- What is Bond Yield?

- How to Calculate Bond Yield

- How to Price a Bond

- Bond Price vs. Bond Yield: What is the Relationship?

- How to Calculate Coupon Rate

- How to Calculate Current Yield

- How to Calculate Yield to Maturity (YTM)

- Discount vs. Par vs. Premium Bond: What are the Differences?

- How Do Bond Prices Affect Current Yield and Coupon Rate?

- What are the Features of Callable Bonds?

- How to Calculate Yield to Call (YTC)

- How to Calculate Yield to Worst (YTW)

- Bond Yield Calculator

- 1. Bond Yield Calculation Tutorial Assumptions

- 2. Current Yield (CY) Calculation Example

- 3. Yield to Maturity (YTM) Calculation Example

- 4. Yield to Call (YTC) Calculation Example

- 5. Yield to Worst (YTW) Calculation Example

What is Bond Yield?

The Bond Yield is the rate of return expected to be received by a bondholder from the date of original issuance until maturity.

How to Calculate Bond Yield

The bond yield earned by bondholders is analyzed using a combination of methods, each with their own set of pros and cons.

By not relying on only a single method to arrive at the yield on a bond, bondholders can see a complete picture of the bond’s risk/return profile.

Briefly, the most common bond yield metrics used in practice that we’ll discuss are the following.

| Metric | Description |

|---|---|

| Coupon Rate |

|

| Current Yield |

|

| Yield to Maturity (YTM) |

|

| Yield to Call (YTC) |

|

| Yield to Worst (YTW) |

|

How to Price a Bond

The factors that play an integral role in determining the yield on bonds are the following:

- Face Value (FV) → The par value of the bond on the date of issuance, which the coupon is based on.

- Coupon Rate (I) → The interest rate pricing on the bond determines the dollar amount of coupon payments due each year, expressed as a percentage.

- Coupon (C) → The annual interest amount owed to the bondholder by the issuer.

- Maturity → The tenor of the bond issuance (i.e. length of time), as agreed upon by the issuer and the investor on the lending agreement.

Bond Price vs. Bond Yield: What is the Relationship?

Bond prices and bond yields are inversely related. Therefore, if the price of a bond goes up, its yield declines (and vice versa).

- Higher Bond Price → Lower Bond Yield

- Lower Bond Price → Higher Bond Yield

Notably, the factor with arguably the most influence on bond yields is the prevailing interest rate environment.

The general rule of thumb is that interest rates and yields have an inverse relationship, i.e. if interest rates rise, bond prices decline (and vice versa).

- If interest rates rise, the prices of bonds in the market fall, causing bond yields to increase (i.e. a higher coupon rate).

- If interest rates decline, the prices of bonds in the market rise, resulting in bond yields falling (i.e. a lower coupon rate)

How to Calculate Coupon Rate

The coupon rate, also known as the “nominal yield,” determines the annual coupon payment owed to a bondholder by the issuer until maturity.

The coupon, i.e. the annual interest payment, equals the coupon rate multiplied by the bond’s par value.

The coupon rate can be calculated by dividing the annual coupon payment by the bond’s par value.

For example, given a $1,000 par value and a bondholder entitled to receive $50 per year, the coupon rate is 5%.

- Coupon Rate = $50 ÷ $1,000

- Coupon Rate = 5%

Whereas yields move along with the market, coupons are distinct in that they remain fixed during the bond’s term.

Regardless of the changes in the market price of a bond, the coupon remains constant, unlike the other bond yields, which we’ll discuss in more detail in the subsequent sections.

How to Calculate Current Yield

The coupon rate (“nominal yield”) represents a bond’s annual coupon divided by its face (par) value and is the expected annual rate of return of a bond, assuming the investment is held for the next year.

To calculate the current yield, the formula consists of dividing the annual coupon payment by the current market price.

Calculating the current yield of a bond is a three-step process:

- The current bond price can be readily observed in the markets – in which the bond can either trade at a discount, at par or at a premium to par.

