- What is Change in Net Working Capital?

- How to Calculate Change in Net Working Capital (NWC)

- Change in Net Working Capital Formula (NWC)

- What is a Good Change in NWC?

- How to Interpret Negative Net Working Capital

- How to Find Change in NWC on Cash Flow Statement (CFS)

- Change in NWC Calculator — Excel Template

- 1. Balance Sheet Assumptions

- 2. Change in Net Working Capital Calculation Example (NWC)

What is Change in Net Working Capital?

The Change in Net Working Capital (NWC) measures the net change in a company’s operating assets and operating liabilities across a specified period.

If the change in NWC is positive, the company collects and holds onto cash earlier. However, if the change in NWC is negative, the business model of the company might require spending cash before it can sell and deliver its products or services.

How to Calculate Change in Net Working Capital (NWC)

The net working capital (NWC) metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand.

As a general rule, the more current assets a company has on its balance sheet relative to its current liabilities, the lower its liquidity risk (and the better off it’ll be).

- Current Liabilities → The near-term obligations that a company is required to pay off (“outflow”) within the year – e.g. accounts payable and accrued expenses

- Current Assets → The resources belonging to a company that represent monetary value (e.g. accounts receivable), or can be readily liquidated and converted into cash (“inflow”) or are expected to be used within the year – e.g. accounts receivable (A/R) and inventory

While certain accounting textbooks will define the change in net working capital as current assets minus current liabilities, the more practical formula excludes cash and short-term investments like marketable securities and commercial paper, as well as any interest-bearing debt such as loans and bonds.

Where:

- Operating Current Assets → Accounts Receivables (A/R), Inventory, Prepaid Expenses

- Operating Current Liabilities → Accounts Payable (A/P), Accrued Expense

The reason is that cash and debt are both non-operational and do not directly generate revenue.

In fact, cash and cash equivalents are more related to investing activities, because the company could benefit from interest income, while debt and debt-like instruments would fall into financing activities.

Since we have defined net working capital, we can now explain the importance of understanding the changes in net working capital (NWC).

On the cash flow statement, the changes in NWC are essential, because tracking these changes over time (e.g. year-over-year or quarter-over-quarter) helps assess the degree to which a company’s free cash flows will deviate from its accrual-based net income (“bottom line”).

To calculate the change in net working capital (NWC), the current period NWC balance is subtracted from the prior period NWC balance.

Change in Net Working Capital Formula (NWC)

The change in net working capital (NWC) formula is as follows.

Where:

- Beginning NWC → Net Working Capital (NWC) at Beginning of Period (BoP)

- Ending NWC → Net Working Capital (NWC) at End of Period (EoP)

As a sanity check, confirm that if the NWC is growing year-over-year (YoY), the change is negative (“cash outflow”).

In contrast, the change should be positive (“cash inflow”) if the NWC is declining year-over-year (YoY).

What is a Good Change in NWC?

If a company’s change in NWC has increased year-over-year (YoY), this implies that either its operating assets have grown and/or its operating liabilities have declined from the preceding period.

An increase in the balance of an operating asset represents an outflow of cash – however, an increase in an operating liability represents an inflow of cash (and vice versa).

If calculating free cash flow – whether on an unlevered FCF or levered FCF basis – an increase in the change in NWC is subtracted from the cash flow amount.

But if the change in NWC is negative, the net effect from the two negative signs is that the amount is added to the cash flow amount.

- Increase in Net Working Capital (NWC) → Less Free Cash Flows (FCFs)

- Decrease in Net Working Capital (NWC) → More Free Cash Flows (FCFs)

For instance, suppose a company’s accounts receivables (A/R) balance has increased YoY, while its accounts payable (A/P) balance has increased under the same time span.

The net effect is that more customers have paid using credit as the form of payment, rather than cash, which reduces the liquidity (i.e. cash on hand) of the company.

As for accounts payables (A/P), delayed payments to suppliers and vendors likely caused the increase.

Even though the payment obligation is mandatory, the cash remains in the company’s possession for the time being, which increases its liquidity.

How to Interpret Negative Net Working Capital

In the absence of further contextual details, negative net working capital (NWC) is not necessarily a concerning sign about the financial health of a company.

For instance, if NWC is negative due to the efficient collection of receivables from customers who paid on credit, quick inventory turnover, or the delay in supplier/vendor payments, that could be a positive sign.

However, negative working capital could also be a sign of worsening liquidity caused by the mismanagement of cash (e.g. upcoming supplier payments, inability to collect credit purchases, slow inventory turnover).

In such circumstances, the company is in a troubling situation related to its working capital.

How to Find Change in NWC on Cash Flow Statement (CFS)

