- What is Expense Ratio?

- How to Calculate Expense Ratio for Mutual Fund

- Expense Ratio Formula

- What is a Good Expense Ratio?

- Why Does the Expense Ratio Matter for Mutual Fund Investing?

- What are Examples of Mutual Fund Operating Expenses?

- Expense Ratio Calculator – Excel Template

- Mutual Fund Expense Ratio Calculation Example

What is Expense Ratio?

The Expense Ratio represents the total operating costs incurred by a mutual fund as a percentage of its average value of net assets managed.

In practice, the expense ratio matters because the implied ratio – expressed as a percentage – determines the fees paid by the investors of a mutual fund – i.e. the limited partners (LPs) that contributed capital – based on the general & administrative and other expenses associated with the operations of the fund.

How to Calculate Expense Ratio for Mutual Fund

The expense ratio represents the proportion of a fund’s assets allocated to operating expenses per year, expressed as a percentage.

In short, the expense ratio reflects the costs incurred to operate a specific mutual fund or ETF, such as overhead and administrative expenses.

The fund metric is particularly important to investors in mutual funds and exchange-traded funds (ETFs).

Each year, mutual funds and ETFs must pay operating expenses such as:

- Management Fees and Employee Salaries

- Administrative Expenses and Customer Support

- 3rd Party Fees (e.g. Accountants, Lawyers, Consultants)

- Marketing and Distribution Fees (e.g. 12-1B Distribution Fees)

- Overhead Costs (e.g. Office, Equipment, Utilities)

Expense Ratio Formula

The formula to calculate the expense ratio divides the total annual operating expenses incurred by a mutual fund by the average value of the total assets managed.

For example, suppose a mutual fund incurred $2 million in operating costs for a given year.

If we assume the fund managed $200 million in assets, its expense ratio comes out to 1.0%.

- Operating Expenses = $2 million

- Fund Assets = $200 million

- Expense Ratio = $200 million ÷ $2 million = 1.0%

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayWhat is a Good Expense Ratio?

The expense ratio of a mutual fund measures the incurred operating costs as part of fund operations, which determines the management fee paid by investors.

The expense ratio is determined on an annual basis, wherein a fund’s operating expenses are divided by the value of the fund’s assets.

The more operating expenses required to operate a mutual fund, the lower the net return to investors, all else being equal.

A “good” expense ratio is contingent on the mutual fund’s investing style. For instance, an actively managed mutual fund will have a higher expense ratio in comparison to a passively managed mutual fund.

Why? The mutual fund and fund manager are compensated more for the “hands-on” management of the portfolio and constant monitoring of the holdings (and re-balancing).

The general rules of thumb for evaluating the expense ratio of a mutual is as follows.

- Passively Managed Mutual Funds → For passively managed mutual funds, a good expense ratio is generally around 0.20% (or even less in certain cases, i.e. 0.10%).

- Actively Managed Mutual Funds → In contrast, for actively managed funds, a good expense ratio usually ranges around 0.5 to 1.0%.

Other variables to consider that determine the fund’s expense ratio are the historical (and target) returns of the fund, as higher returns coincide with more resources and time spent managing the fund.

Why Does the Expense Ratio Matter for Mutual Fund Investing?

Considering the ratio compares expenses to assets managed, a higher ratio suggests that expenses are incurred for each asset managed by the fund.

- High Expense Ratio → A higher ratio reduces a fund’s adjusted returns, all else being equal.

- Low Expense Ratio → On the other hand, a lower ratio implies the fund incurs fewer expenses to manage its assets.

A high expense ratio raises the minimum threshold in performance to generate the same returns as a fund with a lower expense ratio. Rather than being directly charged to investors, operating expenses indirectly reduce the fund’s total assets (and thus the returns to investors).

The expense ratio for an actively managed mutual fund usually ranges around 0.50%, but for passively managed investment vehicles, the expense ratio can be as low as 0.10%.

What are Examples of Mutual Fund Operating Expenses?

An actively managed fund’s operating costs are higher, especially management fees – resulting in higher expenses. Since a fund’s operational costs are shared among its investors, a greater fund size means the fees will be spread out across more investors.

Other factors that investors must consider are the following:

- Transaction Costs → Purchasing and Sale of Securities (i.e. Commission, Brokerage)

- Sales Charge → Paid when “Buying In” (i.e. Purchasing Unit Shares of Mutual Funds)

- Redemption Fees → Early Sale of Shares in Mutual Fund Before Specified Date

Expense Ratio Calculator – Excel Template

We’ll now move to a modeling exercise, which you can access by filling out the form below.

