- What is Cash Free Debt Free?

- How Do Cash-Free Debt-Free Basis Transactions Work?

- What is the Structure of a Cash-Free Debt-Free Transaction?

- How to Negotiate Cash-Free Debt-Free Transactions?

- Cash-Free Debt-Free Transaction Calculator

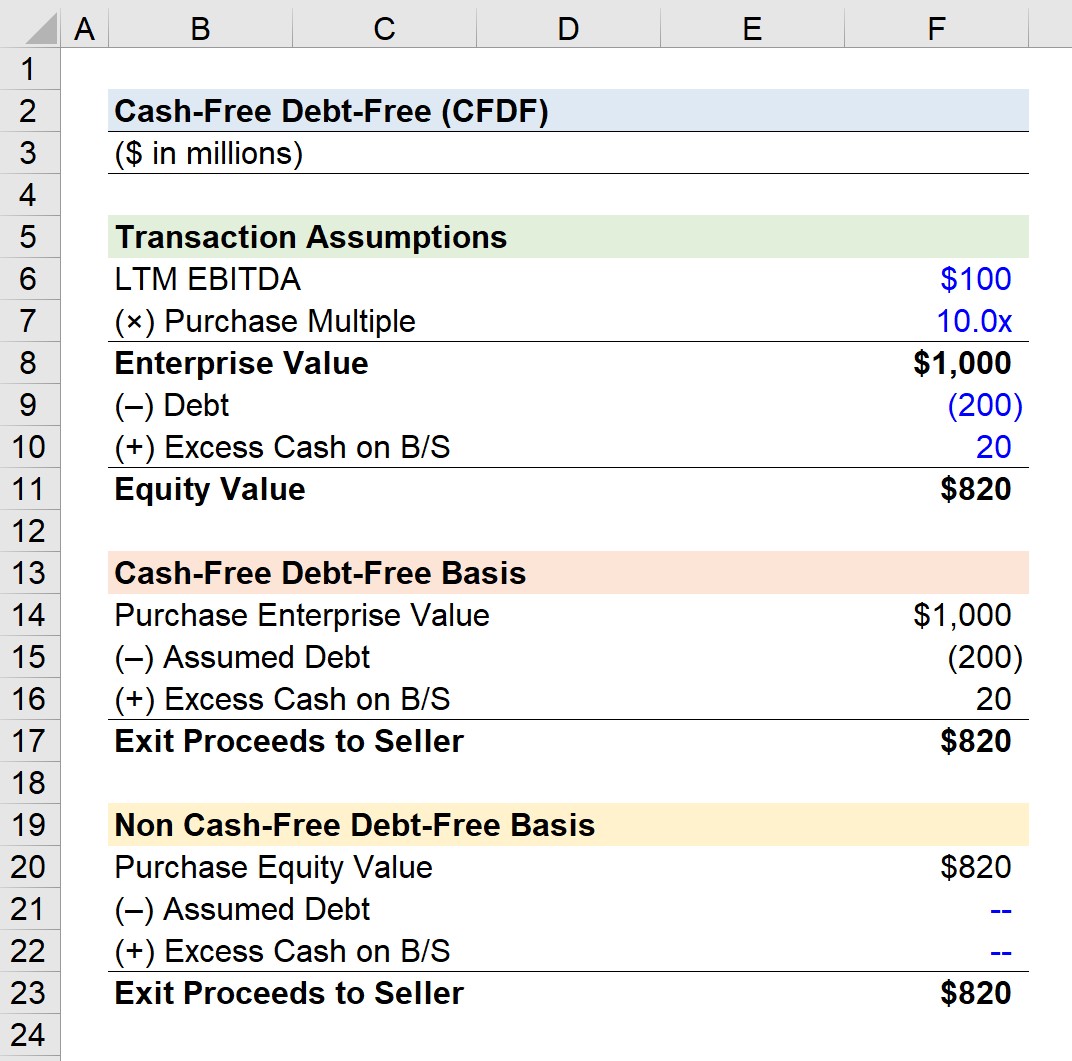

- 1. CFDF Transaction Assumptions

- 2. LBO Cash-Free Debt-Free Transaction Example

- 3. LBO Non-CFDF Transaction Example

- 4. Cash-Free Debt-Free Transaction Analysis (CFDF)

What is Cash Free Debt Free?