- The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon rate must be annualized.

- The current yield formula equals the annual coupon payment divided by the bond’s current market price, expressed as a percentage.

For example, a bond trading at $900 with a $1,000 face value and a $60 coupon has a 6% coupon rate and a current yield of 6.7%.

Unlike the coupon rate, which remains fixed, the current yield fluctuates based on the market price of the bonds.

Note that the current yield metric only becomes relevant if the market price of the bond deviates from its par value.

How to Calculate Yield to Maturity (YTM)

The yield to maturity (YTM) is the rate of return received if the investment is held to maturity, with all interest payments reinvested at the same rate as the YTM.

If bond investors use the term “yield,” in all likelihood, they are most likely referring to the yield to maturity (YTM).

Yield to maturity (YTM) accounts for all interest received over time, the initial purchase price (i.e. capital invested), the par value (i.e. amount returned at redemption), and maturity (i.e. the time from issuance to maturity).

The widespread usage of YTM is largely attributable to how the metric can be used for comparisons among bonds with different maturities and coupons.

Unlike the yield to maturity (YTM), the current yield is not the “real” yield of a bond since it neglects the yield associated with recovering the principal amount and assuming the reinvestment of coupon payments at the same rate as the YTM.

Discount vs. Par vs. Premium Bond: What are the Differences?

Since the price of a bond adjusts based on the prevailing macro conditions and credit health of the underlying issuer (e.g. credit ratings), bonds can be purchased at discounts or premiums relative to par.

Moreover, the current market prices of bonds can be categorized into three buckets:

- Discount Bond → Yield to Maturity (YTM) > Coupon Rate

- Par Bond → Yield to Maturity (YTM) = Coupon Rate

- Premium Bond → Yield to Maturity (YTM) < Coupon Rate

For example, if the par value of a bond is $1,000 (“100”) and if the price of the bond is currently $900 (“90”), the security is trading at a discount, i.e. trading below its face value.

Conversely, if the bond price in the market is $1,100 (“110”), the bond is selling at a premium, i.e. priced by the market above its face value.

How Do Bond Prices Affect Current Yield and Coupon Rate?

The pricing of the bond (e.g. discount, par, premium) directly affects the current yield and coupon rate.

- Bond Price < Par Value → “Discount” Bond

- Discount Bond: Current Yield > Coupon Rate

- Bond Price = Par Value → “Par” Bond

- Par Bond: Current Yield = Coupon Rate

- Bond Price > Par Value → “Premium” Bond

- Premium Bond: Current Yield < Coupon Rate

What are the Features of Callable Bonds?

Before delving into yield to call (YTC) and yield to worst (YTW), it would be best to preface the sections with a review of callable bonds.

If a bond issuance is callable, the issuer can redeem the borrowing before maturity, i.e. pay off the debt earlier.

Callable bonds should exhibit greater yields than comparable, non-callable bonds – all else being equal.

Within the bond indenture of callable bonds, the contract will state the schedule of when prepayment is permitted. For example, the “NC/3” abbreviation means the bond issuer cannot redeem the bonds until three years have passed.

Certain provisions included in the bond agreement can make yield calculations more complicated, which is the call feature in this scenario.

- Call Price → The fixed cost to redeem the bonds is ordinarily set at a slight premium above the par value.

- Call Premium → Common bond feature makes the offering more attractive to risk-averse investors, i.e. more downside risk protection.

- Prepayment Fees → The call provision can also result in prepayment fees, which again, are intended to make the bond offering more marketable when raising capital from prospective investors.

Specific to callable bonds, one concern during declining interest rates is that the bond’s issuer might view the low interest rates as a chance to refinance its existing debt at more favorable rates.

How to Calculate Yield to Call (YTC)

The yield to call (YTC) metric implies that a callable bond was redeemed (i.e. paid off) sooner than the stated maturity date.

