfill the financing needed based on the total purchase price.

- Equity Contribution (%) = 40.0%

- Equity Investment ($) = $875,000 – $525,000 = $350,000

What is a Good Loan to Value Ratio?

In reality, there is no “quick-and-easy” method to reduce the loan-to-value ratio (LTV) ratio, as the process can be time-consuming and requires patience.

One option is to contribute more toward the down payment prior to taking out the loan. However, note that not every borrower is provided with this sort of option.

For consumers that cannot increase the down payment, one potential course of action is to consider waiting to grow your savings to complete the purchase in better financial circumstances, or perhaps at a time when homes or cars become more affordable (e.g. recession).

The lower the LTV ratio, the better off a borrower will be over the long-term in terms of the interest rate pricing, receipt of favorable lending terms, and optionality to refinance.

While not ideal at initial glance, the compromise can pay off in the long run, so when the right time comes, a larger down payment can be provided with more equity ownership in the property.

Another side consideration is to get your property re-appraised, especially if there is a valid reason to believe that the property value might have risen over the past couple of years.

If so, refinancing or taking out a home equity loan can become easier.

- Refinancing Loan → Refinancing can be negotiated at a lower interest rate since LTV is based on the appraised value rather than the original purchase price.

- Home Equity Loan → Home equity loans are borrowings against the equity on the property, which is beneficial for the borrower if the home’s value has been re-valued at a higher value.

How to Analyze LTV Ratio in Commercial Real Estate (CRE)

Most institutional lenders tend to perceive higher loan-to-value (LTV) ratios as riskier financing arrangements.

- Higher Loan to Value Ratio (LTV) ➝ More Credit Risk (and Higher Interest Rate)

- Lower Loan to Value Ratio (LTV) ➝ Less Credit Risk (and Lower Interest Rate)

In the context of real estate mortgages, the LTV can determine the necessary down payment, the total amount of credit extended, the terms of the loan, and more (e.g. insurance policy).

Typically, banks and lending institutions view an LTV of 80% or less as favorable, and are far more likely to offer favorable terms in such cases, i.e. lower interest rates.

Therefore, a higher loan to value ratio (LTV) can negatively affect the borrower in several ways, such as:

- Higher Interest Rate (i.e. Interest Expense in Function of Loan Balance)

- Higher Monthly Payments

- Private Mortgage Insurance (PMI)

- Less Equity in Property (i.e. Smaller-Sized Down Payment)

- Less Flexibility in Refinancing

- Lower Credit Score

- Increased Credit Risk (and Risk of Default)

- Risk of Asset Forfeiture Post-Default (i.e. Seized Property)

Lenders in real estate frequently use the loan to value ratio (LTV) in the process of underwriting and performing credit analysis to gauge the credit risk undertaken if a proposed loan is approved, alongside other ratios such as the debt service coverage ratio (DSCR) and debt yield ratio.

