- What is FFO?

- What is the Definition of Funds from Operations (FFO)?

- How to Calculate FFO

- FFO Formula

- Is FFO a GAAP Measure?

- Why is FFO Important in Real Estate?

- FFO vs. Cash Flow: What is the Difference?

- FFO vs. AFFO: What is the Difference?

- FFO vs. EBITDA vs. NOI: What are the Differences?

- How to Use FFO to Analyze REITs

- FFO Calculator

- REIT FFO Calculation Example

What is FFO?

Funds from Operations (FFO) measures the operating performance of real estate investment trusts (REITs) and their capacity to generate cash.

- FFO stands for "Funds from Operations" and quantifies the cash generated by real estate investment trusts (REITs).

- FFO is a non-GAAP financial measure, yet is widely recognized in the REIT sector as the industry-standard metric to analyze operating performance.

- The formula to calculate FFO reconciles net income starting with the add-back of the depreciation of real estate assets, followed by adjustments for non-recurring items, such as the gain (or loss) on an asset sale and impairments.

- FFO and CFO bear some commonalities, yet FFO is an industry-specific metric intended to measure the operating cash of REITs without adjustments for changes in working capital, which pertain more to non-REIT corporations.

What is the Definition of Funds from Operations (FFO)?

The funds from operations (FFO) metric, in simple terms, measures the cash generated by a real estate investment trust (REIT).

The FFO metric was originally developed by Nareit to reconcile net income, the accrual accounting-based net profit metric per U.S. GAAP reporting guidelines, to become more suitable for analyses on REITs.

REITs own and operate a portfolio of income-producing real estate properties, with holdings that span across a broad range of sectors, such as the residential, commercial, office, retail, and hospitality segments.

REITs must issue a significant proportion of their income to shareholders as dividends as part of their business model because of the regulations governing the REIT sector.

That said, the funds from operations (FFO) metric is a practical method to estimate the capacity of a REIT to maintain, or perhaps raise, its current payout of cash dividends.

