What is Cash Runway?

The Cash Runway measures the implied amount of time that an early-stage startup can continue operating at a loss before depleting its cash on hand.

How to Calculate Cash Runway

The cash runway is closely tied to the burn rate, which is the rate at which a company is spending its cash, typically expressed on a monthly basis.

More specifically, in the context of cash flow negative start-ups – i.e. companies that are not yet profitable – the burn rate measures the pace at which a start-up is using its equity capital as typically raised from outside investors.

- Gross Burn = Monthly Cash Expenses

- Net Burn = Monthly Cash Sales – Monthly Cash Expenses

The burn rate is an important metric in early-stage venture investing (VC), as it is an input to the implied runway formula.

Cash Runway Formula

The formula for calculating the cash runway is the amount of cash on hand divided by the burn rate.

What is a Good Cash Runway?

The cash burn rate and implied runway – two metrics that go hand-in-hand – dictate how long a start-up has until its current operations can no longer be sustained, making outside funding necessary.

If at that point the start-up is unable to raise additional capital, the start-up in all likelihood will be forced to shut down.

As a result, start-up founders must estimate the projected runway to plan for the timing around when to begin raising interest from investors for the next financing round.

Otherwise, as a last resort, a start-up can increase its implied runway by:

- Implementing Cost-Cutting Initiatives

- Shutting Down Underperforming Business Units

- Switching to Cash Payment Only (i.e. No Accounts Receivable, or “A/R”)

- Liquidate Non-Core Inventory

The ease with which a start-up can raise capital is contingent on positive growth and other key performance indicators (KPIs), namely sales and user growth.

Start-ups with proven market traction and proof of concept within their target customer market and a clear plan for how to spend the newly raised capital are far more likely to raise enough capital for operations to continue.

Learn More → Benchmark of Raising Capital (Source: NUOPTIMA)

Cash Runway Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Cash Runway Calculation Example

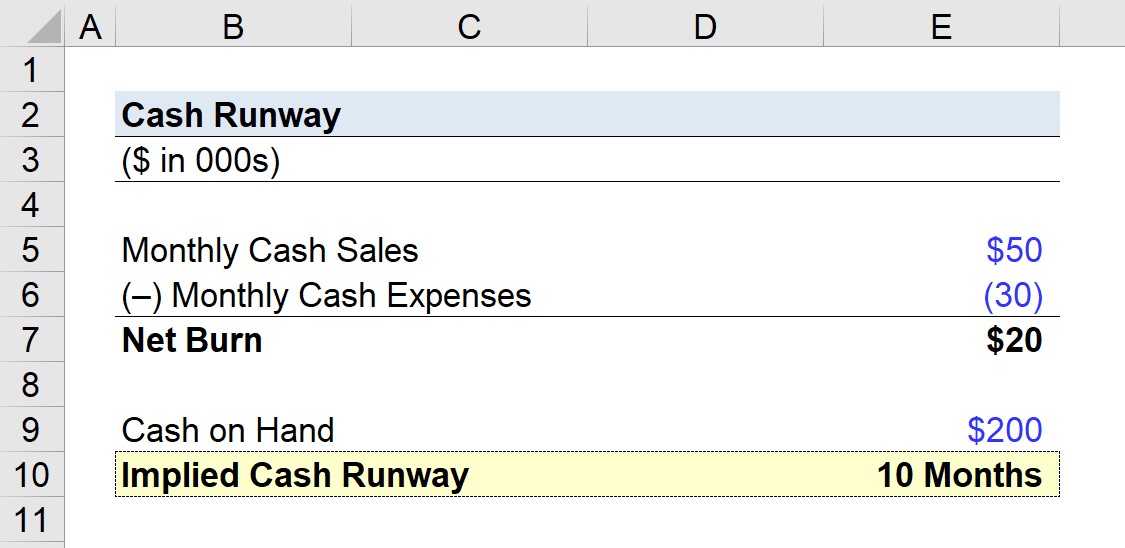

Suppose an early-stage SaaS start-up currently has $200,000 in cash, which it previously raised from venture capital (VC) firms.

- Cash on Hand = $200,000

If the start-up has monthly cash sales of $50,000 and monthly cash expenses of $30,000, the net burn rate is $20,000 per month.

- Monthly Cash Sales = $50,000

- Monthly Cash Expenses = ($30,000)

- Net Burn = $50,000 – $30,000 = $20,000

Given the net burn of $20,000 per month, the implied runway is equal to 10 months.

- Cash Runway = $200,000 ÷ $20,000 = 10 Months

Therefore, the cash runway of 10 months implies the startup must either become profitable or raise its next round of equity funding from existing or new investors.

The Wharton Online and Wall Street Prep Private Equity Certificate Program

Level up your career with the world's most recognized private equity investing program. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll Today