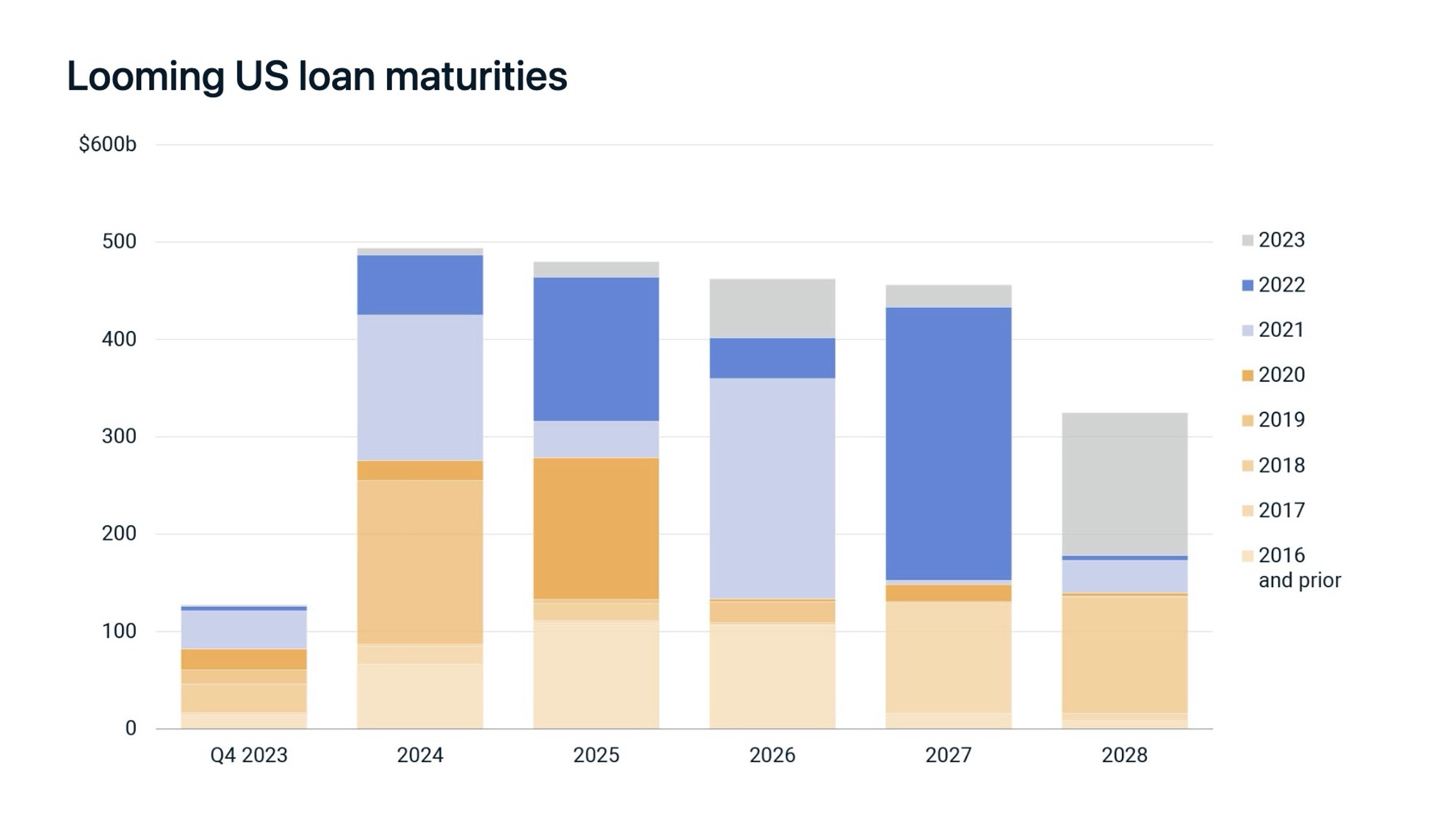

Commercial loan to value ratios (LTVs) for 7-to-10 year fixed-rate mortgage (FRM) products was 57% in 2023, a reduction of 2% from 2021, per research conducted by MSCI.

Loan Maturities by Origination Vintage, Q4 2023 (Source: MSCI Mortgage Debt Intelligence)

LTV Ratio vs. CLTV Ratio: What is the Difference?

The combined loan to value (CLTV) is a ratio that measures two mortgages combined against the appraised property value.

For instance, suppose a homeowner already has a pre-existing mortgage on their home but has decided to apply for another.

The lender that receives the request for financing must evaluate the combined LTV (CLTV), which factors in the following two components:

- Outstanding Loan Balance on the 1st Mortgage → The percentage remaining on the 1st mortgage, the past track record of payments, inter-creditor agreements, etc.

- Proposed 2nd Mortgage → The size of the requested loan, total debt burden placed on the borrower (if approved), the purpose of the 2nd mortgage, etc.

If the current outstanding loan balance is $240,000 on a recently appraised home at $500,000, but now you want to borrow an additional $20,000 in a home equity loan for backyard renovations, the CLTV formula is as follows.

- Combined Loan to Value Ratio (CLTV) = ($240,000 + $20,000) ÷ $500,000

- CLTV Ratio = 52%

Loan to Value Ratio Calculator (LTV)

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

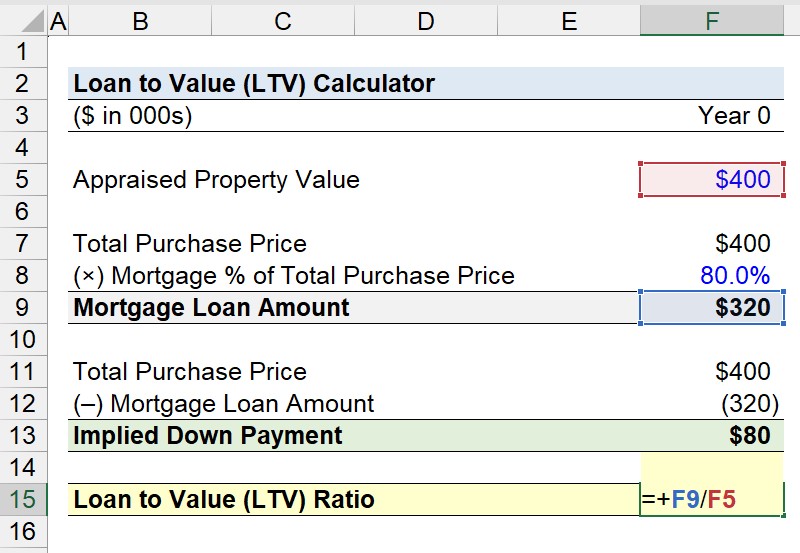

1. Commercial Mortgage Financing Assumptions

Suppose a commercial real estate investor has decided to purchase a commercial office property worth $400k in the market based on a recent appraisal.