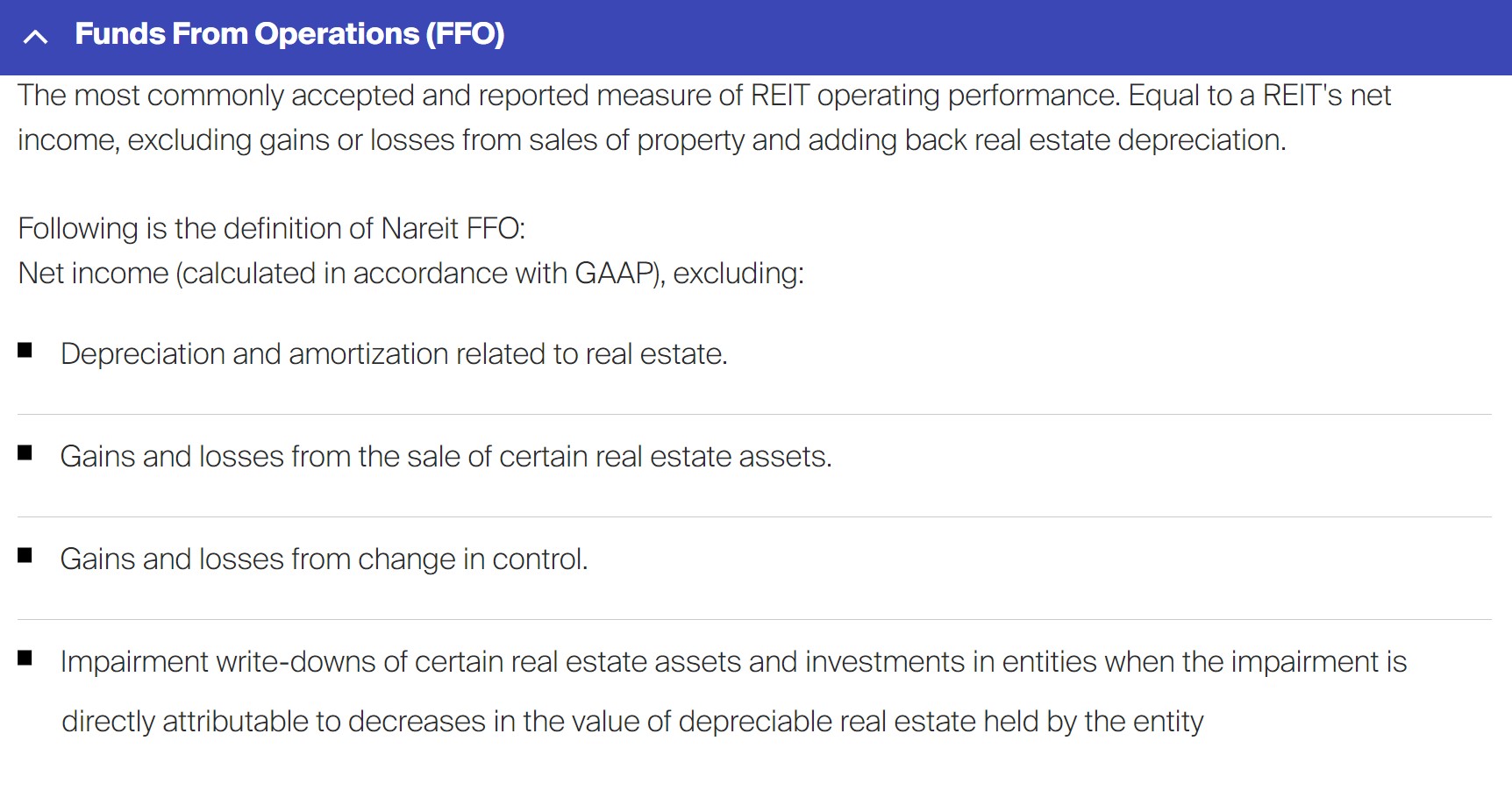

FFO Definition (Source: Nareit Glossary of REIT Terms)

FFO Definition (Source: Nareit Glossary of REIT Terms)

How to Calculate FFO

The following pieces of information are necessary to calculate the funds from operations (FFO).

| Formula Input | Data Source |

|---|---|

| Net Income to Common |

|

| Depreciation of Real Estate Assets |

|

| Gains on Sale, net |

|

| Non-Controlling Interest (NCI) Loss, net |

|

To calculate the funds from operations (FFO) metric, follow the four-step process outlined here.

- Financial Data Collection → Gather the values of the formula inputs from the SEC reports filed with the SEC (Net Income to Common Shareholders, Depreciation, Gains on Sale, and NCI Losses, net of Earnings)

- Non-Cash Expense Add-Back → Starting from net income, add back the depreciation of real estate assets

- Non-Recurring Item Adjustment → Subtract the gain on sale (or add back the loss on sale)

- Non-Controlling Interest (NCI) Adjustment → Add the total NCI losses, such as interest expense, net of the NCI earnings, like cash dividends

FFO Formula

Unlike many non-GAAP measurements, the funds from operations (FFO) metric does have a quasi “official” formula. Most REITs adhere to Nareit’s formal definition and guidelines to compute FFO.

The formula to calculate funds from operations (FFO) is as follows.

Non-Controlling Interest (NCI) – Consolidation Method

Non-controlling interest (NCI) comprises operating partnership (OP) unit holders that have not yet converted their units into common shares. Thus, the accounting treatment for the NCI ownership must abide by the consolidation method, whereby the REIT records the assets (and liabilities) tied to the NCI on its balance sheet.

For the sake of transparency, REITs maintain and report a separate NCI equity account in their filings, which is designed to reflect that a portion of the consolidated interests are not entirely attributable to common shareholders.

Learn More → FFO Discussion Paper (Source: Nareit)

Is FFO a GAAP Measure?

Unlike GAAP-based profit metrics, such as net income, the funds from operations (FFO) metric is a non-GAAP measure.

However, FFO is widely perceived as the more accurate measure of profitability for REITs.

Why? Traditional GAAP metrics tend to fall short of portraying the actual operating profitability of REITs.

