Is Wall Street Prep Worth It?

Trainees that complete Wall Street Prep’s Premium Package or live seminars are eligible for Wall Street Prep’s Certification in Financial & Valuation Modeling.

We often get asked, “Is Wall Street Prep worth it?”

So in the following post, we’ll address the most important considerations to ensure you make the most informed decision.

Wall Street Prep | About Us

“Learn financial modeling and valuation from Wall Street’s top training provider”

Investment banks most often recruit candidates attending undergraduates and MBAs from top “target” schools, such as Harvard, Wharton, NYU, and Princeton.

While bankers are still recruited out of “non-target” schools, the process is less formal and structured.

Most prospective investment bankers pursue undergraduate degrees in finance, business, economics, and accounting, but it is not an application requirement at investment banks.

The statement above can be confirmed by the number of hires with liberal arts and engineering degrees, as banks focus on finding bright, motivated students that can be trained internally and molded, regardless of prior education.

In fact, it is widely recognized that the primary determinant of whether a candidate will get an interview are GPA, the reputation of the undergraduate or MBA program, and past work experience.

The result is that those interviewing for investment banking jobs as well as those eventually landing jobs as incoming analysts (and to some extent associates) have a wide variance in relevant academic backgrounds.

Even for those with undergraduate finance concentrations, the academic skill set is not directly applicable; at most schools, students never learn how to actually perform the types of analysis or build the types of models they would find themselves building on the job from day one.

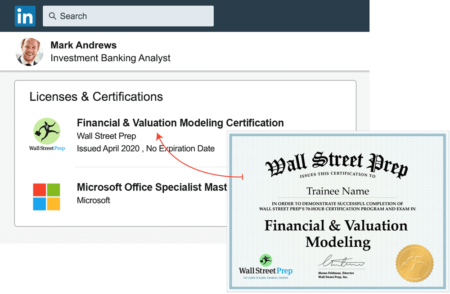

Industry-Recognition of Wall Street Prep Certification

Investment banks hire companies – such as Wall Street Prep – to provide the highest-quality, rigorous training programs for new hires, with some programs lasting over 2 months).

The objective of Wall Street Prep’s Premium Package Certification is for individuals to gain access to the same type of training provided to the top investment banks, private equity firms, and business programs (undergraduate and MBA).

That way, all candidates, even those attending less prestigious schools, have a higher likelihood of landing an offer at the leading firms, as they are equipped with the skill set necessary for the job.

The courses are made available directly to all students, new and experienced hires alike, and are designed to enhance the skills and competitive profile of prospective investment bankers by equipping them with the skill set they will use daily on the job.

Wall Street Prep Certification Program Eligibility

Certification is issued upon passing an online assessment which tests the concepts taught in the Premium Package or live seminars.

Upon passing the certification requirements, trainees can place the credential on their resumes, since simply enrolling in a program does not signal to recruiters that one actually completed the program.

Is a Financial Modeling Certification Necessary?

The primary determinants of whether a candidate will get an interview are the following:

- Undergraduate/MBA Program Reputation (Target vs. Non-Target)

- GPA and Test Scores (SAT, GMAT)

- Networking Prowess

- Relevance of Past Internship (or Work) Experience

If you do not have those things in place, no certification will help you, so prioritize those first.

However, when those other elements are in place, the certification can help “round out” the profile.

Do Investment Bank and Private Equity Recruiters Care?

In a nutshell, some recruiters care while others do not.

The reason is that since Wall Street Prep works directly with corporate clients, the certification is a “seal of approval” of sorts that hinges on the reputations of the training providers.

At Wall Street Prep, we consistently receive calls from employers to validate certification claims on candidates’ resumes – employers would only do this if the certification mattered.

For international students and students that come from a liberal arts background, certification is a highly effective way to demonstrate basic competence in financial concepts and modeling.

So those who complete the program and receive our certification have the option to place it on their resumes. While some recruiters might not view the credential as a “significant” resume booster, others believe that the certification does in fact enhance a student’s academic profile.

But frankly, understanding financial modeling can only serve to benefit you in interviews and on the job.

The Bottom Line

It should be noted that some have argued that such a credential may potentially be counter-productive because it will expose the trainee to more challenging technical questions.

This is a red herring; it is true that the more candidates represent what they know during interviews, the more they will be challenged.

But this is not unique to candidates who complete a program like this: A finance major will undoubtedly receive more challenging technical questions than a music major.

But stronger resumes are also more likely to lead to an interview in the first place.

From our experience, if the candidate is careful about not “overselling” the experience, the advantages of using such a Certification as a credential far outweigh any perceived risk.

In closing, Wall Street Prep’s certification offers a way to gain confidence and succeed in interviews and during the networking process by providing students with intuitive, step-by-step training in what they would actually be doing on the job.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

I highly recommend WSP. I did their self study program and learned an incredible amount of information you would never see at the university level in such detail. It’s not a waste of time if you truly learn and figure out how to market the information. Basically, you have to… Read more »

What is the validity of a premium package account once I register? I mean is there a maximum time limit for course completion once I enroll?