Cash Free Debt Free (CFDF) is a transaction structure where the buyer does not assume any debt on the seller’s balance sheet, nor gets to keep any leftover cash.

How Do Cash-Free Debt-Free Basis Transactions Work?

In M&A, the term “Cash-Free Debt-Free” simply means that when an acquirer purchases another company, the transaction will be structured such that the buyer will not assume any of the debt on the seller’s balance sheet, nor will the buyer get to keep any of the excess cash on the seller’s balance sheet.

From the perspective of the seller, a cash-free debt-free (CFDF) transaction results in the following implications:

- Seller Retains Excess Cash ➝ The seller retains the excess cash on their balance sheet at the time of closing, except for a usually negotiated amount of “operating” cash that is considered a minimum amount that needs to transfer over in the sale to keep the operations of the freshly acquired business running smoothly.

- Seller Liable for Existing Debt ➝ The outstanding debt obligations remaining on the seller’s balance sheet must be paid off in full by the seller.

What is the Structure of a Cash-Free Debt-Free Transaction?

The purchase price delivered to the seller is the enterprise value in M&A deals structured as cash-free-debt-free (CFDF).

If an M&A transaction is structured on a cash-free, debt-free basis, the enterprise value is implied to equal the purchase price.

Because the acquirer does not have to assume the seller’s debt (nor get the benefit of the seller’s balance sheet cash), the acquirer is simply paying the seller for the value of the core operations of the business, i.e. the enterprise value.

In CFDF deals, the purchase price delivered to the seller is simply the enterprise value (TEV).

By contrast, in an acquisition where the acquirer acquires all the seller’s assets (including cash) and assumes all the liabilities (including debt), the purchase price delivered to the seller would need to be adjusted by taking the enterprise value and subtracting out the seller’s existing net debt and purchasing just its equity.

The Wharton Online and Wall Street Prep Private Equity Certificate Program

Level up your career with the world's most recognized private equity investing program. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayHow to Negotiate Cash-Free Debt-Free Transactions?

In practice, most leveraged buyouts (LBOs) – i.e. the transactions that private equity firms specialize in – are structured on a cash-free debt-free basis (CFDF).

Frequently, the letter of intent (LOI) will contain language to formally establishes that the transaction structure will be on a cash-free debt-free basis (CFDF).

However, the definition of what counts as cash and debt is not finalized and negotiations may continue about this up until the close, making the cash-free debt-free basis structure a sometimes delicate point of negotiations.

For instance, suppose you are a seller thinking you’ll get to keep $5 million in cash, but the private firm argues that $3 million of that is intrinsic to the operations of the business and should come over with the company in the late stages of the deal.

Learn More → Issues in Negotiating Cash-Free Debt-Free Deals (PDF)

Cash-Free Debt-Free Transaction Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

1. CFDF Transaction Assumptions

Suppose WSP Capital Partners, a private equity firm, seeks to acquire JoeCo, a coffee wholesaler and retailer.

WSP Capital Partners believes JoeCo deserves an enterprise value of $1 billion, representing 10.0x JoeCo’s last twelve months (LTM) EBITDA of $100m.

- Enterprise Value = $1 billion

- Purchase Multiple = 10.0x

- LTM EBITDA = $100 million

JoeCo has $200mm in debt on its balance sheet, along with $25m in cash on its balance sheet, of which $5m the buyer and seller jointly agreed to consider “operating cash” that will be delivered to the buyer as part of the sale.

- Existing Debt = $200 million

- Cash on B/S = $25 million

- Operating Cash = $5 million

- Excess Cash = $20 million

Note: Our illustrative LBO model will ignore all transaction and financing fees for simplicity.