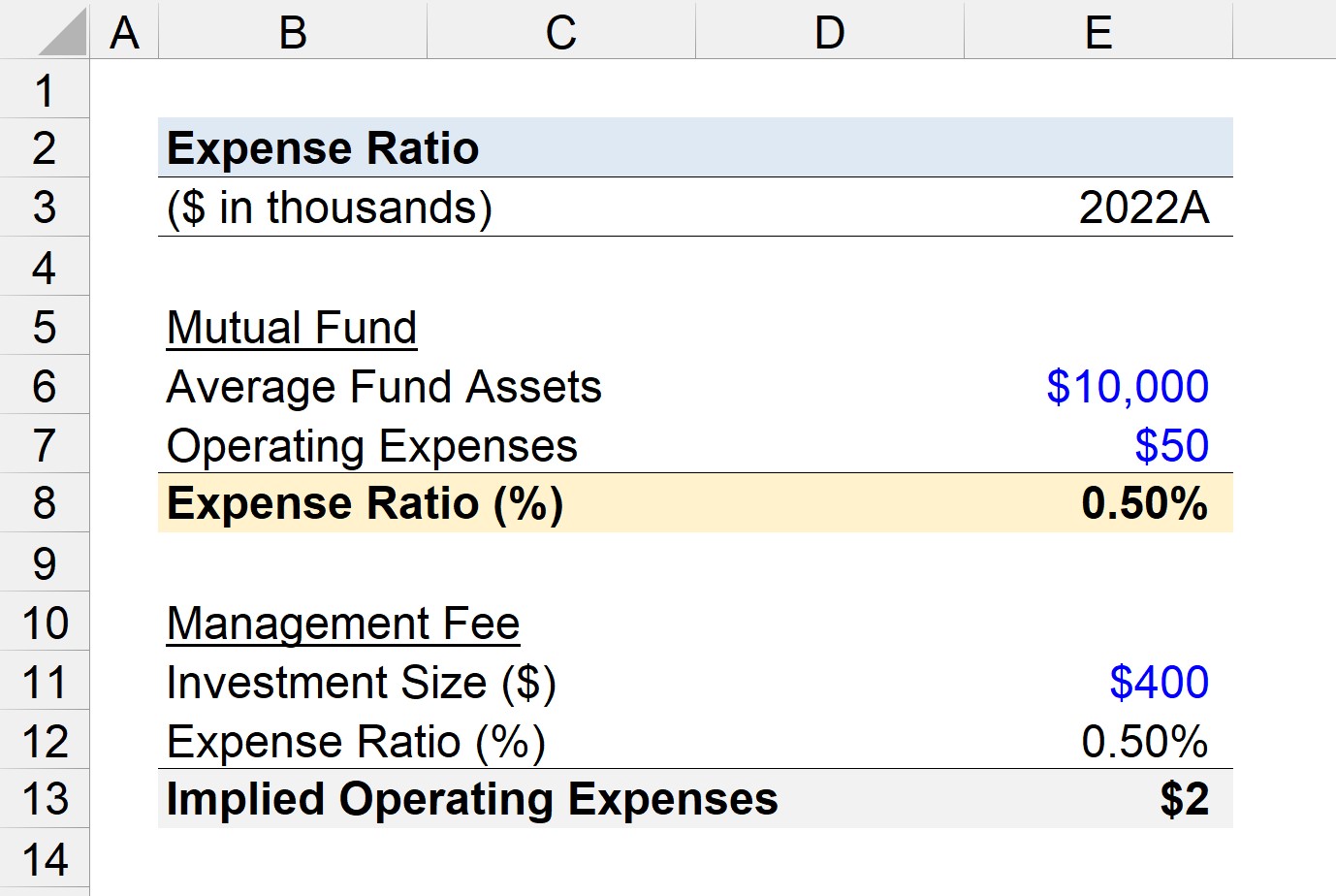

Mutual Fund Expense Ratio Calculation Example

Suppose an actively managed mutual fund in 2022 averaged $10 million in fund assets in 2022, while incurring a total of $50,000 in operating expenses.

- Average Fund Assets = $10 million

- Operating Expenses = $50,000

Upon dividing the average fund assets by the annual operating expenses, the implied expense ratio of the mutual fund is 0.50%.

- Expense Ratio (%) = $50,000 ÷ $10 million = 0.50%

In the next part of our exercise, let’s assume that an investor contributed $400,000 to our hypothetical mutual fund with an expense ratio of 0.50%.

The dollar amount paid each year to support the fund’s operational costs is $2,000.

- Operational Expenses = $400,000 × 0.50%

- Operational Expenses = $2,000

While the $2,000 expense can appear marginal relative to the amount invested, these seemingly minor differences in mutual fund cost structures can significantly affect long-term returns. Hence, the expense ratio is an important factor to consider for investors with regard to capital allocation.