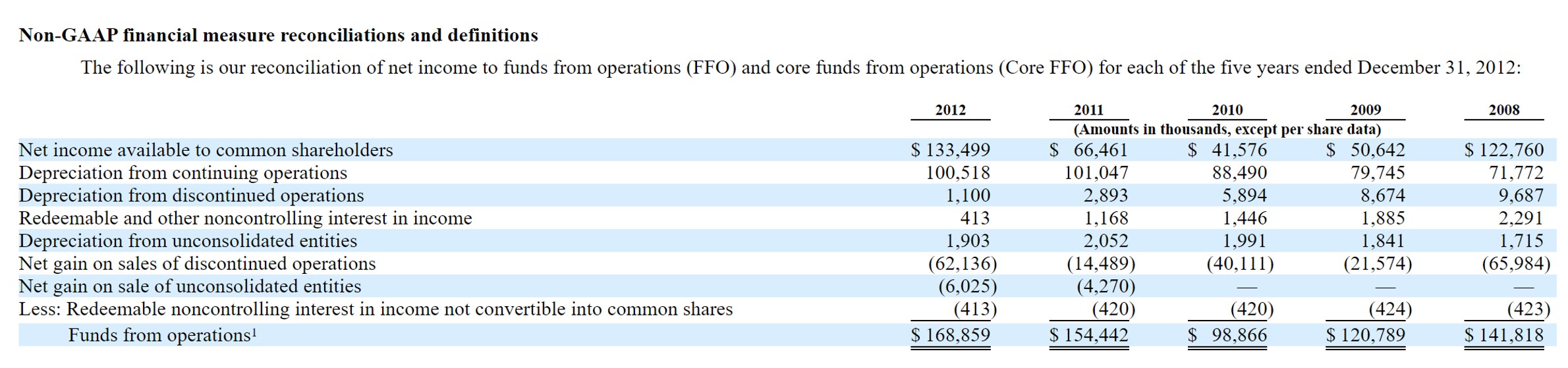

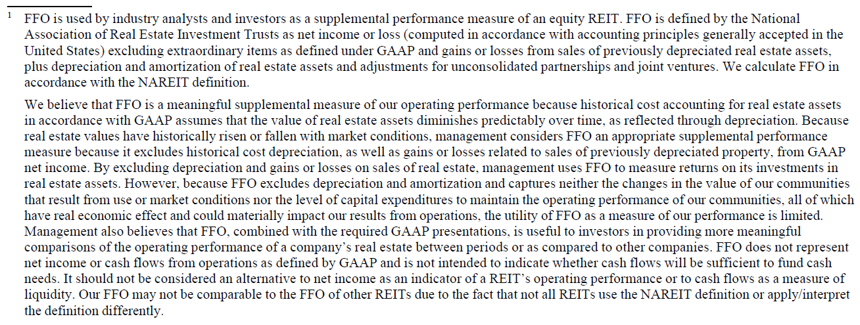

The SEC filings from REITs nowadays contain a section dedicated to reconciling their reported net income to funds from operations (FFO). As a real-world example, the following screenshot is from the 10-K filing of BRE Properties.

Funds from Operations Reconciliation Footnote (Source: BRE Properties, 2012 10K)

Why is FFO Important in Real Estate?

So, why does the funds from operations (FFO) metric matter?

- Transparency in REIT Performance → Standard GAAP metrics, such as net income, are sub-par for analyzing REITs. In comparison, FFO is a more accurate, reliable gauge of performance, which is the priority at the end of the day, i.e. offering transparency to investors to reduce the risk of capital losses.

- Consistency in Analysis in Capital Markets → The use of a standardized metric, such as FFO, increases the transparency of the actual performance of REITs, as the prior bullet alluded to. In effect, there is more credibility to the broader REIT industry to existing and potential market participants, including the capital markets (e.g. the lenders that provide debt financing), since there is a standard metric relied upon, in spite of the fact that FFO is a non-GAAP metric.

- Capital Inflow into REIT Asset Class → By fostering uniformity within the REIT industry with regard to the methods of analyzing the operating performance of a REIT and internal practices (e.g. investment diligence), the perception of the asset class as one based on consistent principles and structure enhances interest from potential investors, which matters because institutional and retail investors are often reluctant to place their capital in an unstructured segment, i.e. the risk of capital loss among investors is greater in those cases.

- REIT Industry Transparency → The alignment of the performance metrics utilized within the REIT industry results in fewer discrepancies, which is of particular importance in the context of negotiating a potential acquisition. Therefore, the role of FFO is akin to the usage of EBITDA in M&A, which is widely understood as a standardized metric that underpins the purchase multiple (and exit multiple).

The Wharton Online and Wall Street Prep Real Estate Investing & Analysis Certificate Program

Level up your real estate investing career. Enrollment is open for the Feb. 10 - Apr. 6 Wharton Certificate Program cohort.

Enroll TodayFFO vs. Cash Flow: What is the Difference?

Contrary to a common misconception, the funds from operations (FFO) metric is not designed to measure cash flow.

