- What is EBITDA Coverage Ratio?

- How to Calculate EBITDA Coverage Ratio

- EBITDA Coverage Ratio Formula

- Interest Coverage Ratio: EBITDA vs. EBIT Comparison

- How to Analyze Credit Risk with the EBITDA Coverage Ratio

- EBITDA Coverage Ratio Calculator

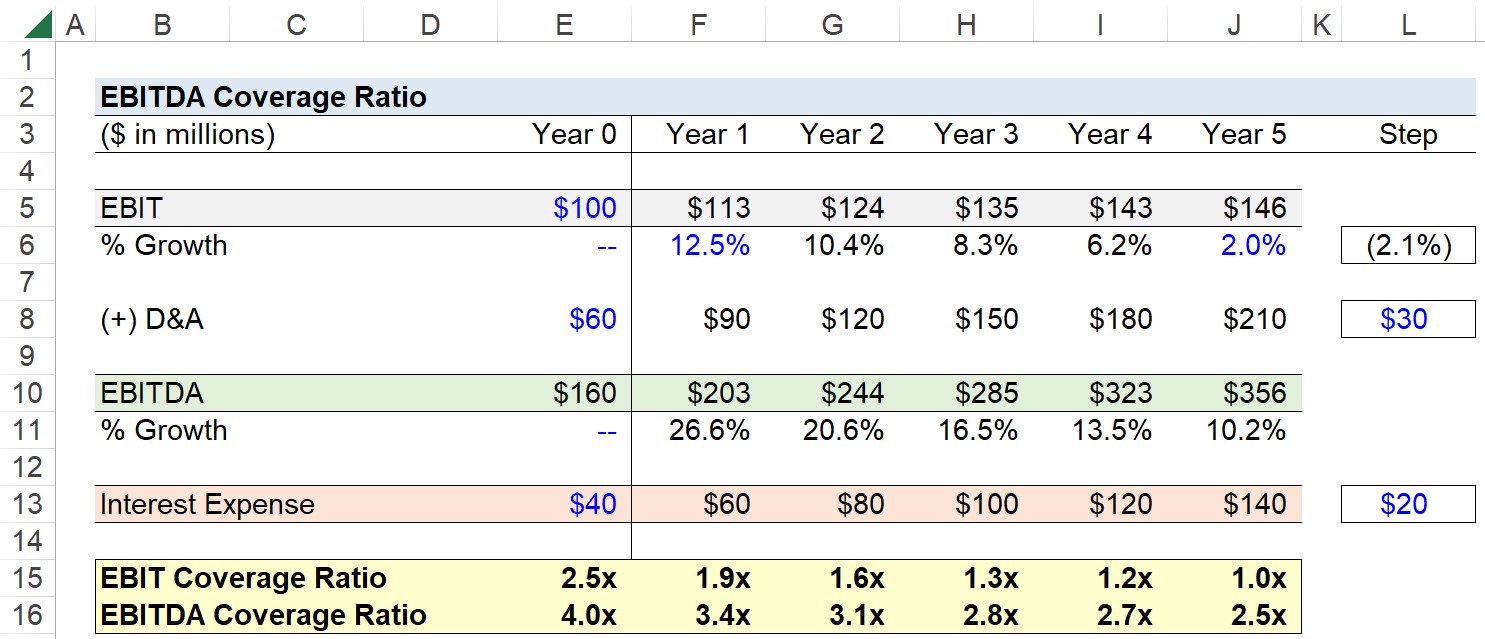

- 1. Operating Assumptions

- 2. Income Statement Forecast Example

- 3. EBITDA Coverage Ratio Example

What is EBITDA Coverage Ratio?

The EBITDA Coverage Ratio measures a company’s capacity to meet its interest payments by comparing its EBITDA against its interest burden.

How to Calculate EBITDA Coverage Ratio

The EBITDA coverage ratio is used to determine the credit profile of a borrower, namely in terms of understanding liquidity risk.

The drawbacks to raising capital in the form of debt financing relate to the periodic interest payments and the return of the original principal amount by the date of maturity, which are contractually binding per the lending agreement.

Conceptually, the EBITDA coverage ratio measures the number of times (“turns”) that the company’s EBITDA can meet the interest expense payments coming due.

The higher the EBITDA coverage ratio, the more financially stability in the credit profile of the borrower, with minimal risk of defaulting on its debt obligations.

Since the borrower is afforded with more of a “cushion”, the probability of withstanding periods of underperformance or poor economic conditions, such as a recession, is much greater.

Since debt securities such as bonds and loans represent contractual obligations—wherein capital is provided by a lender in exchange for the promise to meet the required payments on time—the borrower’s failure to abide by the payment schedule can lead to financial distress (and potential bankruptcy).

EBITDA Coverage Ratio Formula

Formulaically, the EBITDA coverage ratio compares the EBITDA of a company relative to its interest expense.

Where:

- EBITDA → EBITDA is a non-GAAP measure of a company’s operating cash flow, which, in its simplest form, is calculated by adding depreciation and amortization (i.e. non-cash items) to operating income, or “EBIT”.

- Interest Expense → The periodic interest payments owed to the lender, which reflects the company’s cost of debt, i.e. the riskiness of providing debt capital to the borrower (and the expected return).

Interest Coverage Ratio: EBITDA vs. EBIT Comparison

There are numerous interest coverage ratios relied upon in practice as part of credit analysis, but the EBIT and EBITDA variations are the two most common, especially regarding their practicality across different industries and sectors.

The distinction between the EBITDA and EBIT coverage ratio is that the latter does not add back depreciation and amortization (D&A).

