What is Days to Cover?

Days to Cover, often used interchangeably with “short interest ratio,” is the number of days necessary for all short positions to be covered, i.e. bought back by the short-seller and returned.

How to Calculate Days to Cover

The days to cover, or short interest ratio, is the number of days needed on average for all shares sold short to be covered and closed.

The days to cover metric estimates the average number of days it would take for all short-positions on a particular company’s stock to be covered.

As an indicator of short interest, days to cover can be useful for assessing the ease (or lack of) of buying shares that were sold short.

The days to cover gauges the overall market sentiment regarding specific securities and the potential for dramatic share price movements, i.e. a “short squeeze.”

Days to Cover Formula

The formula for calculating the days to cover metric – also known as the short-interest ratio – divides the number of shares currently shorted by the average daily trading volume of the security in question.

Short interest is the number of shares sold short, i.e. borrowed and sold in the open markets by a short-seller to profit from repurchasing the shares at a lower price.

For example, if the total number of shorted shares on a company is 8 million and the average daily trading volume is 2 million shares, days to cover is two days.

- Days to Cover = 8 million / 2 million = 4 Days

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayHow to Interpret the Days to Cover

Calculating the days to cover helps understand the vulnerability of a specific stock to a “short squeeze”.

Generally, competition is directly related to higher stock prices, so the higher the number of days to cover, the greater the probability of a short squeeze.

In the example above, if all the short-sellers desired to close positions right now, it would take roughly four days in total.

- High Days to Cover → Long Time to Unwind Short-Positions

- Low Days to Cover → Short Time to Unwind Short-Positions

In the unfavorable scenario where the share price rises, a lower days to cover metric is clearly preferred because a short-seller would seek to close out the position to minimize their losses.

- If a short squeeze were to occur, the lower the number of days to cover, the better off the short-sellers are (i.e. they can quickly close out short positions and exit).

- If the number of days to cover is longer, the chance of incurring substantial losses from the inability to close out the short is much greater.

What is the Risk of a Short Squeeze?

In the case of a short squeeze, the losses will grow each day as while the share price soars, the trading volume also picks up as more outside buyers in the market attempt to purchase shares.

Thereby, a short-seller should avoid shorting securities with already high short interest and long days to cover because the risk of steep losses might outweigh the potential returns.

Learn More → Hedge Fund Primer

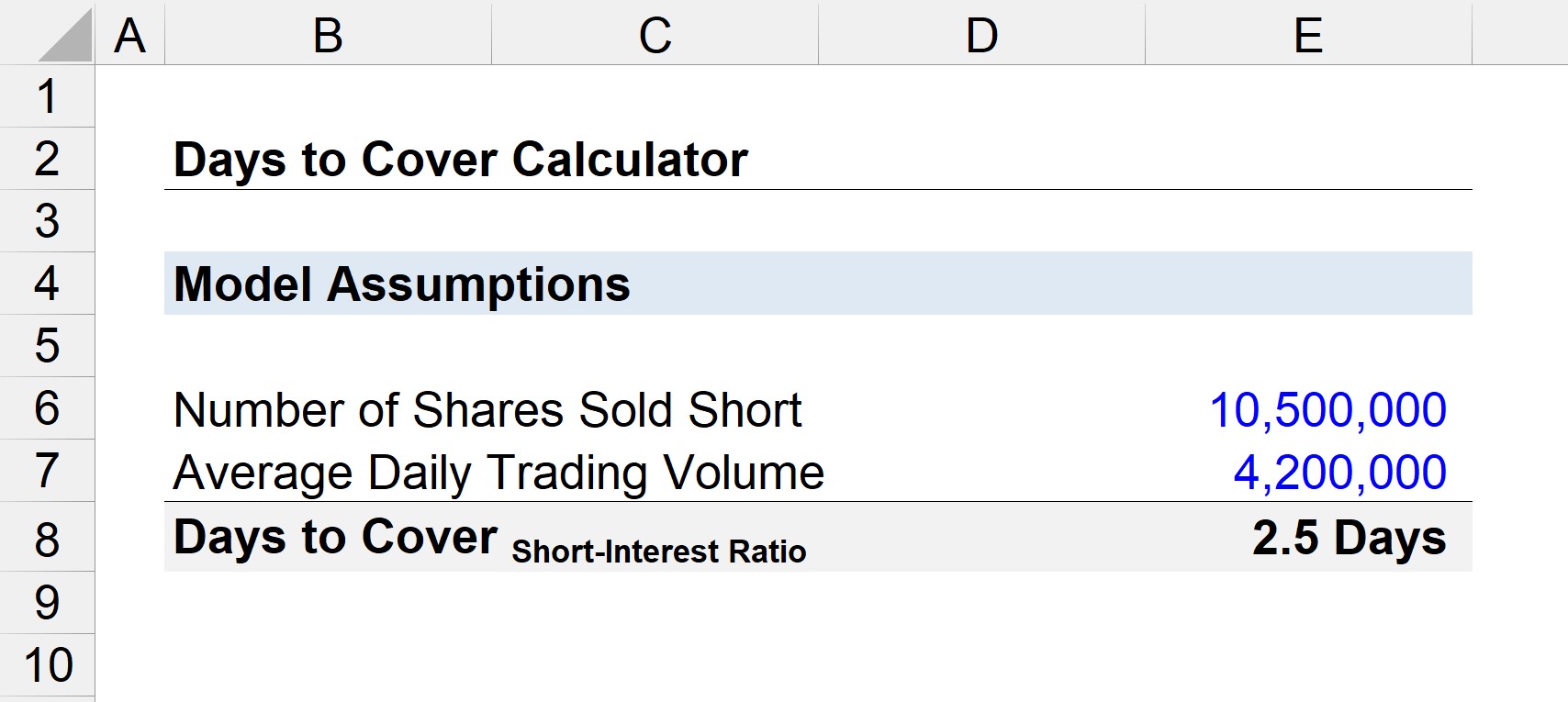

Days to Cover Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Days to Cover Calculation Example

As mentioned earlier, calculating days to cover – i.e. the short-interest ratio – involves dividing short interest by the average daily trading volume.

- Days to Cover = Number of Shares Short ÷ Average Daily Trading Volume

If we assume 10.5 million shares of a company are sold short and the average trading volume per day is 4.2 million, the days to cover is around 2.5 days.

- Days to Cover = 10.5 million / 4.2 million

- Days to Cover = 2.5 Days

The takeaway is that if all short-sellers decided to exit simultaneously, they would need 2.5 days to repurchase the shares in the open market to return them to the brokerage firm or institution that originally lent them the shares.