What is Internal Growth Rate?

The Internal Growth Rate (IGR) estimates the maximum rate that a company could grow using solely its retained earnings without external financing.

How to Calculate Internal Growth Rate (IGR)

The internal growth rate (IGR) sets a “ceiling” on the maximum growth rate achievable for a specific company, assuming it does not obtain any external financing.

Conceptually, the internal growth rate is the highest growth rate that can be achieved by a company without reliance on equity or debt issuances.

Instead, the implied growth rate assumes that operations are funded solely by internal sources, such as retained earnings and paid-in capital.

There are two main sources of raising external financing:

- Equity Issuances → Selling ownership stakes in the company in exchange for capital.

- Debt Issuances → Borrowing capital with the obligation meet scheduled payments as stated in the loan agreement (e.g. interest expense, mandatory repayment at maturity)

Practically all companies nowadays must raise capital in the form of either issuing equity or debt capital (e.g. corporate bonds).

From a different viewpoint, the internal growth rate could signal that the company might need to seek external financing, i.e. more outside funding is required to reach the next growth stage.

The IGR could be enough for certain companies (and their investor base) while falling short of expectations for others.

Internal Growth Rate Formula (IGR)

The formula for calculating the internal growth rate (IGR) consists of three steps:

- Calculate the retention ratio by subtracting the annual dividend from net income and dividing that by net income

- Calculate the return on assets (ROA) metric, which is equal to net income divided by the average total assets balance (i.e. the sum of the beginning and end-of-period balances divided by two)

- Multiply the company’s retention ratio and return on assets (ROA) to arrive at the internal growth rate (IGR)

Where:

- Retention Ratio = (Net Income – Dividends) ÷ Net Income

- Return on Assets (ROA) = Net Income ÷ Average Total Assets

The retention ratio is the percentage of net income that a company kept to reinvest into its operations, i.e. rather than issue a dividend to shareholders, the leftover earnings are measured by the retention ratio.

The retention ratio can also be calculated by one minus the dividend payout ratio.

- Retention Ratio (%) = 1 – Dividend Payout Ratio

To break down the components of the internal growth rate formula in more detail, the IGR expresses the retained earnings as a percentage of total assets.

- Internal Growth Rate (IGR) = Retained Earnings ÷ Total Assets

The right side of the formula can be re-arranged as:

- IGR = (Retained Earnings ÷ Net Income) × (Net Income ÷ Total Assets)

- IGR = Retention Ratio × Return on Assets (ROA)

Internal Growth Rate Calculation Example

For example, suppose a company reported retained earnings of $4 million, an average total assets of $20 million, and net income of $5 million for fiscal year 2023.

The internal growth rate (IGR) of the company is 20%, which we determined by dividing its retained earnings by its average total assets..

- IGR = $4 million ÷ $20 million = 20%

After entering the same numbers into our expanded formula, the IGR is again equal to 20%.

- IGR = ($4 million ÷ $5 million) × ($5 million ÷ $20 million)

- IGR = 80% × 25% = 20%

IGR vs. SGR: What is the Difference?

One concept closely related to the internal growth rate (IGR) is the sustainable growth rate, which is the growth rate that a company could achieve if its current capital structure – i.e. the mixture of debt and equity – is maintained.

Unlike the IGR, the sustainable growth rate accounts for external financing. But external funding sources are constrained to its existing capital structure.

In comparison, the sustainable growth rate should be higher than the internal growth rate, as more capital is available for reinvesting and discretionary spending on future growth.

Internal Growth Rate Calculator (IGR)

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Internal Growth Rate Calculation Example