- EBIT → The interest coverage ratio, more often than not, refers to the EBIT coverage ratio, because it is the more conservative measure of a company’s operating cash flow, i.e. the “middle ground”. Since EBIT, or operating income, is a GAAP metric recorded on the income statement, the profit measure is a convenient option and less prone to discretionary management adjustments or accounting tactics, albeit U.S. GAAP accrual accounting is not without its fair share of shortcomings.

- EBITDA → In contrast, EBITDA is a non-GAAP metric, and the increasingly lenient add-backs beyond the traditional D&A adjustment—i.e. “adjusted EBITDA”—can portray a misleading picture of its financial health to investors. Hence, the EBITDA coverage ratio exceeds the EBIT coverage ratio in practically all cases, assuming the company in question owns fixed assets (PP&E) or intangible assets and has D&A expenses. The lack of standardization, less stringent regulatory oversight from the SEC, and management discretion on what items constitute a valid add-back complicates matters, especially for risk-averse investors that lack the expertise, time, and resources that are accessible to institutional lenders such as banks.

How to Analyze Credit Risk with the EBITDA Coverage Ratio

While the metric is an interest coverage ratio—i.e. a cash flow metric such as EBIT or EBITDA is compared to a company’s interest expense—the ratio is of high relevance to understanding a company’s long-term solvency, i.e. the company’s ability to continue operating as a “going concern.”

The interest expense component of debt is a direct function of its outstanding debt principal on the company’s balance sheet, i.e. more reliance on debt financing coincides with a greater interest burden, all else being equal.

The risk of not meeting a near-term interest payment on time can often be the tip of the iceberg, rather than a temporary setback.

But of course, there are other variables that lenders pay close attention to while performing diligence on a potential borrower and setting the interest rate pricing and the terms attached to the debt instrument.

- External Factors → Other than company-specific traits, external risk factors such as industry cyclicality, seasonality, and the threat of disruption from technological advancements or new entrants (i.e. increased competition in the market) can contribute to the threshold being set higher.

- Liquid Assets → The ownership of highly liquid assets (e.g. cash and equivalents, accounts receivable, inventory, short-term investments) that are marketable and can be easily sold for cash in the open markets can offset the perceived credit risk and enable a company to remain afloat in challenging times, even if its coverage ratios suggest otherwise.

EBITDA Coverage Ratio Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

1. Operating Assumptions

Suppose you’re tasked with measuring the credit risk of a manufacturer using the EBITDA coverage ratio.

The selected financial data of the company in Year 0 is as follows.

- EBIT = $100 million

- D&A = $60 million

- EBITDA = $100 million + $60 million = $160 million

- Interest Expense = $40 million

Considering the manufacturer’s D&A as a percentage of its EBIT is 60% in Year 0, we can reasonably assume its business model requires significant capital expenditures (Capex) to generate revenue.

The manufacturer’s operating margin also seems to be on the lower end, as the growth in D&A outpaces its growth in EBIT.

Even if we were to assume the manufacturer’s revenue is exhibiting strong, stable growth, its reinvestment needs—and its allocation towards capital expenditures (Capex) in particular—might need to be reduced.

Note: For capital-intensive companies, (EBITDA – Capex) is often used for financial ratios and valuation multiples. However, for illustrative purposes (i.e. EBITDA vs. EBIT coverage), we chose otherwise in this example.

2. Income Statement Forecast Example

For the first year of our forecast period (Year 1), we’ll assume the following assumptions.

- EBIT Growth (%) = 12.5%

- D&A = $90 million

- EBITDA = $113 million + $90 million = $203 million

- Interest Expense = $60 million

From that point onward, the manufacturer’s EBIT growth rate is expected to reach 2.0% by the end of Year 5 in equal increments, its D&A will increase by $30 million each year, and interest expense will increase by $20 million per year.

- EBIT Growth (%), Step Function → (2.1% YoY)

- D&A, Step Function → +$30 million YoY

- Interest Expense, Step Function → +$20 million YoY

3. EBITDA Coverage Ratio Example

In the final step of our exercise, we’ll divide our cash flow metrics—either EBIT or EBITDA—by the interest expense in the corresponding period.

- Year 0 → EBIT Coverage = 2.5x; EBITDA Coverage = 4.0x

- Year 1 → EBIT Coverage = 1.9x; EBITDA Coverage = 3.4x

- Year 2 → EBIT Coverage = 1.6x; EBITDA Coverage = 3.1x

- Year 3 → EBIT Coverage = 1.3x; EBITDA Coverage = 2.8x

- Year 4 → EBIT Coverage = 1.2x; EBITDA Coverage = 2.7x

- Year 5 → EBIT Coverage = 1.0x; EBITDA Coverage = 2.5x

From the initial period (Year 0) to the end of the forecast (Year 5), the manufacturer’s EBIT coverage ratio declined from 2.5x to 1.0x, i.e. the company’s operating income is barely sufficient to service the corresponding interest payment, which should signal the need for urgent measures to be taken to avoid a potential future default.

Over the same time frame, the manufacturer’s EBITDA coverage ratio declined from 4.0x to 2.5x, which is also trending in an unfavorable direction, but the 2.5x ratio is substantially less of a concern than the 1.0x EBIT coverage ratio.

The discrepancy that formed between the EBIT and EBITDA coverage ratios is attributable to the capital-intensive nature of the manufacturer’s operations, where revenue stems from capital expenditures and the productivity of its fixed asset base.

In closing, the incurred D&A expense is treated as a non-cash add-back to calculate EBITDA starting from EBIT. However, the non-cash adjustment, coupled with the capital intensity of the manufacturer and likely poor profit margins, causes the EBITDA coverage ratio to be misleading.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today