- What is Project Finance?

- Before We Begin – Download the Free Excel Template

- Video 1: Introduction

- Video 2: Project Finance Primer

- Video 3: Course Overview

- Video 4: Timeline and Process

- Video 5: Timeline and Process, Part 2

- Video 6: Construction and Operations Calculations

- Video 7: Negotiations & Optimizations

- Conclusion & Next Steps

What is Project Finance?

What is Project Finance?

Welcome to Wall Street Prep’s free online course on Project Finance!

Project finance refers to the funding of large, long term infrastructure projects such as toll roads, airports, renewable energy using a non-recourse financing structure, which means that debt lent to fund the project is paid back using the cash flows generated by the cash flows generated by the project.

Course objectives: We created this course to provide students and finance professionals pursuing a career in project finance with an understanding the role and interests of the typical participants project finance transaction, key debt and cash flow metrics such as CFADS, DSCR & LLCR, as well as equity return calculations. We hope you enjoy – let’s begin!

Before We Begin – Download the Free Excel Template

Video 1: Introduction

This is the first part of a 7 part series, where you will learn about the basics of project finance analysis. Using Heathrow’s expansion of a third runway, we will walk through the basics of a project finance transaction, key debt, and cash flow metrics, as well as return calculations and common scenarios used to support negotiations.

Video 2: Project Finance Primer

In part 2, you’ll learn the basics of a typical project finance transaction, as well as key project finance jargon and terminology, such as SPV, PPP, CFADS, DSCR, EPV, EPC, DSRA, P90/P50.

Video 3: Course Overview

In part 3, we introduce our project finance case study: Heathrow Airport’s expansion of a third runway.

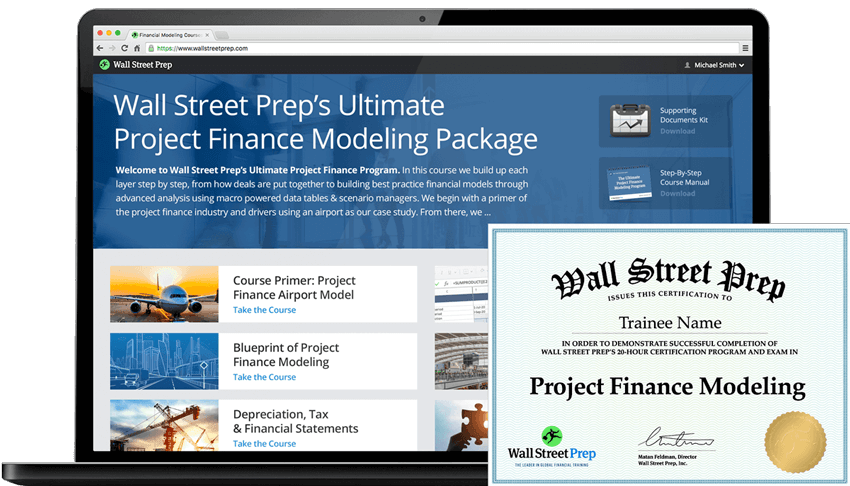

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll TodayVideo 4: Timeline and Process

In part 4, you’ll learn about the typical project finance timeline and process. You’ll learn about the different characteristics of the project development, construction and operation phases of an infrastructure project.

Video 5: Timeline and Process, Part 2

In this lesson, you’ll continue on with the Heathrow Airport case study and learn about the capex, operations, debt and tax mechanics and calculations involved in a project finance transaction.

Video 6: Construction and Operations Calculations

In part 6, you’ll learn about the cash flow waterfall and set the stage to determine cash flow available for debt service (CFADS), the Debt Service Coverage Ratio (DSCR), the Loan Life Coverage Ratio (LLCR), determine the all-important Project IRR.

Video 7: Negotiations & Optimizations

In this final lesson, we will introduce the various interests of the stakeholders involved in a project finance transaction. You will learn about the typical contours of a project finance negotiation and the typical scenarios that a project finance model must accommodate to support these negotiations.

Conclusion & Next Steps

We hope you enjoyed the course and please provide feedback in the comment section below. To learn more about how to build a comprehensive bankable project finance model, consider enrolling in our complete Project Finance Modeling Certification Program.

Well done.

Project Finance is really demystified.

A joy to listen.

It´s interesting for me the Scenarios Manager. In the model End i see it but in the other one i don´t know how to make the table and the index. Could you explain me?

kindly e mail to me the schedule of On line courses and fees and eligiblity criterion .

We will adjust our work shcedule to match the time lags/leads owing to our geographical locations

Sir , I would consider referring my employees from finance department to go for concise On Line Course . we are taking up BOOT projects of mid sized tickets for food waste digesters and Effluent Treatment and recycling to private industries in India

Dear sir , this free on line course on BOOT Finance is excellant , it enlightened me on all aspects of Long term Project financing . It is crisp, to the point , simplified to understand the complex process of making the financial decision .I work as CEO in Indian… Read more »

I think this free Project Finance intro course was brilliant! I wish we could also get the slides