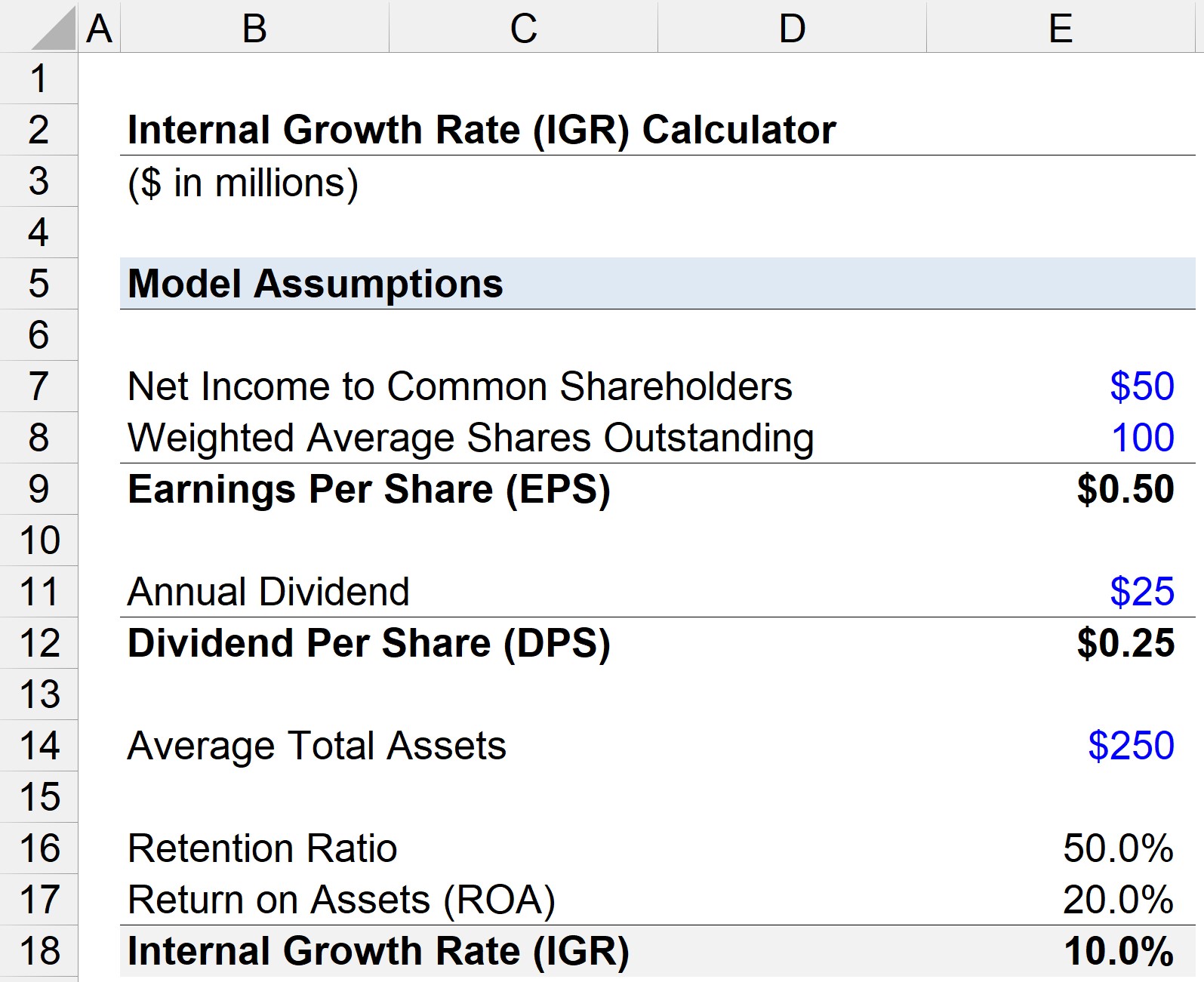

Suppose we’re tasked with calculating the internal growth rate (IGR) for a company with the following financials.

- Net Income to Common Shareholders = $50 million

- Weighted Average Shares Outstanding = 100 million

- Annual Dividend = $25 million

Given those assumptions, we can calculate earnings per share (EPS) and dividend per share (DPS).

- Earnings Per Share (EPS) = $50 million ÷ 100 million = $0.50

- Dividend Per Share (DPS) = $25 million ÷ 100 million = $0.25

If we assume the average total assets is $25 million, the retention ratio can be calculated by the following formula:

- Retention Ratio = ($50 million – $25 million) ÷ $50 million = 50%

Alternatively, we could divide the company’s dividend per share (DPS) by its earnings per share (EPS), and then subtract the result from one – which yields the same value, 50%.

- Retention Ratio = 1 – (DPS ÷ EPS)

- Retention Ratio = 1 – ($0.25 ÷ $0.50) = 50.0%

The final input left in our calculation – return on assets (ROA) – is calculated by dividing net income by average total assets.

- Return on Assets (ROA) = $50 million ÷ $250 million = 20%

We can now multiply the retention ratio by the return on assets (ROA) to calculate the internal growth rate (IGR).

- Internal Growth Rate (IGR) = 50% × 20% = 10%

The 10% IGR in our illustrative scenario implies that our company can achieve a maximum 10% growth rate without any reliance on external financing.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll Today