Hello,

What is the average number of hours in total needed to complete the Premium Package?

Do you have lifetime access if you want to take the course more then once?

EXCELLENT course, totally worth the money. I exceeded my boss expectations during my Investment Banking Summer Internship at a BB.

Is training program is good or online program? Do both provide certificate

EXCELLENT course, totally worth the money.

I exceeded my boss expectations during my Investment Banking Internship at a BB.

Hope this helps 😉

Hello, I see on here that to reset both scores I was supposed to email [email protected]. I emailed and still have not gotten a response back yet. Is this still the appropriate method? Let me know.

Thanks,

How many attempts do you receive on the accounting crash course exam in the event of a failing score?

How many attempts do you receive on the financial modeling exam in the event of a failing score?

One question

Does the FIMC and EMC courses have a lifetime validity?!

I failed a test, took the retest, and failed again. How do I get another try on the test?

Since all the questions about the number of attempts are old, 1- is it possible to tell me how many attempts there are for the premium package course now? , also it says you have 1 attempt in the page before beginning the exam. 2- Do I need 70% for… Read more »

Do u provide a physical copy of the certificate in addition to the online one after we have passed the exam

Once we buy this is there a time limit to complete or can we go at our own pace and finish the premium package whenever?

What is promo cod? how can I get it Promo Code:

where can I take the certification exam? I can’t find any link for the certification exam on the Wallstreet website? Thank you.

Hello, what are the key differences between FPAMC and Financial and Valuation Modelling (Premium Package)?

Can someone tell me if you should have a finance/business background to take this Financial Modelling Premium certification? Or is this supposed to be for beginners?

Mikel:

I would reach out to support at wall street prep dot com for further assistance with this.

Best,

Jeff

Hello,

I plan to take the ultimate excel vba course exams and it just seems to me that 138 questions are a lot for only 90 minutes. Do I only have two attempts?

Q1. With your premium package will there be exam for each 6 courses or will there be just one certification exam??

Q2. Can it can used as a designation like CFA or CA ??

Q3. Is your course updated to 2020 with new case studies??

Hello,

Do you have a full package of all online courses premium+powerpoint + project finance, etc.?

Best

Hi WSP team,

I just bought the Project Finance Modelling course, and I intend to get the premium package once I have completed it. I saw that the premium package comes with lifetime access . Is it the same for the project finance course ?

Many thanks,

Two questions:

1. Does the course have a lifetime validity ?

2. Do you provide financial aid ?

Thank you

Bandar:

They are similar: the new FSM/DCF courses are updates to the older Apple course. If you plan to take the Certification Exam it shouldn’t matter which FSM or DCF course you took.

Best,

Jeff

Can I sit for the online exam and if I fail, make another attempt immediately thereafter, say 6 hours later especially if my mark was very close to the pass mark

Please I failed the wall street prep certification exam, how do I retake it?

For the course exams it says there is “one attempt”, what happens if you fail this exam?

I have 16 courses on my courses page, which ones are included in the certification exam? and can I know the weights for each course in the exam

Hello! Can I download the videos once I pay for the premium package?

James, 1) You will get access to our self study materials. Currently we do not have videos produced for this course. 2) As mentioned, this course is self-paced – you should assume about 2-3 days of time to devote to the course to fully complete it 3) Please email [email protected]… Read more »

Does the Premium Package access expire? How long do I have before I must complete the exam?

Would you recommend taking the online premium package course first and then also taking the boot camp in-person course for F & V modeling or is that essentially the same curriculum and redundant?

Hi,

How many retakes can we take in total?

Which courses are the most important to pass the Excel exam? Will the test cover all of the courses, or only a select few?

Hi Haseeb,

Another question. Do you train on Interview Questions and Answers. If so , which program is that? I could not find it in any of the packages. Thanks.

Hi Haseeb, I have graduated from Masters in Economics in Canada and I went back to my country and it has been almost years since. But I want to find a job in Toronto. You can say I am not a recent grad. Do you think Wall Street Prep only… Read more »

Hi, Where can I have the re-take of the examination?

Would the Premium Package benefit someone desiring to go into corporate finance, or is it mostly geared toward investment banking?

Would you say obtaining this certification helps when I’m applying to a top tier MBA program? Especially for someone who is not a finance major.

How many hours the exam and do I needs to pay the course and exam?

Hi,

I was curious as to what happens if you do not pass the exam? Whether it be on your first attempt or additional attempts.

Thank you,

Nick

Hi. I would like to know the format of the exam. How many attempts we get and is the exam taken online? Thank you.

I’ve purchased the 3-day Financial and Valuation Modeling Boot Camp package – will this give me access to the exams? Thank you.

Thanks Haseeb

Can we only appear for the examination without enrolling for the premium package?

I am willing to work with the team . thank you

Hi, guys

Once i fall the exam, would the second exam be same as the first?

so how long is the exam , how come some says 3 hours some says 90 minutes ?