What is Discount Factor?

The Discount Factor is used to estimate the present value (PV) of receiving $1 in the future based on the expected date of receipt and discount rate assumption.

How to Calculate Discount Factor

The discount factor is most often used to determine the present value (PV) of a series of future cash flows.

The present value of a cash flow – i.e. the value of a future cash flow discounted back to the present date – is calculated by multiplying the cash flow for each projected year by the discount factor, which is driven by the discount rate and the matching time period.

Generally speaking, there are two methods to calculate the discount factor, but in either case, the discount factor is a function of the following two variables.

- Discount Rate → The discount rate can be thought of as representing the percentage of return that you could have received by investing that dollar, if you had received it today.

- Time Period → The time period refers to the future date on which the cash flow is expected to be received.

The reason you would prefer to have $1 today than $1 three years from now is that if you received the $1 three years from now, you would have missed out on a full three years when you could have invested that $1 and ended up with more than $1 by the end of that time.

Discount Factor Formula

The discount factor formula is as follows.

Alternatively, the formula can also be re-arranged to state the following.

Either formula could be used in Excel; however, we will be using the first formula in our example as it is a bit more convenient

Why? Excel re-arranges the formula itself in the first formula.

Illustrative Discount Factor Calculation Example

To arrive at the present value using the first approach, the discount factor is multiplied by the cash flow to compute the present value (PV).

While the discount rate remains constant throughout the projection, the period number rising is what causes the factor to decrease over time.

Note that the period can be whatever length you want (years, months, days, even hours) – but it is critical to ensure that the period is aligned with the implied period of the discount rate.

Intuitively, the discount factor, which is always calculated by one divided by a figure, decreases the cash flow values. This also ties back to what we discussed at the beginning, where receiving $1 today is more valuable than receiving $1 in the future.

To tie this back to the example using $1, assuming a 10% discount rate and a one-year time horizon – the discount factor would be calculated as:

- 0.91 = 1 ÷ (1 + 10%) ^ 1

Next, the present value can be calculated using:

- 0.91 = $1 × 0.91

The example implies that $1 dollar received one year from the current period would be worth $0.91 in the present day.

The formula for the second approach is virtually identical, except for the absence of the negative sign in front of the period number exponent.

Unlike the first approach, the present value formula this time divides the cash flow by the discount factor.

By entering the discount factor formula into the PV formula, the formula can be re-expressed as:

As opposed to decreasing over time, the factor increases in this case – thereby, the downward adjustment on the present value becomes more apparent in later years.

Returning to the prior example with the same 10% discount rate and one-year time frame, the calculation is:

- 1.1 = (1 + 10%) ^ 1

And upon applying this to the $1 in cash flow:

- 0.91 = 1 ÷ 1.1

So, as we can see, both methods calculate the same present value for the $1 one year from today ($0.91).

