- What is IRR?

- How to Calculate IRR

- IRR Formula

- Predicting IRR Outcomes with AI

- Test Text

- What is a Good IRR?

- How to Analyze IRR in Commercial Real Estate (CRE)

- Excel XIRR vs. IRR Function: What is the Difference?

- What Causes IRR to Increase or Decrease?

- What are the Limitations to Internal Rate of Return?

- IRR Calculator — Excel Template

- 1. LBO Model Entry Assumptions

- 2. Cash Flow Analysis Example

- 3. IRR Calculation Example

- 4. Multiple of Money Calculation Example (MoM)

- 5. LBO Returns Analysis (IRR and MoM)

What is IRR?

The Internal Rate of Return (IRR) is the annualized interest rate at which the initial capital investment must have grown to reach the ending value from the beginning value.

The IRR measures the compounded return on an investment, with the two inputs being the value of the cash inflows / (outflows) and the timing, i.e., the coinciding dates.

- The internal rate of return (IRR) is the annualized interest rate at which an initial capital investment grows to its ending value.

- The IRR reflects the compounded return on an investment, per the size of the cash inflows (or outflows) and the coinciding timing.

- The formula to calculate IRR divides the future value (FV) by the present value (PV) and raises the resulting figure to the inverse power of the number of periods, which is subtracted by one.

- The IRR can be conceptualized as the expected yield on an investment, or the discount rate at which the net present value (NPV) is equal to zero.

- The IRR is integral to capital budgeting and investment analysis, as a higher IRR implies a more profitable investment or project (and vice versa).

How to Calculate IRR

The internal rate of return (IRR) metric is an estimate of the annualized rate of return on an investment or project.

- Capital Budgeting ➝ The internal rate of return (IRR) is the discount rate at which the net present value (NPV) on a project or investment is equal to zero, i.e. the discounted series of cash flows are of equivalent value to the initial investment.

- Investment Analysis ➝ The internal rate of return (IRR) is the potential rate of return on an investment, expressed on an annualized basis. The IRR is a tool to analyze the expected yield on an investment to ensure the return meets the minimum required rate of return (“hurdle rate”) specific to the investor.

The higher the internal rate of return (IRR), the more profitable a potential investment will likely be if undertaken, all else being equal.

Unlike the multiple of on invested capital (MOIC), another metric tracked by investors to measure their returns, the IRR is considered to be “time-weighted” because it accounts for the specific dates that the cash proceeds are received.

The manual calculation of the IRR metric involves the following steps:

- Step 1 ➝ Divide the Future Value (FV) by the Present Value (PV)

- Step 2 ➝ Raise to the Inverse Power of the Number of Periods (i.e. 1 ÷ n)

- Step 3 ➝ From the Resulting Figure, Subtract by One to Compute the IRR

IRR Formula

The formula for calculating the internal rate of return (IRR) is as follows:

Conceptually, the IRR can also be considered the rate of return, where the net present value (NPV) of the project or investment equals zero.

The alternative formulas, most often taught in academia, involve solving for the IRR for the equation to hold true (and require using a financial calculator).

- 0 = CF t = 0 + [CF t = 1 ÷ (1 + IRR)] + [CF t = 2 ÷ (1 + IRR)^2] + … + [CF t = n ÷ (1 + IRR)^ n]

Or, an alternative method to solve for IRR is the following:

- 0 = NPV Σ CF n ÷ (1 + IRR)^ n

Predicting IRR Outcomes with AI

Imagine using artificial intelligence to predict deal outcomes, giving you a real-time understanding of IRR. Well, we’re there! Understanding the internal rate of return of a project is the holy grail in decision-making, and the power of artificial intelligence can provide instant insights into the potential return of a project. You can remove the guesswork and all-night number crunching using artificial intelligence. That’s why we created a world-class professional AI for Business and Finance Certificate in partnership with Columbia Business School Executive Education.

Test Text

What is a Good IRR?

In the context of a leveraged buyout (LBO) transaction, the minimum internal rate of return (IRR) is usually 20% for most private equity firms.

However, the IRR can be easily distorted by the earlier receipt of cash proceeds.

For instance, suppose a private equity firm anticipates an LBO investment to yield an 30% internal rate of return (IRR) if sold on the present date, which at first glance sounds great.

But from a more in-depth look, if the multiple on invested capital (MOIC) on the same investment is merely 1.5x, the implied return is far less impressive.

Why? The 30% IRR is more attributable to the quicker return of capital, rather than substantial growth in the size of the investment.

The Wharton Online and Wall Street Prep Private Equity Certificate Program

Level up your career with the world's most recognized private equity investing program. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayHow to Analyze IRR in Commercial Real Estate (CRE)

In the commercial real estate (CRE) industry, the target IRR on a property investment tends to be set around 15% to 20%.

