What is Debt Service Coverage Ratio?

If the most important line item in a project finance model is the CFADS, then the most important ratio is the Debt Service Coverage Ratio (DSCR).

DSCR is calculated as CFADS divided by debt service, where debt service is the principal and interest payments due to project lenders. For example, if a project generates $10 million in CFADS and debt service for the same period is $8 million, the DSCR is $10 million / $8 million = 1.25x.

Debt Service Coverage Ratio Formula (DSCR)

The debt service coverage ratio (DSCR) formula is as follows.

- DSCR = Cash Flow Available for Debt Service / Debt Service

Where:

- Debt Service = Principal + Interest

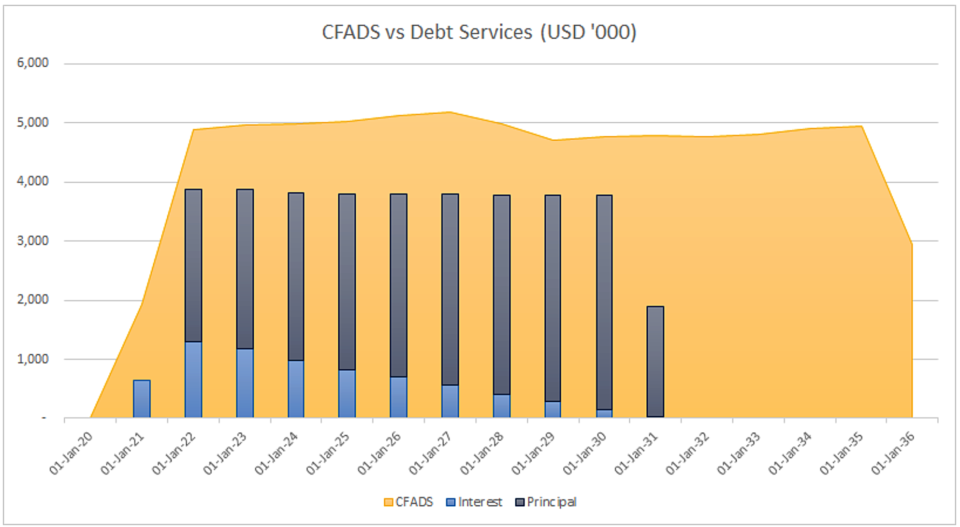

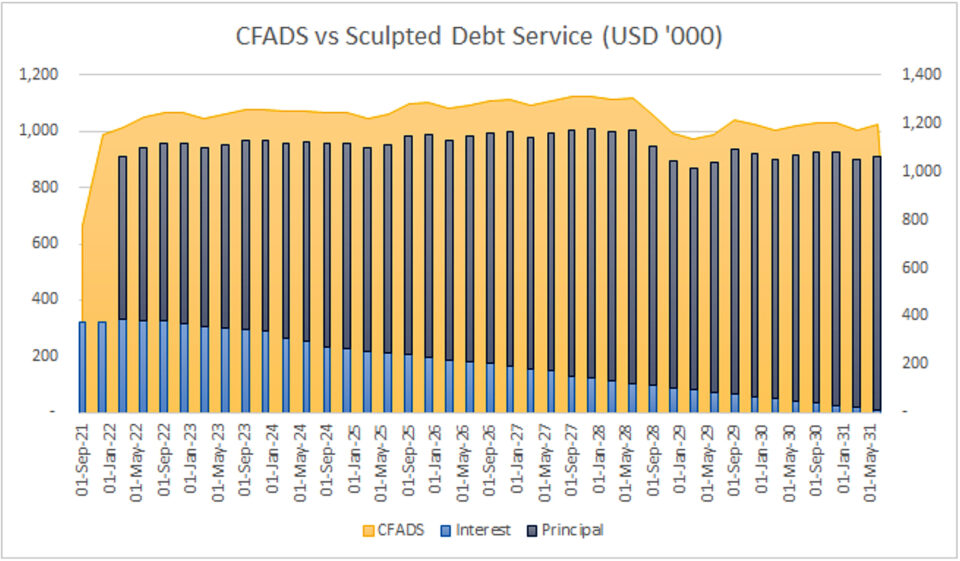

Unlike corporate finance, in project finance lenders are paid back solely through the cash flows generated by the project (CFADS) and DSCR functions as a barometer of health of those cash-flows. It measures, in a given quarter or 6 month period, the number of times that the CFADS pays the debt service (principal + interest) in that period.