- Funds from Operations (FFO) → The reconciliation process to compute funds from operations (FFO) begins with net income and adds back the depreciation of real estate assets, similar to the indirect cash flow method of arriving at cash from operations (CFO). However, the FFO metric neglects changes in working capital and other discretionary cash flow adjustments.

- Cash from Operations (CFO) → The funds from operations (FFO) metric is similar – yet still not identical – to cash from operations (CFO). The first section of the cash flow statement (CFS) calculates cash from operations (CFO) by adjusting net income for non-cash items like D&A, non-recurring items, and changes in working capital line items. However, most of those adjustments, aside from depreciation, are more applicable to non-REIT corporations.

FFO vs. AFFO: What is the Difference?

The notable limitation of funds from operations (FFO) is the inclusion of several non-recurring items while omitting significant outflows, namely capital expenditures (Capex).

Hence, the adjusted funds from operations (AFFO) metric, or “adjusted FFO”, has become an increasingly common method to measure operating performance among analysts and participants in the REIT markets.

The formula to compute the adjusted funds from operations (AFFO) starts by further normalizing FFO and deducting maintenance capital expenditures.

- Pros → AFFO strives to reflect the operating performance of a REIT more accurately by addressing the shortcomings of FFO, such as subtracting the REIT’s recurring, maintenance capital expenditures (Capex) and normalizing certain items like rent (i.e. “straight-lined”).

- Cons → Unlike the traditional funds from operations (FFO) metric, however, the drawback to the AFFO metric is the lack of industry-wide standardization. The risks here are parallel to the “slippery slope” of using “Adjusted EBITDA” – where there is more room for discretionary adjustments to present past performance in a misleading manner – in lieu of the traditional EBITDA metric (EBIT + D&A).

Learn More → Adjusted Funds from Operations (FFO)

FFO vs. EBITDA vs. NOI: What are the Differences?

The list below outlines the differences between funds from operations (FFO), EBITDA, and net operating income (NOI):

- FFO vs. EBITDA → By ignoring working capital, FFO shares some similarities with EBITDA, but the metric is not exactly EBITDA, either. The notable difference is that EBITDA attempts to capture profitability from operations, while FFO is a levered metric (post-interest) and captures the effect of taxes and preferred dividends.

- FFO vs Net Operating Income (NOI) → While net operating income (NOI) is a useful profit measure for analyzing real estate down to the property level, the metric ignores general & administrative expenses, leverage (e.g. interest expense), and taxes, which are expenses that FFO does factor into its calculation.

To further elaborate on the distinction between FFO vs. EBITDA, we’ll return to our earlier example of BRE Properties.

BRE Properties 10-K Filing

“Because real estate values have historically risen or fallen with market conditions, management considers FFO [which ignores accounting depreciation and gains/losses] an appropriate supplemental performance measure”FFO is a superior metric over EBITDA, net income, or cash from operations because REITs have distinct characteristics that make it harder to analyze if investors solely rely on the other aforementioned common measures of profits.Specifically, REITs are highly levered, generate significant non-cash income / losses from property sales.In BRE Properties’ 10K, they provide the rationale for using FFO: “Because real estate values have historically risen or fallen with market conditions, management considers FFO [which ignores accounting depreciation and gains/losses] an appropriate supplemental performance measure”

How to Use FFO to Analyze REITs

The funds from operations (FFO) stands as a standardized metric to analyze the operating performance of REITs. However, the operating profitability of REITs is not enough on its own to form an investment thesis.

There are plenty of other property-level real estate measures of profitability (and thus valuation) to utilize in conjunction with NOI to grasp a better understanding of the fundamental qualities of a given property investment, namely the following two metrics:

- Net Operating Income (NOI) → While funds from operations (FFO) provide a levered measure of profit after taxes and overhead, net operating income (NOI) provides a pure, property-level measure of profit.

- Cap Rate → The capitalization rate, or cap rate, is the most widely used measure of value in real estate for valuing REITs, as well as for property-level analysis. The cap rate is conceptually the equivalent of using the EV/EBITDA multiple to value non-real estate corporations.

