- What is Effective Tax Rate?

- How to Calculate Effective Tax Rate

- Effective Tax Rate Formula

- How to Find Effective Tax Rate on Income Statement

- Effective Tax Rate Calculation Example

- Effective Tax Rate vs. Marginal Tax Rate: What is the Difference?

- How to Interpret Effective Tax Rate?

- How to Forecast Income Taxes in a DCF Model?

- GAAP vs. Tax Accounting: How Depreciation Impacts Tax Rate

- How Do Net Operating Losses (NOLs) Affect Taxes?

- Write-Off Recognition: Bad Debt and Bad A/R Examples

What is Effective Tax Rate?

The Effective Tax Rate represents the percentage of a corporation’s pre-tax income that was actually paid out in the form of taxes.

How to Calculate Effective Tax Rate

The effective tax rate measures the actual taxes paid by a corporation based on the incurred tax bill in a given period.

By dividing the income taxes paid by a company by its pre-tax income (EBT) in the corresponding period, the implied effective tax rate can be calculated.

- Income Taxes → The income tax provision recognized on the income statement by a company for bookkeeping purposes.

- Pre-Tax Income (EBT) → The remaining taxable income after adjusting earnings before interest and taxes (EBIT) for non-operating items.

Since there is a difference between the pre-tax income (EBT) reported on the financials as prepared following accrual accounting standards and the taxable income reported on tax filings, the effective tax rate often differs from the marginal tax rate.

Effective Tax Rate Formula

The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre-tax income, or earnings before tax (EBT).

The formula used to calculate the effective tax rate is the ratio between the taxes paid and pre-tax income (EBT).

How to Find Effective Tax Rate on Income Statement

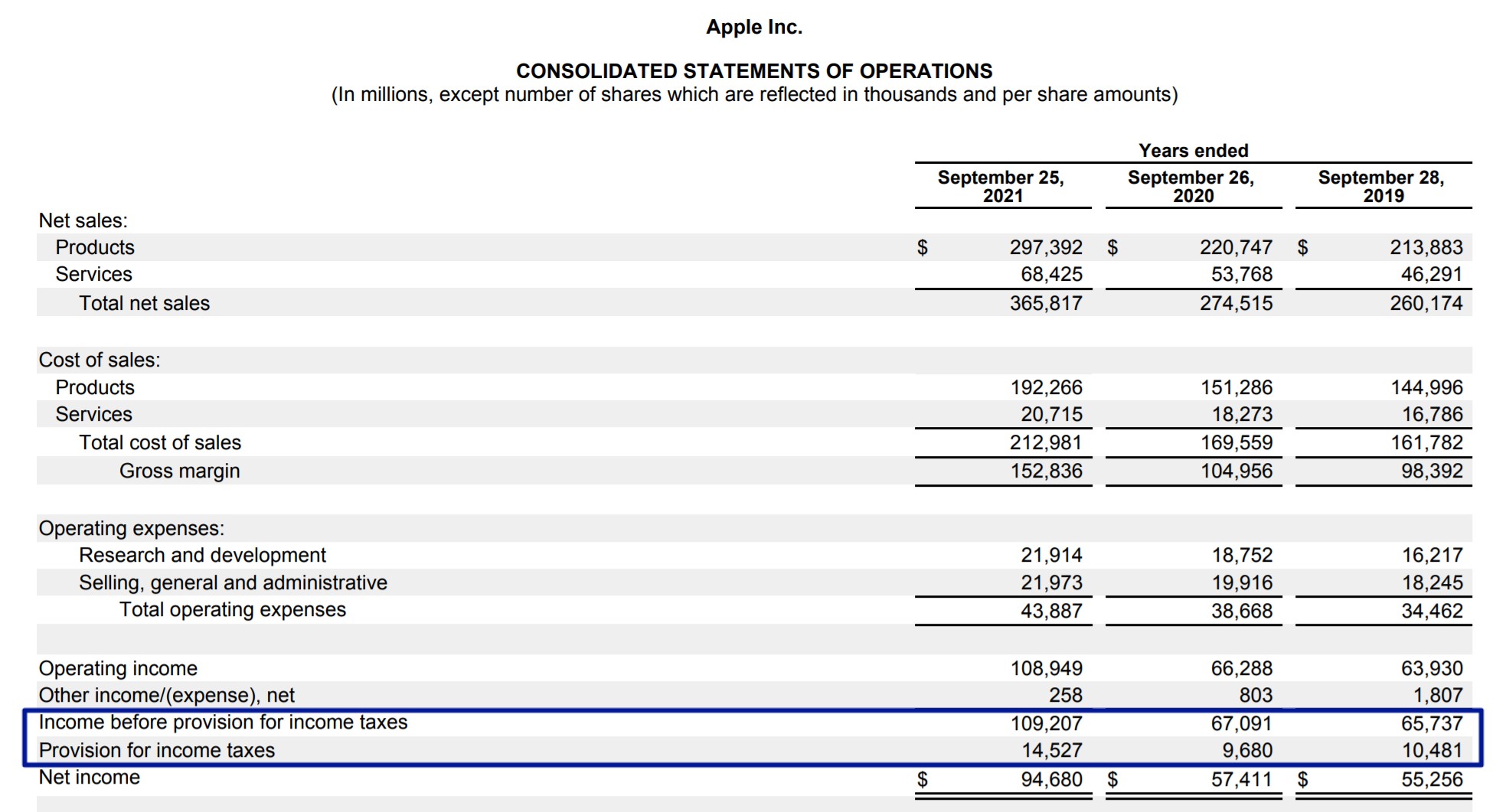

The line items with the taxes paid (i.e. the tax bill), and pre-tax income (EBT) can be found on the income statement, as shown in the screenshot below from the 10-K filing of Apple (NASDAQ: AAPL).