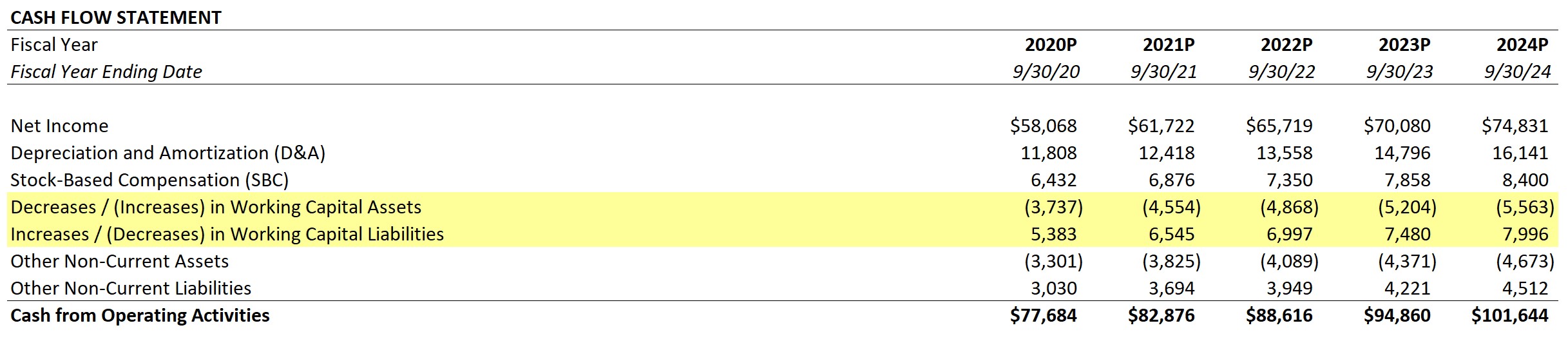

The cash flow statement (CFS) of Apple (NASDAQ: AAPL) is highlighted, to point out which line items measure the increase or decrease in Apple’s working capital assets and working capital liabilities.

Screenshot from Apple 3-Statement Model (Source: WSP Premium Package)

Change in NWC Calculator — Excel Template

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

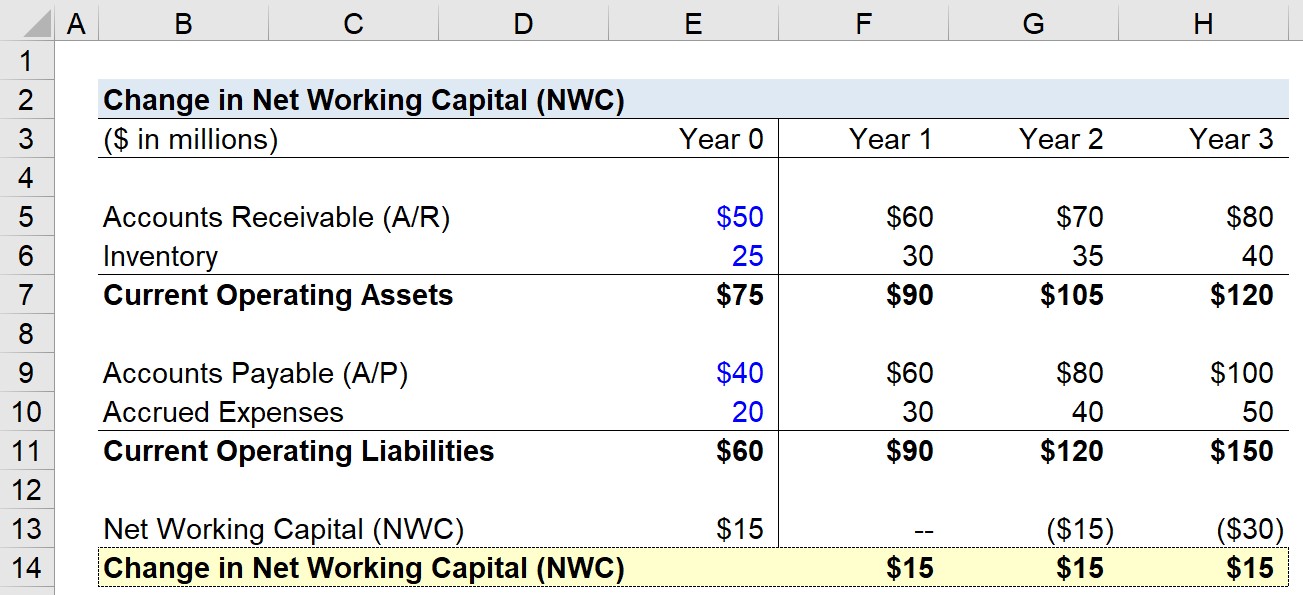

1. Balance Sheet Assumptions

In our hypothetical scenario, we’re looking at a company with the following balance sheet data (Year 0).

Selected Financial Data (Year 0)

- Accounts Receivable (A/R) = $50mm

- Inventory = $25mm

- Accounts Payable = $40mm

- Accrued Expenses = $20mm

Given those figures, we can calculate the net working capital (NWC) for Year 0 as $15mm.

- Current Operating Assets = $50mm A/R + $25mm Inventory = $75mm

- (–) Current Operating Liabilities = $40mm A/P + $20mm Accrued Expenses = $60mm

- Net Working Capital (NWC) = $75mm – $60mm = $15mm

As for the rest of the forecast, we’ll use the following assumptions for each projected year:

- Accounts Receivable (A/R) = (+) $10mm Growth YoY

- Inventory = (+) $5mm Growth YoY

- Accounts Payable = (+) $20mm Growth YoY

- Accrued Expenses = (+) $10mm Growth YoY

2. Change in Net Working Capital Calculation Example (NWC)

Once the remaining years are populated with the stated numbers, we can calculate the change in NWC across the entire forecast.

Since the growth in operating liabilities is outpacing the growth in operating assets, we’d reasonably expect the change in NWC to be positive.

The change in NWC comes out to a positive $15mm YoY, which means the company retains more cash in its operations each year.

- Change in Net Working Capital (NWC) = $15 million

In conclusion, our change in net working capital (NWC) exercise illustrates how increases in operating current assets are cash outflows, while increases in operating current liabilities are cash inflows.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

Dear Sir/Madam, I hope you can offer some assistance with the following. Assuming I use the below formulas. I am wondering why a component in the operating cash flow formula, inventory in net working capital, has the effect of subtracting from the net income figure. I am using the following formulas: Operating… Read more »

Very informative article on working capital. However, I am always confused with the signs used in calculating change in working capital. Is it prior period minus current period or vice versa? Also wanted to know the signs used in calculation of changes in operating assets and operating liabilities in cash… Read more »