Since the real estate investor purchased the property as a rental investment – rather than as a place to occupy – the investor plans to rent out each unit to generate rental income.

To finance the purchase, the investor resorts to finance the purchase using a secured commercial mortgage loan provided by a bank lender.

The bank lender agrees to offer 80.0% of the total purchase price, or $320k.

- Total Purchase Price = $400,000

- Mortgage % of Total Purchase Price = 80.0%

- Mortgage Loan Amount = 80.0% × $400,000 = $320,000

The remaining 20% must be paid out of the investor’s pocket – i.e. the implied down payment – which amounts to $80k.

- Implied Down Payment = 20.0% × $400,000 = $80,000

Note: Assume the “Total Purchase Price” is equivalent to the “Appraised Property Value” and ignore all fees, such as origination fees and closing costs, for the sake of simplicity.

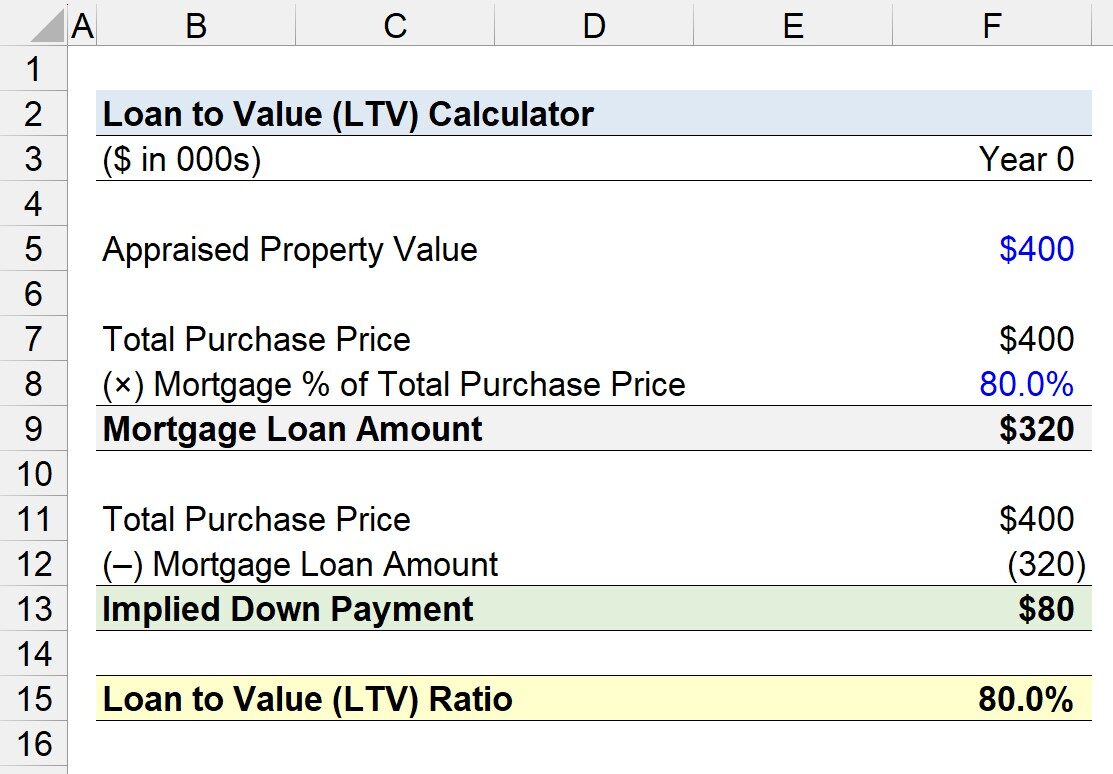

2. Loan to Value Ratio Calculation Example

In conclusion, we arrive at a loan to value (LTV) ratio of 80%, where the bank lender has formally agreed to provide a mortgage loan of $320,000, while $80,000 is the responsibility of the real estate investor.

The investor must contribute the remaining $80,000 in equity for the transaction to close.

The 80% loan-to-value ratio (LTV) implies the bank lender is funding 80% of the total purchase price in the form of a secured mortgage loan, while the remaining 20.0% is contributed by the real estate investor.

- Loan-to-Value Ratio (LTV) = $320,000 ÷ $400,000 = 80.0%

- Equity Contribution = $80,000 ÷ $400,000 = 20.0%