Apple Pre-Tax Income and Income Taxes (Source: AAPL 10-K)

Effective Tax Rate Calculation Example

Using historical financial data from the income statement of Apple, we’ll determine the effective tax rate (%) for the trailing three years.

From fiscal year 2019 to 2021, Apple’s effective tax rate can be calculated using the following formulas:

- Effective Tax Rate (FY-2019) → $10,481 million ÷ $65,737 million = 15.9%

- Effective Tax Rate (FY-2020) → $9,680 million ÷ $67,091 million = 14.4%

- Effective Tax Rate (FY-2021) → $14,527 million ÷ $109,207 million = 13.3%

Effective Tax Rate vs. Marginal Tax Rate: What is the Difference?

The taxes paid by a company based on the accrual-based income statement rarely match the actual cash taxes paid to the IRS.

Why?

The effective tax rate is the actual percentage of taxes paid by a company based on its pre-tax income, whereas the marginal tax rate is the rate charged on the last dollar of income.

The marginal tax rate is the taxation percentage applied to the last dollar of a company’s taxable income, with the following factors considered:

- Jurisdiction-Specific Statutory Tax Rate

- Federal Income Tax Brackets

The marginal tax rate adjusts according to the tax bracket under which the company’s profits fall, i.e. the tax rate changes as the company earns more (and moves into higher tax brackets).

The incremental, “marginal” income is then taxed at the corresponding bracket, rather than each dollar of income being taxed at the same fixed rate.

How to Interpret Effective Tax Rate?

In practically all cases, there is a difference between the pre-tax income displayed on the income statement and the taxable income as shown on the tax filing.

Therefore, the effective and marginal tax rates are rarely equivalent, as the effective tax rate formula uses pre-tax income from the income statement, a financial statement that abides by accrual accounting.

Typically, the effective tax rate is lower than the marginal tax rate, as most companies are incentivized to defer paying the government.

Under US GAAP reporting, most companies follow different accounting standards and rules for financial reporting vs. filing tax reports, as the subsequent sections will explain in more detail.

How to Forecast Income Taxes in a DCF Model?

In the discounted cash flow (DCF) model, the decision on whether to use the effective tax rate or marginal tax rate boils down to the terminal value assumption.

The company’s tax rate is assumed to remain constant into perpetuity beyond the explicit forecast period.

With that said, if a projection uses the effective tax rate, the implicit assumption is that the deferral of taxes – i.e. DTLs and DTAs – are expected to be a continuously recurring line item, as opposed to reaching zero over time.

Clearly, that would be inaccurate since DTAs and DTLs eventually unwind (and the balance declines to zero).

Our recommendation is to evaluate a company’s effective tax rate in the past three to five years and then base the near-term tax rate assumption accordingly.

The effective tax rate can either be averaged if the tax rates are generally within the same range or by following the directional trend.

Once the constant-growth stage approaches – i.e. the company’s operations have normalized – the tax rate assumption should converge to the marginal tax rate.

GAAP vs. Tax Accounting: How Depreciation Impacts Tax Rate

Deferred tax liabilities (DTLs) stem from temporary timing differences related to GAAP/IRS accounting.

One reason the marginal and effective tax rates often differ is related to the concept of depreciation, the allocation of capital expenditure (Capex) across the fixed asset’s useful life.

- Financial Reporting → Most companies elect to use straight-line depreciation, in which the PP&E is reduced in value by equal amounts each year.

- Tax Filing → The Internal Revenue Service (IRS), on the other hand, requires accelerated depreciation for tax purposes, resulting in deferred tax liabilities (DTLs).

The depreciation expense recorded in earlier periods for tax purposes is greater than the amount recorded on GAAP filings. But these tax differences are temporary timing discrepancies and the cumulative depreciation is the same at the end of the day.

Eventually, an inflection point is reached in the asset’s useful life assumption where the depreciation recorded for tax purposes is lower than the amount stated on the books, i.e. the DTLs gradually reach zero.

How Do Net Operating Losses (NOLs) Affect Taxes?

Many companies incur substantial losses in earlier years and receive tax credits that can be applied to later periods once profitable, called net operating loss (NOL) carry-forwards.

A profitable company can apply the previously accumulated tax credits to reduce their amount of taxes in the current and future periods, creating a difference in taxes under book and tax accounting.

Write-Off Recognition: Bad Debt and Bad A/R Examples

If a company’s debt or accounts receivable (A/R) is deemed uncollectible – called “Bad Debt” and “Bad AR,” respectively – deferred tax assets (DTAs) are created, which causes differences in taxes.

The write-off is recorded on the income statement as a write-off; however, it is not deducted from the company’s tax returns.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

Hello, what if tax expense is negative because deferred tax is negative. Then How to calculate tax rate