DSCR Role in Project Finance

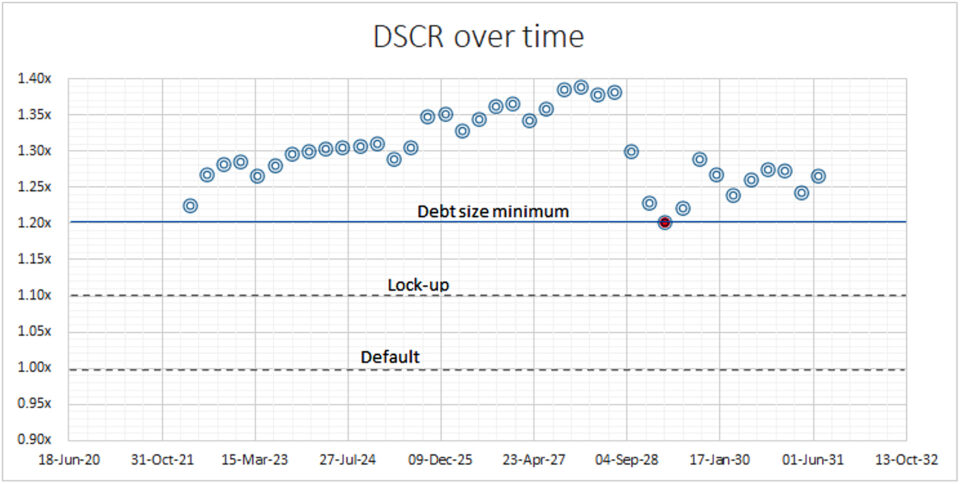

The DSCR is used for two main purposes in project finance: Sculpting & Debt sizing and Covenant testing.

1. Sculpting and Debt Sizing

This is used prior to financial close, in order to determine the debt size, and the principal repayment schedule.

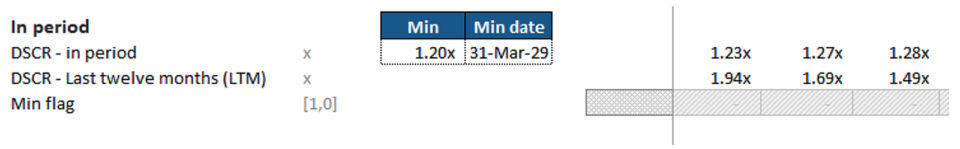

Lenders will set debt sizing parameters, typically including a gearing (or leverage) ratio (Loan to Cost Ratio) and a DSCR (sometimes a LLCR in addition to, or instead of, a DSCR). While the gearing ratio helps to ensure that equity have skin in the game, the DSCR target ratio helps to ensure that a minimum DSCR is maintained at all times.

Here the formula is rearranged, and the debt service is calculated based off the forecast CFADS and specified DSCR.

Debt service = CFADS / DSCR

The debt service can be thus calculated in every period to satisfy the lenders sizing parameters. Sculpting the debt service based off the CFADS and target debt service will yield a debt service profile that follows the CFADS (as above).

Upon adding all the principal components of the debt service up, that will calculate the debt size. Learn more about debt sizing here and learn to build macros automate the process here.

2. Covenant Testing

As the loan is getting repaid during the operations phase of a project, covenants are set in terms of maintaining minimum DSCRs. There are two covenants to pay attention to

- Lock-up: DSCRs form a part of the lock-up covenants. For example if cash-flows breach a minimum covenant of 1.10x, this may trigger a project lock-up. There are different restrictions that this may trigger but the main one is a restriction of distributions to equity holders.

- Default: If the DSCR is less than 1.00x, that means that the project cashflows are not sufficient to meet the projects debt service obligations. Per the facility agreement, this would constitute a project default, which means that the lender has step in rights; and can run the project in their best interests.

The function of these covenants is to give lenders some control, providing a mechanism through which to bring the project sponsors to the table to re-negotiate.