The investment strategies, of course, are much more diverse in the commercial real estate (CRE) industry, since properties like office buildings are purchased, rather than companies.

However, one commonality between the two industries is the reliance on leverage to fund the purchase price.

Furthermore, the hold period can last from five to ten years in the CRE industry, whereas the standard holding period in the private equity industry is between three to eight years.

But applicable to both industries, the IRR metric is the most benchmarked marketing metric to measure fund performance and an influential factor in the ability for firms to meet (or surpass) their capital raising efforts for their next fund from existing and new limited partners (LPs).

Excel XIRR vs. IRR Function: What is the Difference?

The Excel XIRR function is preferable over the IRR function as it has more flexibility by not being restricted to annual periods. Under XIRR, daily compounding is assumed, and the effective annual rate is returned. But for the IRR function, the interest rate is returned assuming a stream of equally spaced cash flows.

The drawback to the Excel IRR function is the implicit assumption that precisely twelve months separate each cell. Unlike the IRR Function in Excel, the XIRR function can handle complex scenarios that require taking into account the timing of each cash inflow and outflow (i.e. the volatility of multiple cash flows).

What Causes IRR to Increase or Decrease?

The following factors are the main contributors which drive the internal rate of return (IRR):

| Positive IRR Levers | Negative IRR Levers |

|

|

|

|

|

|

Regardless, the internal rate of return (IRR) and MoM are both different pieces of the same puzzle, and each comes with its respective shortcomings.

Of course, the magnitude by which an investment grows matters, however, the pace at which the growth was achieved is just as important.

What are the Limitations to Internal Rate of Return?

The internal rate of return (IRR) cannot be singularly used to make an investment decision, as in most financial metrics.

- Timing of Cash Flows ➝ The internal rate of return (IRR) metric is imperfect and cannot be used as a standalone measure due to being highly sensitive to the timing of the cash flows. Thus, the IRR can be misleading in its portrayal of returns under certain circumstances, wherein a greater proportion of the cash flows are received earlier.

- Shorter Holding Periods ➝ The implied IRR from an investment could be impressively high, yet stem from the shorter holding period, which caused the returns to be artificially inflated and unsustainable if the holding period were hypothetically extended longer.

- Dividend Recap ➝ If a private equity firm issued itself a dividend soon after a leveraged buyout (LBO), i.e. a dividend recapitalization (or recap), the payment would increase the IRR to the fund regardless of whether the multiple-of-money (MoM) meets the required return hurdles – which can cause the IRR to be potentially misleading.

IRR Calculator — Excel Template

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

1. LBO Model Entry Assumptions

Suppose a private equity firm made an equity investment of $85 million in 2022 (Year 0).

- Year 0 = –$85 million Cash Outflow

The value of the initial investment stays unchanged regardless of which year the firm exits the investment.

Since the investment represents an outflow of cash, we’ll place a negative sign in front of the figure in Excel.

2. Cash Flow Analysis Example

Afterward, the positive cash inflows related to the exit represent the proceeds distributed to the investor following the sale of the investment (i.e. realization at exit).

Here, our assumption is that exit proceeds increase by a fixed amount of $25 million each year, starting from the initial investment amount of $85 million.

- Annual Growth in Sponsor Proceeds ($) = +$25 million Per Year

Therefore, the exit proceeds in Year 1 are $110 million, while in Year 3, the proceeds come out to $160 million.

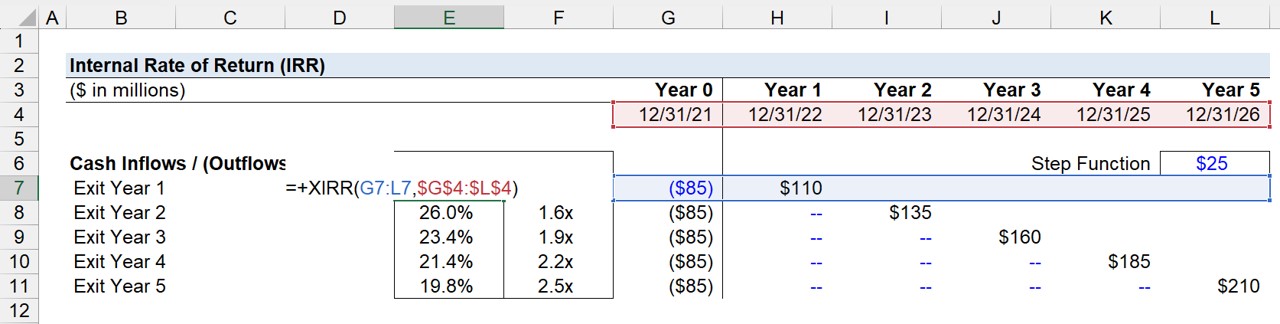

3. IRR Calculation Example

Once our table depicting the cash outflow in Year 0 (the initial investment) and the cash inflows (the exit proceeds) at different dates in the holding period is done, we can calculate the IRR and MoM metrics from this particular investment.