Yield to call (YTC) is the anticipated return on a callable bond, assuming the bondholder redeemed (i.e. retired) the bond on the earliest call date.

The YTC metric is only applicable to callable bonds, in which the issuer has the right to redeem the bonds earlier than the stated maturity date.

Issuers are more likely to call a bond earlier than scheduled due to:

- Refinancing Debt in a Lower Interest Rate Environment

- Reducing the Proportion of Debt in the Capital Structure

Note: While it is possible to calculate the YTC on a date later than the first call date, it is standard to calculate the metric using the first date on which the bond can be redeemed.

Yield to Maturity (YTM) vs. Yield to Call (YTC)

The distinctions between YTM and YTC are as follows:

- Yield to call (YTC) uses the call date, rather than the date of maturity.

- Yield to call (YTC) calculates the return if the bonds are redeemed, i.e. prior to maturity.

- Yield to call (YTC) uses the call price, instead of the par value at the redemption price.

How to Calculate Yield to Worst (YTW)

Assuming the issuer does not default, the yield to worst (YTW) is the minimum return received on a callable bond – assuming the issuer does not default.

Yield-to-worst (YTW) is the lowest potential return received by a lender (i.e. the most conservative yield), as long as the issuer does not default.

YTW is thereby the “floor yield”, i.e. the lowest percent return aside from the expected yield if the issuer were to default on the debt obligation.

As part of worst-case scenario contingency planning, the yield to worst (YTW) is estimated – but note that “worst-case” here refers to the bond being redeemed by the issuer at the earliest possible date, rather than a default.

From determining the yield to worst (YTW), bondholders can mitigate their downside risk by avoiding being unexpectedly blindsided by an issuer calling a bond early.

In real life, the yield to worst (YTW) is applicable only for callable bonds and those trading at a premium.

