What are Cash and Cash Equivalents?

Cash and Cash Equivalents is a categorization on the balance sheet consisting of cash and current assets with high liquidity (i.e. assets convertible into cash within 90 days).

What is the Definition of Cash and Cash Equivalents?

The cash equivalents line item on the balance sheet states the amount of cash on hand plus other highly liquid assets readily convertible into cash.

The assets considered as cash equivalents are those that can generally be liquidated in less than 90 days, or 3 months, under U.S. GAAP and IFRS.

The two primary criteria for classification as a cash equivalent are as follows:

- Readily Convertible into Cash On-Hand with Relatively Known Value (i.e. Low-Risk)

- Short-Term Maturity Date with Minimal Exposure to External Factors (e.g. Interest Rates Cuts/Hikes)

U.S. GAAP Cash Equivalents Definition

“Formally, U.S. GAAP defines cash equivalents as: “short-term, highly liquid investments that are readily convertible to known amounts of cash and that are so near their maturity that they present insignificant risk of changes in value because of changes in interest rates.” (Source: SEC.gov)

Furthermore, the cash and cash equivalent line item is always treated as a current asset and is the first item listed on the assets side of the balance sheet.

What are Examples of Cash and Cash Equivalents?

To reiterate, the “Cash and Cash Equivalents” line item refers to cash – the hard cash found in bank accounts – as well as cash-like investments.

Common examples of assets included in cash and cash equivalents are the following:

- Cash

- Commercial Paper

- Short-Term Government Bonds

- Marketable Securities

- Money Market Accounts

- Certificate of Deposit (CD)

All of these assets have high liquidity, meaning that the owner could sell and convert these short-term investments into cash rather quickly.

These cash equivalents are included in the calculation of numerous measures of liquidity:

- Cash Ratio = Cash and Cash Equivalents ÷ Current Liabilities

- Current Ratio = Current Assets ÷ Current Liabilities

- Quick Ratio = (Cash & Equivalents + Accounts Receivables) ÷ Current Liabilities

How Cash and Cash Equivalents Impact Net Working Capital (NWC)?

In practice, the cash and cash equivalents account is excluded from the calculation of net working capital (NWC).

The rationale is that cash and cash equivalents are closer to investing activities rather than the core operating activities of the company, which the NWC metric attempts to capture.

In the net debt metric, a company’s cash and cash equivalents balance is deducted from its debt and interest-bearing securities.

Cash and Cash Equivalents in Financial Modeling

Long-term investments are technically not current assets. However, considering the liquidity of the long-term cash equivalents – i.e. the ability to be sold in the open market without a material loss in value – can allow them to be grouped together for purposes of financial modeling.

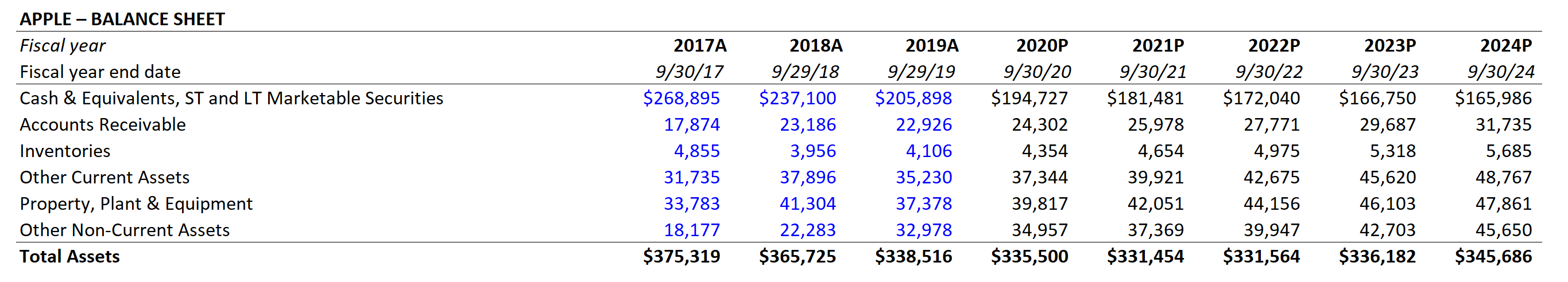

For example, our financial model on Apple (AAPL) includes both short-term and long-term marketable securities in the cash and cash equivalents line item.

Consolidation can be done in this case because the drivers of the cash and investments roll-forward schedules are identical (i.e. the same net impact on the ending cash balance).

Apple 3-Statement Financial Model (Source: WSP FSM Course)

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

When consolidating marketable securities into cash and equivalents (as in the example of Apple), how do you typically adjust the historical cash flow statement so as to reconcile the change in cash and equivalents (inclusive of marketable securities) to the ending balance of cash and equivalents (inclusive of marketable securities)?… Read more »

How do you no if it really plays cash