To determine the internal rate of return (IRR) on the LBO investment in Excel, follow the steps below.

- Start by listing out the value of all the cash inflows/(outflows) and the corresponding dates of the date of receipt

- Use the XIRR Excel function (“= XIRR (Range of Cash Flows, Range of Timing)”); the first input requires you to drag the selection box across the range of cash inflows/(outflows)

- For the second input, do the same across all the corresponding dates.

- Press Enter to Calculate the Internal Rate of Return (IRR)

For example, if the exit year is assumed to be Year 1, the IRR comes out to 29.4%.

To reiterate from earlier, the initial cash outflow (i.e. sponsor’s equity contribution at purchase) must be entered as a negative number since the investment is an “outflow” of cash.

Note that for the formula to work and be dragged down, the date selection must be anchored in Excel, i.e. fixed (Press F4).

While the two main factors are the entry investment and exit sale proceeds, other inflows such as dividends or monitoring fees (i.e. the services related to portfolio company consulting) must be input as positives, as well as any additional equity injections later on in the holding period.

4. Multiple of Money Calculation Example (MoM)

In order to calculate the multiple-of-money (MoM), or multiple on invested capital (MOIC), we’ll calculate the sum of all the positive cash inflows from each holding period.

We must then divide that amount by the cash outflow in Year 0.

For instance, assuming a Year 5 exit, the exit proceeds of $210 million are divided by -$85 million to get an MoM of 2.5x.

- Multiple-of-Money (MoM) = $210 million ÷ ($85 million) = 2.5x

Therefore, the private equity firm (PE) retrieved $2.50 per $1.00 equity investment.

5. LBO Returns Analysis (IRR and MoM)

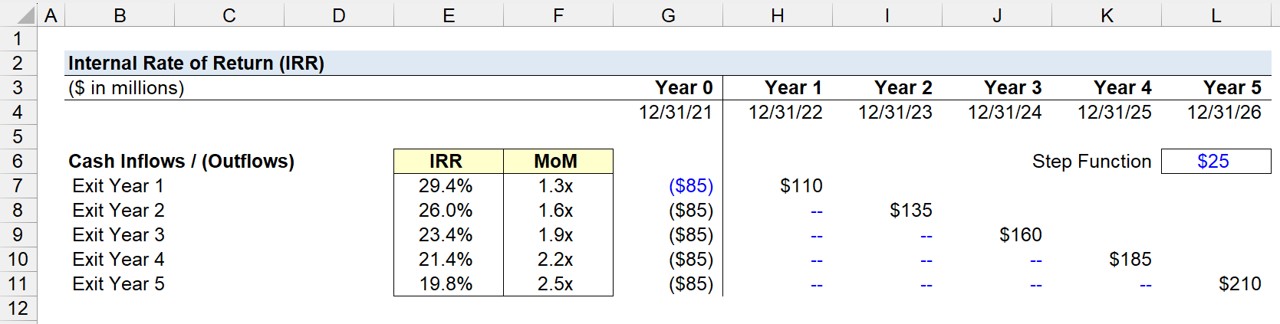

In the final section of our IRR calculation tutorial in Excel, we’ll compute the IRR for each exit year period using the XIRR Excel function.

Based on the completed output for our exercise, we can see the implied IRR and MoM at a Year 5 exit – the standard holding period assumption in most LBO models – is 19.8% and 2.5x, respectively.

- IRR – Exit Year 1 = 29.4%

- IRR – Exit Year 2 = 26.0%

- IRR – Exit Year 3 = 23.4%

- IRR – Exit Year 4 = 21.4%

- IRR – Exit Year 5 = 19.8%

If we were to calculate the IRR using a calculator, the formula would take the future value ($210 million) and divide by the present value (-$85 million) and raise it to the inverse number of periods (1 ÷ 5 Years), and then subtract out one—confirming the internal rate of return (IRR) in Year 5 is 19.8%.

I have a problem with this irr

I get decimals instead of percentage

The cash flow her means operating cash flows only or total cash flows ??

How does the $25M assumption happen? Where is that assumption from/based in?

Re: IRR For the calculation of IRR denoted on the IRR & MoM Calculation worksheet and explained in the Internal Rate of Return (IRR) document, are the Cash Flows in Years1 through Year 5 Pre-tax or After-tax? Example: Let’s assume that the $85m is the full cash investment. If the… Read more »

What if my investment has multiple cash outflows, like the fees associated with licensing software? Let’s say it is a 5-year project and every year I have cash outflows of $125,000? All the IRR examples I’ve seen only have an initial cash outflow. Can I use IRR when I have… Read more »

Can anyone please explain how to calculate irr