Learn More → Cap Rate Primer

FFO Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

REIT FFO Calculation Example

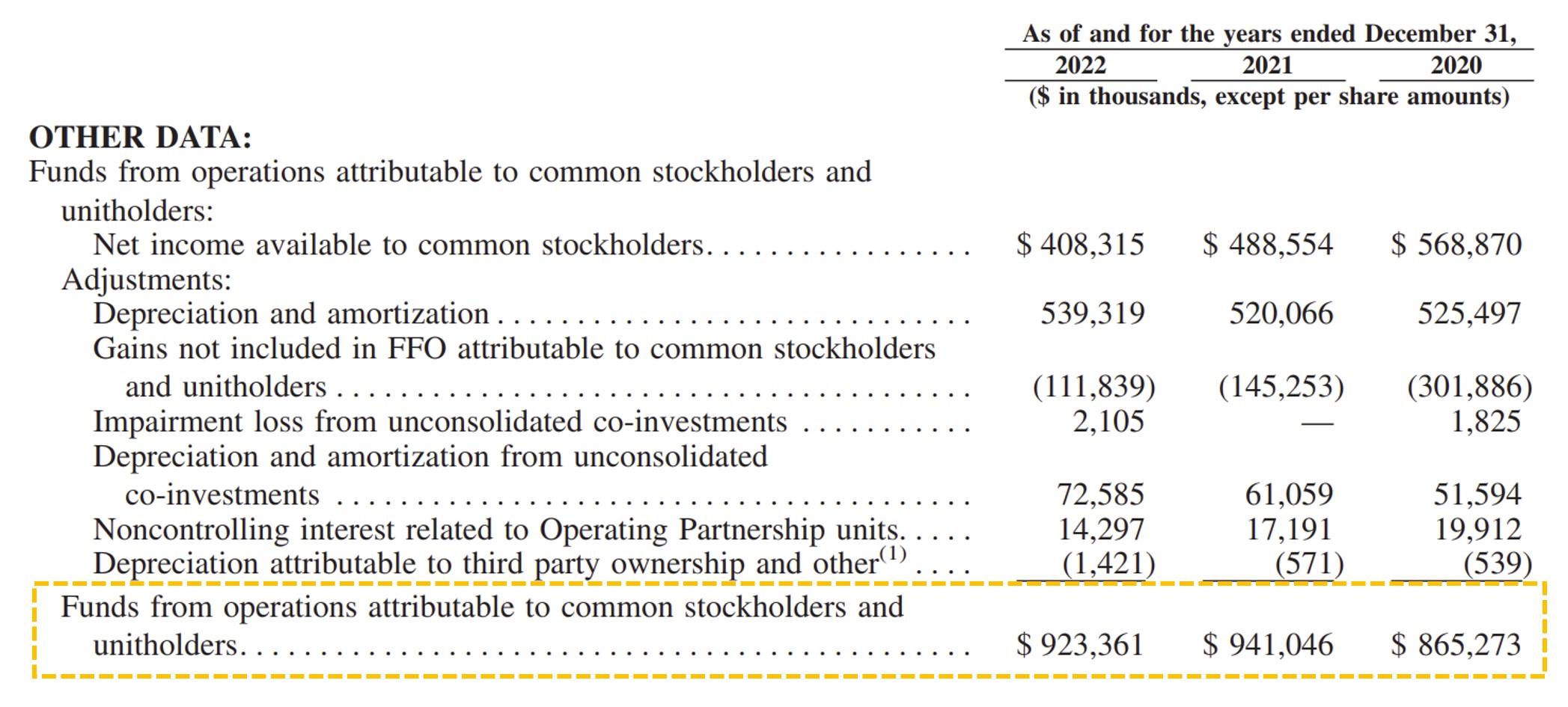

Suppose we’re tasked with calculating the funds from operations (FFO) of Essex Property Trust (NYSE: ESS) as of its latest fiscal year (2022).

Essex Property Trust is a real estate investment trust (REIT) that manages apartment communities, which are predominately multi-family properties based on the West Coast.

For the fiscal year ending 12/31/2022, Essex reported the following supplementary data in its annual 10-K filing.

Essex Property Trust – Funds from Operations Reconciliation Section (Source: ESS 2022 10-K)