Discount Factor Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

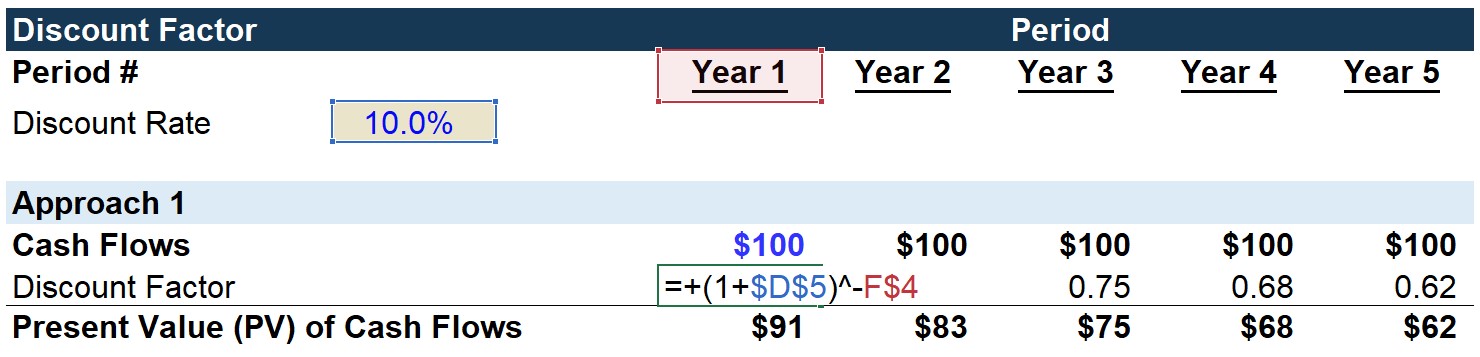

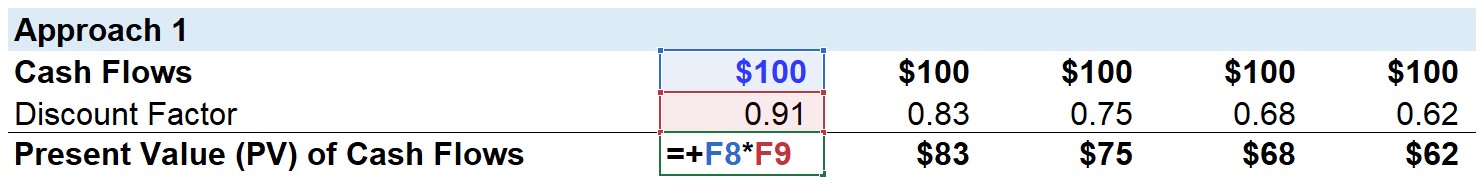

Method 1. Discount Factor Calculation Example

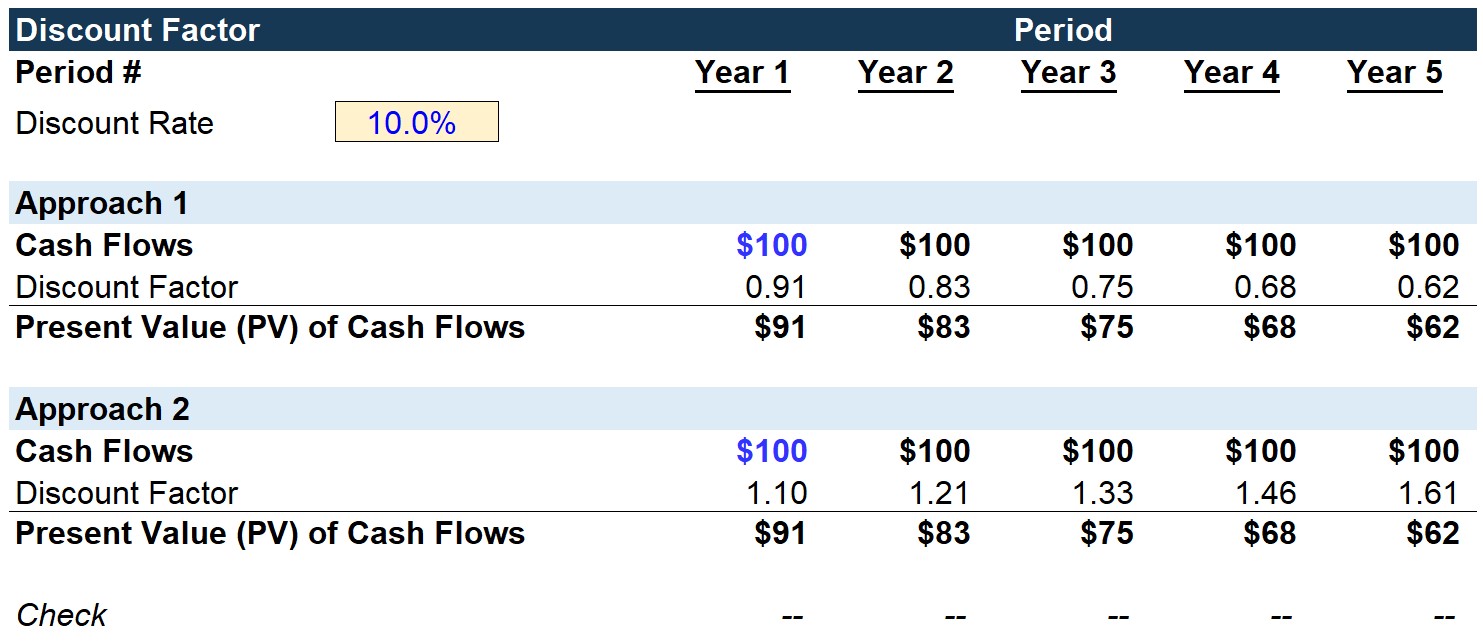

In the hypothetical scenario we will be using, the company has the following financial profile:

- Cash Flow: $100 per Year

- Discount Rate: 10%

For example, in 2021, the discount factor comes out to 0.91 after adding the 10% discount rate to 1 and then raising the amount to the exponent of -1, which is the matching time period.

The 0.91 is subsequently multiplied by the cash flow of $100 to get $91 as the PV of the 1st year cash flow.

By the end of Year 5, we can see the discount factor drop in value from 0.91 to 0.62 by the end of the forecast period due to the time value of money.

