What is Project Finance?

Project finance is the financing of large, long term infrastructure projects. But theoretically, companies can still “corporate finance” an infrastructure project. So what really separates project finance from other types of finance? The answer is twofold:

#1: Project Finance is Non-Recourse

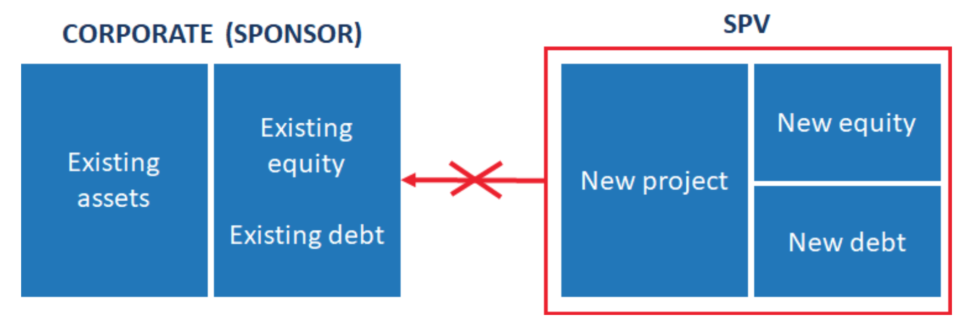

In corporate finance, lenders can generally lay claim to the the assets of the entire company. For example, when Hertz announced their bankruptcy in 2020, their lenders are generally entitled to collect on their debts from all the assets held by Hertz. By contrast, in project finance, the project is “ring-fenced” from the company (sponsoring entity) that is putting the transaction together via a special purpose vehicle (SPV) and lenders claims are solely limited to the cash flows the SPV generates.

The lenders to the SPV have no claim on the assets of the corporate entity that is sponsoring the project.

That difference changes everything.

That’s because in corporate finance, debt capacity and borrowing costs are determined based on the assets and risk (or more specifically, enterprise value) of the entire firm.

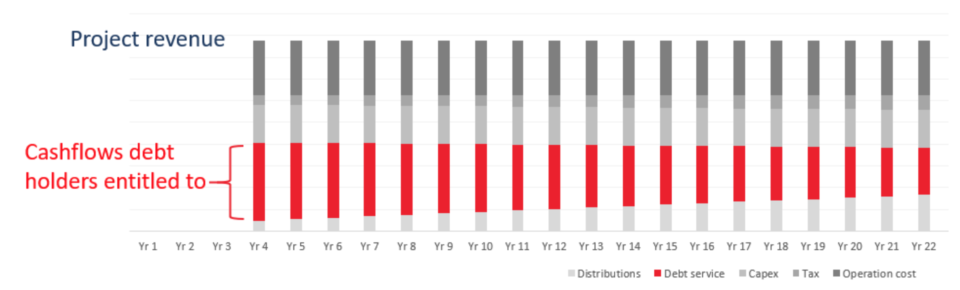

By contrast, the amount of debt that can be raised in project finance is based on the projects ability to repay debt through the cashflows generated of that project alone. This is the key point around which the structure of project finance hangs off.

Project Finance is Non-Recourse, meaning the amount and risk of debt financing is determined solely by the cash flows the project can generate.

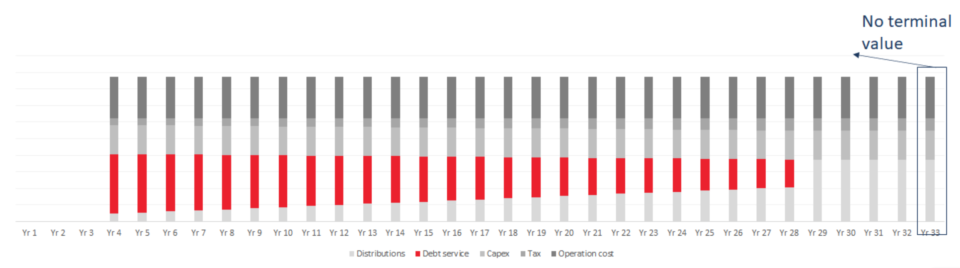

#2 Project Finance has no Terminal Value

The second distinction is that there is very often no “terminal value” in project finance – no sale at the end of the project lifespan which results in an influx in cash to pay creditors (e.g. lenders). This is partly due to the long term nature of the assets, and the size of the assets – the market just isn’t that liquid for an operator of a $1B toll road.

Consider a toll-road concession, where the government grants the rights for 30 years to a private entity for operating the toll road. At the concession end, the government takes over the toll road. There are no further cashflows to the private entity beyond that. Therefore, it’s critical that the cashflows during that 30 year concession can repay the loan principal and interest, AND adequately compensate the entity.

Alternatively, consider a wind farm which a private entity develops and operates. It may be that the technology is rated for a 25-30 year lifespan. Or the lease of the land expires, and the entity needs to decommission the wind farm. There are really no assets to speak of at the end of the project life. Typically any scrap value is offset by the cost of removal and rehabilitation of the land.

And therefore, terminal value is not a factor.

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll TodayWhy project finance is not well suited for small projects

Since lenders believe that their loan principal will be repaid solely from the cashflows generated by the project, as opposed to the values of the assets, their focus centers on mitigating all risks around those cashflows.

This requires a well developed risk sharing mechanism to get creditors (especially lenders) on board. Specifically, this takes the form of:

- A lot of scrutiny to quantify and allocate risk (e.g. what happens if construction takes longer than planned? Who will buy the product?)

- The allows more confidence and a high level of debt (e.g. 70 – 90% of the project cost)

- Leads to high transaction costs and a lengthy transaction process

The high costs and due diligence makes project finance well suited to large projects that throw off a reasonably predictable cashflow, but not particularly well-suited for small projects. Larger projects typically means longer construction times, and longer operations times to generate a return, which brings us back full circle to the definition above: Project finance is the financing of large long term infrastructure projects!

Why would an entity pick project finance over corporate finance?

Above we’ve covered the characteristics of project finance, now pulling out the benefits that this structure allows:

Benefit 1: Risk segmentation: If a corporate entity raises new funds for a project, which has a riskier profile than the current business activities, there is a contamination of risk.

- This puts the corporate at risk in the event of the project defaulting (i.e. contamination risk).

- And likely results in a lower valuation for the corporate overall as the cost of debt & equity go up to compensate for the risk. Project finance removes or reduces this risk.

Benefit 2: A (typically) higher leverage (gearing) ratio: Higher debt capacity means that the sponsors of the project need to commit or raise less equity, and equity returns (e.g. IRR) are higher.

Benefit 3: Smaller entities can develop large projects. The ability to raise capital is less related to the strength of the corporate, and more to the economics of the project.

Bottom line: Project finance is an entirely different beast from corporate finance. The level of focus on cashflows, and risk mitigation force project finance models to be highly structured.