What is Book Value Per Share?

The Book Value Per Share (BVPS) is the per-share value of equity on an accrual accounting basis that belongs to the common shareholders of a company.

How to Calculate Book Value Per Share (BVPS)

The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities.

Therefore, the book value per share (BVPS) is a company’s net asset value expressed on a per-share basis.

The difference between a company’s total assets and total liabilities is its net asset value, or the value remaining for equity shareholders.

The BVPS is a standardized metric and thus facilitates comparisons between different companies operating in the same (or an adjacent) industry..

Therefore, the amount of cash remaining once all outstanding liabilities are paid off is captured by the book value of equity.

Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet.

As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q).

Book Value Per Share Formula (BVPS)

The formula for BVPS involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding.

If relevant, the value of preferred equity claims should also be subtracted from the numerator, the book value of equity.

For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm.

If we assume the company has preferred equity of $3mm and a weighted average share count of 4mm, the BVPS is $3.00 (calculated as $15mm less $3mm, divided by 4mm shares).

Book Value Per Share vs. Market Stock Price: What is the Difference?

The difference between book value per share and market share price is as follows.

- Book Value Per Share (BVPS) ➝ The book value of equity per share (BVPS) reflects the equity value recorded on the balance sheet. Unlike the market share price, the BVPS is a historical measure intended for accrual accounting.

- Market Stock Price → The market share price factors in existing investor sentiment regarding future growth and profits (and is forward-looking). In nearly all cases, the market price is much greater than the book value of equity per share. The market share price reflects the most recent prices that investors in the open markets recently paid for each share (i.e. the fair value).

Although infrequent, many value investors will see a book value of equity per share below the market share price as a “buy” signal. But an important point to understand is that these investors view this simply as a sign that the company is potentially undervalued, not that the fundamentals of the company are necessarily strong.

In other words, investors understand the company’s recent performance is underwhelming, but the potential for a long-term turnaround and the rock-bottom price can create a compelling margin of safety.

Nevertheless, most companies with expectations to grow and produce profits in the future will have a book value of equity per share lower than their current publicly traded market share price.

For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash. In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS).

Alternatively, another method to increase the BVPS is via share repurchases (i.e. buybacks) from existing shareholders.

Book Value Per Share Calculator (BVPS)

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Book Value Per Share Calculation Example (BVPS)

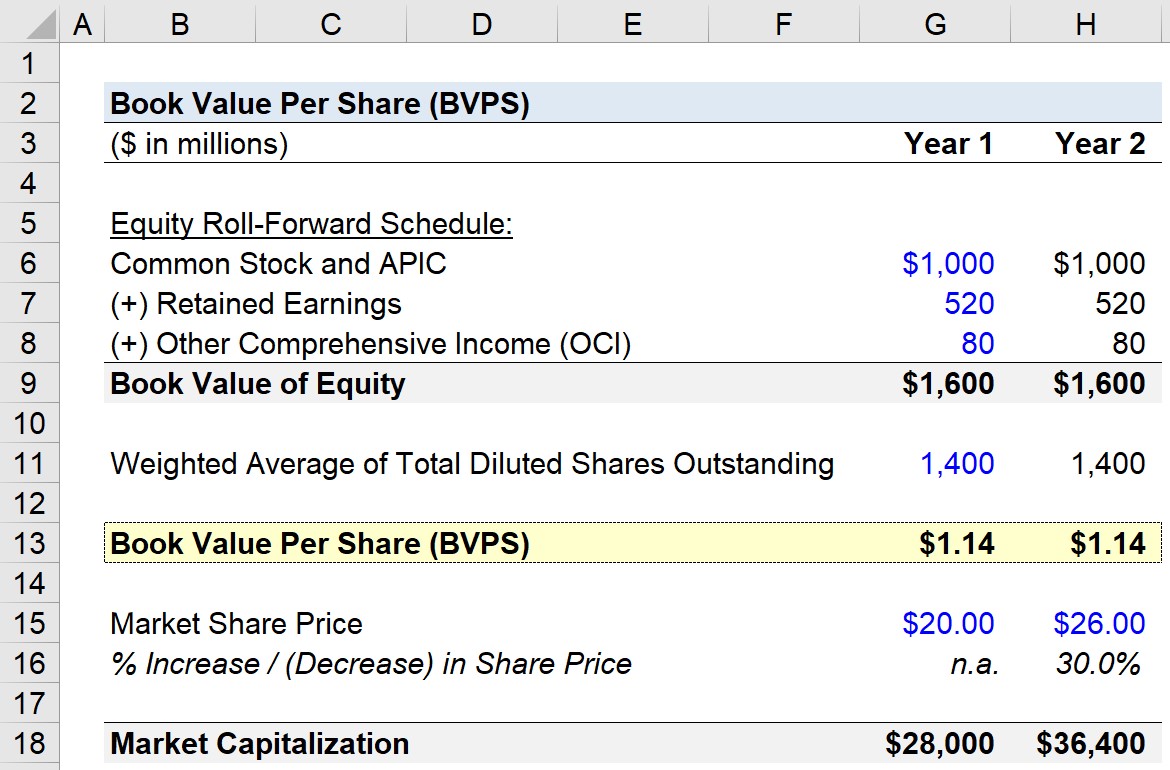

In our example scenario, the company we’ll be calculating the book value of equity per share with the following financial data:

- Common Stock and APIC = $1bn

- Retained Earnings = $520mm

- Other Comprehensive Income (OCI) = $80mm

With those three assumptions, we can calculate the book value of equity as $1.6bn.

The next assumption states that the weighted average of common shares outstanding is 1.4bn.

Using those two assumptions, we can calculate the Year 1 BVPS as $1.14.

- Book Value Per Share (BVPS) = $1.6bn ÷ 1.4bn = $1.14

As for the next projection period, Year 2, we’ll simply extend each operating assumption from Year 1, and thus, the BVPS will be $1.14 again.

The difference lies in the change in the market share price. We’ll assume the trading price in Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase.

By multiplying the diluted share count of 1.4bn by the corresponding share price for the year, we can calculate the market capitalization for each year.

- Market Capitalization, Year 1 = $28.0bn

- Market Capitalization, Year 2 = $36.4bn

Despite the increase in share price (and market capitalization), the book value of equity per share (BVPS) remained unchanged in Year 1 and 2.

- Book Value Per Share (BVPS) = $1.14

Unless the company has updated certain assets and liabilities items on its balance sheet to their (usually higher) fair market values (FMV), the book value of equity (BVE) will not reflect the complete picture.

Clear differences between the book value and market value of equity can occur, which happens more often than not for the vast majority of companies.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today