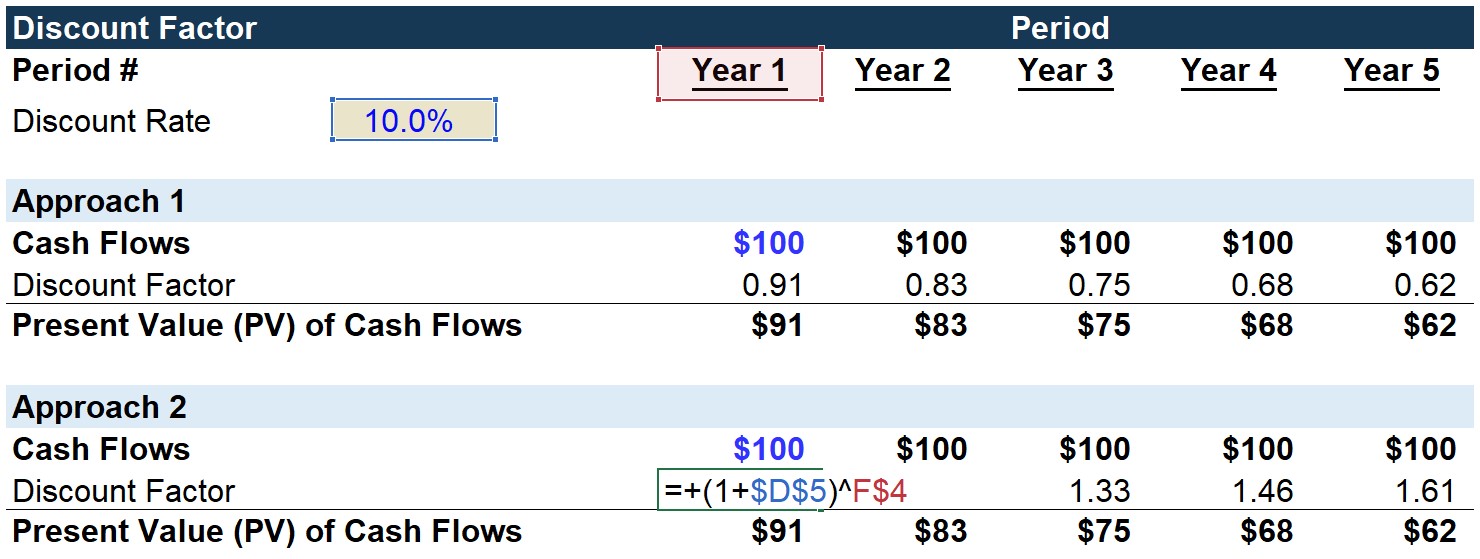

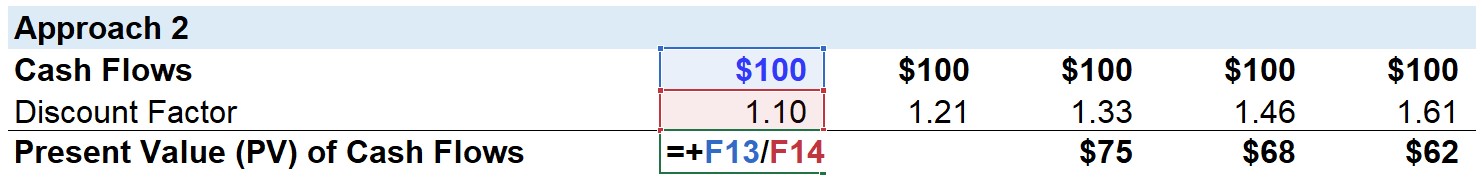

Method 2. Discount Factor Calculation Example

Recall how this time around, the cash flow will be divided by the discount factor to get the present value.

And in contrast to the 1st approach, the factor will be in excess of 1.

For 2021, the discount rate of 10% is added to 1, which is raised to the exponent of 1, as that is the first projected year. From doing so, the output is 1.10.

Conversely, the factor increases over time in the 2nd approach, since the cash flows are being divided by this >1 factor.

Then, the 1st year cash flow of $100 is divided by 1.10 to get $91 for the PV of the cash flow.

In conclusion, the present value (PV) of the cash flows calculated under both approaches result in the same figures.

Ultimately, irrespective of the discount factor method used, the two are conceptually identical; hence, the equivalent outcome.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

‘Discount Factor = (1 + Discount Rate) ^ Period Number’ – the formula is correct?

I mean the correct formula is Discount Factor = (1 + Interest Rate) ^ Period Number.

Interest Rate is not equal to Discount Rate because:

Discount Rate = Interest Rate / (1+Interest Rate)

Best regards