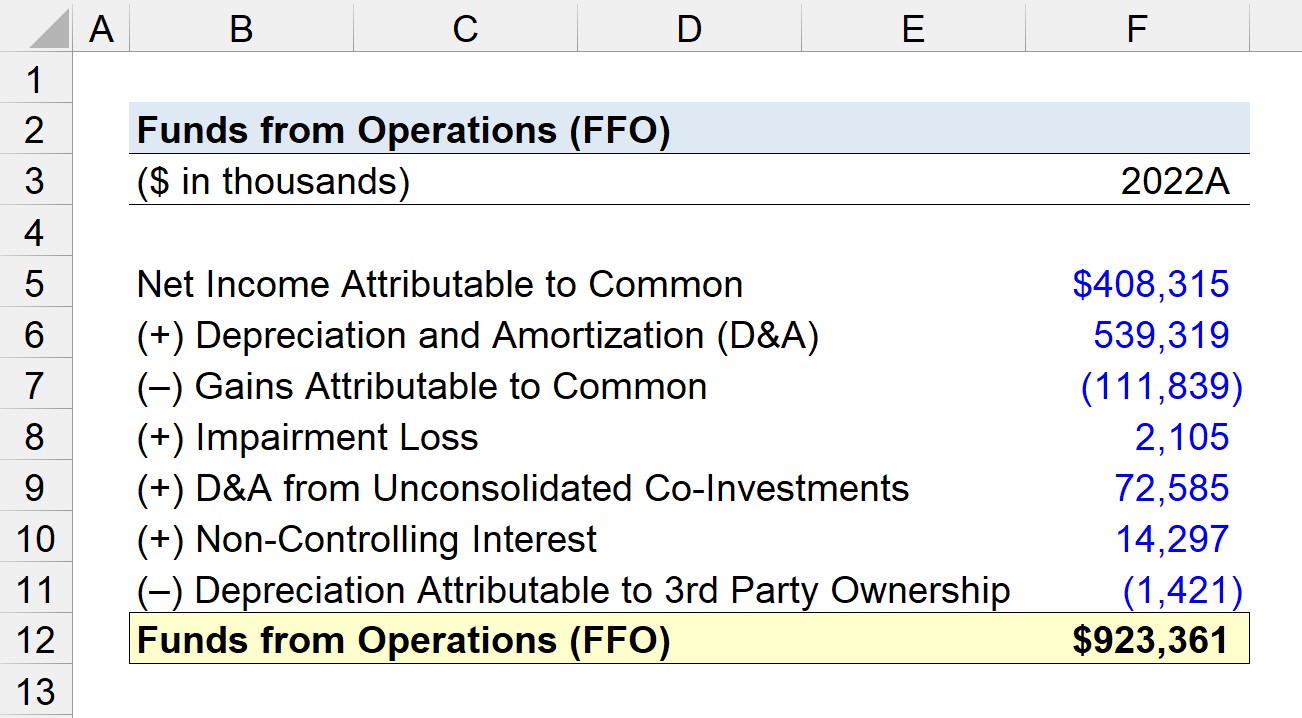

In our first step, we’ll input the relevant financial data reported for 2022 into our spreadsheet.

| Financial Data | 2022A |

|---|---|

| Net Income Attributable to Common | $408,315k |

| Depreciation and Amortization (D&A) | $539,319k |

| Gains Attributable to Common | ($111,839k) |

| Impairment Loss | $2,105k |

| D&A from Unconsolidated Co-Investments | $72,585k |

| Non-Controlling Interest (NCI) | $14,297k |

| Depreciation Attributable to 3rd Party Ownership | ($1,421k) |

The starting point of the funds from operations (FFO) calculation is net income, which we’ll adjust by the non-cash D&A expense (+), the gain on sale (–), impairment loss (+), D&A from co-investments (+), non-controlling interest (+), and depreciation attributable to 3rd party ownership (–).

- Non-Cash Adjustments → The intuition behind the treatment of impairment loss and D&A from co-investments should be straightforward, i.e. an add-back of non-cash expenses recognized to abide by the reporting requirements per accrual accounting (US GAAP) standards.

- Non-Operating Items (Non-Recurring) → Like non-cash items, the gain or loss from the sale of property assets can be misleading in the accurate portrayal of a REIT’s profitability (and cash flows). The gain on sale is thus subtracted because the event is not a part of the core operations of the REIT nor is it a recurring item.

The depreciation attributable to third-party ownership, our final adjustment, is NOT an add-back in the calculation.

Why? The funds from operations (FFO) metric measures the cash generated by the REIT from the perspective of common shareholders (or “unitholders”).

Upon adjusting Essex’s net income by the factors mentioned earlier, we arrive at an implied funds from operations (FFO) of $923.4 million for the fiscal year 2022, which matches the reported FFO on Essex’s 10-K filing.

- Funds from Operations (FFO), 2022 = $408,315k + $539,319k – $111,839k + $2,105k + $72,585k + $14,297k – $1,421k

- FFO = $923,361k