2. LBO Cash-Free Debt-Free Transaction Example

Since the buyer is only buying the enterprise value, the buyer simply defines the purchase price as $1 billion, which is the enterprise value.

From the buyer’s perspective, since there’s $0 net debt that goes along with this newly acquired business, its equity value is simply $1 billion, i.e. the same as the enterprise value.

So, what happens to the debt and cash on the seller’s balance sheet?

The seller receives the $1 billion purchase price and pays off the $180m in net debt ($200m, net of the $20m in excess cash).

- Purchase Enterprise Value (TEV) = $1 billion

- Assumed Debt = $180 million

- Excess Cash on B/S = $20 million

- Equity Value = $1 billion –$200 million + $20 million = $820 million

The proceeds to the seller amount to $820m, which is equal to the equity value.

- Exit Proceeds to Seller = $1 billion –$200 million + $20 million = $820 million

3. LBO Non-CFDF Transaction Example

In contrast, suppose the same LBO transaction was NOT structured on a CFDF basis.

So, how would things look like if the same LBO deal was instead structured such that the acquirer assumes all liabilities (including debt) and acquires all assets (including cash)?

Given the non-CFDF transaction assumption, the acquirer will assume all seller debt and gets all seller cash.

The enterprise value remains $1 billion, so enterprise value is NOT impacted.

Of course, this time, the buyer is not just buying the enterprise, the buyer also assumes the $200m in debt, slightly offset by $20m in cash. The acquirer is still getting the same business, just with a lot more debt. So, all else equal, the buyer would define the purchase price as:

- Purchase Equity Value = $1 billion – $180 million = $820 million

From the seller’s perspective, $820m is received rather than $1 billion, but the seller has no lenders to pay off.

Under either scenario – ignoring any tax or other nuances that usually create a preference for a cash-free debt-free structure (CFDF) – the two approaches are economically identical.

4. Cash-Free Debt-Free Transaction Analysis (CFDF)

Since most M&A deals are valued off EBITDA, the cash-free debt-free (CFDF) structure is conceptually simpler and aligns with how buyers think about the value of potential targets to acquire.

How so?

EBITDA is a measure of operating profitability independent of cash or debt. In fact, the EBITDA metric is solely a function of the businesses’ core operations, regardless of how much excess cash or debt is sitting on the company’s books.

In our JoeCo example, the 10.0x EBITDA entry multiple determines the purchase price, aligning the valuation with the purchase price from the acquirer’s perspective.

The exception to CFDF structure is when the target company is public (i.e. “go-privates”) or in larger mergers & acquisitions.

In conclusion, those types of M&A deals will not be structured as cash-free debt-free (CFDF). Instead, the acquirer will acquire each share via an offer price per share or acquire all the assets (including cash) and assume all the liabilities (including debt).

Hi I have a quick question. If we are a CFDF basis, and the target had A$25m cash (o/w A$5m is minimum cash required and A$20m is excess cash). When we do Sources and Uses table, does it mean the A$20m excess cash is on the sources side to reduce… Read more »

Maybe already answered but curious as to how Accounts Receivable are handled in CFDF? I assume as AP are considered Debts to be covered then AR will be considered as Cash and so also able to be included in final adjustments?

If a public company has $2B Market Cap & $500m Cash, How much would an acquirer have to pay then? This is my thinking (& confusion) Approach 1 (as per the EV bridge): we calculate EV=1,500m. Analysis: Buyer pays 1,500m and doesn’t get the cash balance Seller gets 1,500m+500m (cash… Read more »

Hello, in a CFDF deal, how do you treat assets such as buildings or investments which are not directly related to generating EBITDA?

Also, how would you treat a VAT credit?

In the CFDF option what happens to the operating cash of $5M. Does that go to the buyer for WC?

Hi team, you indicate that Enterprise value is the the Cash Free Debt Free valuation as it already ignores the capital structure of the company. However, in practice for CFDF deals, it appears that firms typically take the Enterprise Value then deduct debt and add cash to arrive at the… Read more »