Bond Yield Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

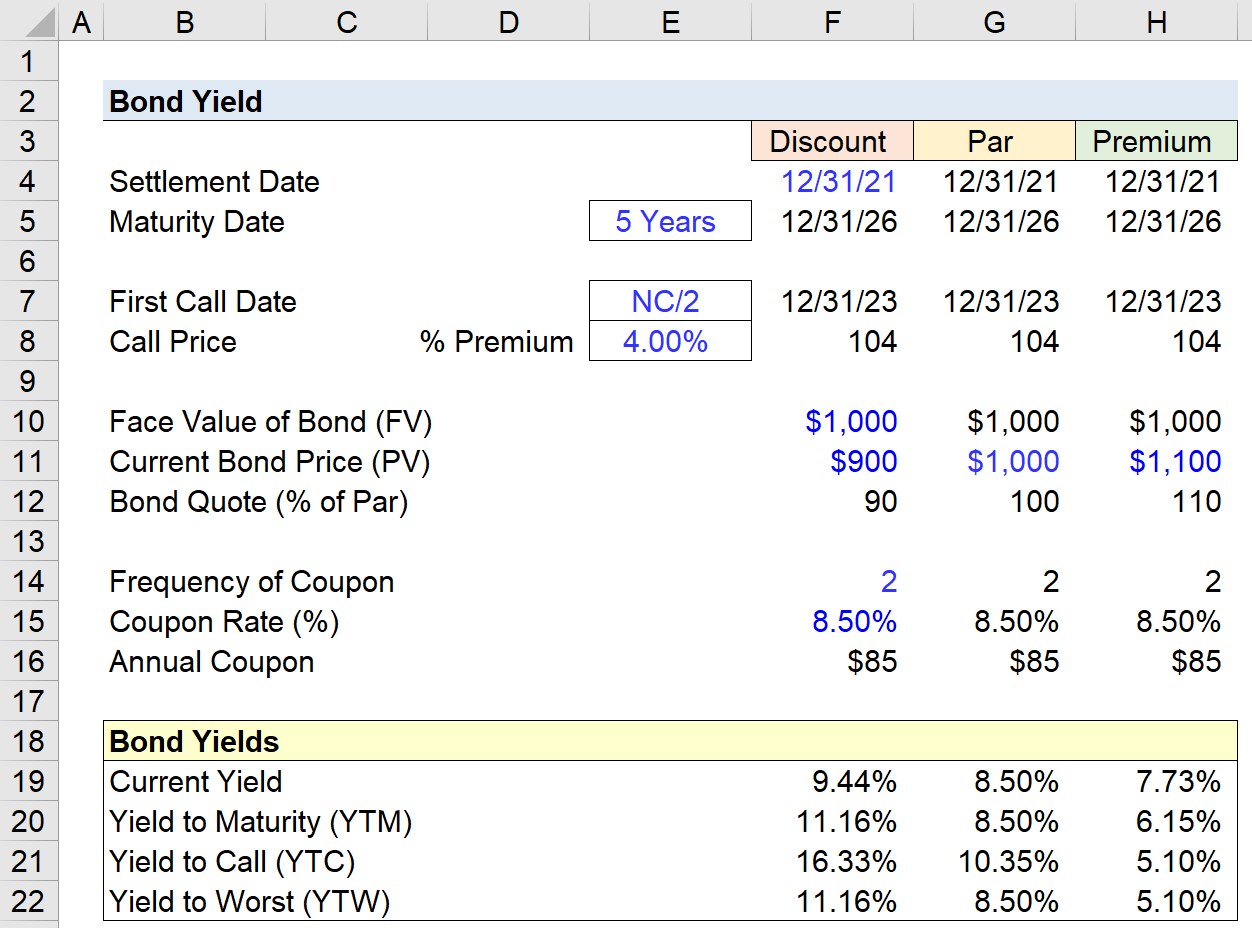

1. Bond Yield Calculation Tutorial Assumptions

In our illustrative exercise, we’ll calculate the yield on a bond using each of the metrics discussed earlier.

Suppose the bond issuance has a maturity of five years, and the financing was finalized on 12/31/2021 with the first call date two years after the settlement date.

- Settlement Date → 12/31/21

- Maturity Date → 12/31/26

- First Call Date → 12/31/23 (“NC/2”)

There will be three distinct scenarios in which all the assumptions will be identical except for the current market pricing.

Given a par value of $1,000 (“100”), the prices for each scenario are as follows:

- Discount Bond = $900 (“90”)

- Par Bond = $1,000 (“100”)

- Premium Bond = $1,100 (“110”)

We’ll assume the bond pays an annual coupon at an interest rate of 8.5%, so the annual coupon is $60.

- Frequency of Coupon = 2x

- Coupon Rate = 8.5%

- Annual Coupon = $85

2. Current Yield (CY) Calculation Example

For our first returns metric, we’ll calculate the current yield (CY) by multiplying the coupon rate (%) by the par value of the bond (“100”), which is then divided by the current bond quote.

- Current Yield – Discount Bond = 9.44%

- Current Yield – Par Bond = 8.50%

- Current Yield – Premium Bond = 7.73%

Note: If the bond quote convention is followed (e.g. 100 par value), all figures should utilize the same convention, or the formula will not work properly.

Now, we will enter our assumptions into the Excel “YIELD” function to calculate the yield to maturity (YTM) and yield to call (YTC).

Where:

- settlement = Settlement Date

- maturity = Original Maturity Date or Early Redemption Date

- rate = Annual Coupon Rate

- pr = Bond Quote (% of Par)

- redemption = Par Value or Call Price

- frequency = Number of Compounding Periods (Annual = 1, Semi-Annual = 2)

3. Yield to Maturity (YTM) Calculation Example

The inputs for the yield to maturity (YTM) formula in Excel are shown below.

- Yield to Maturity (YTM) – Discount Bond = 11.16%

- Yield to Maturity (YTM) – Par Bond = 8.50%

- Yield to Maturity (YTM) – Premium Bond = 6.15%

4. Yield to Call (YTC) Calculation Example

Moving on, the yield to call (YTC) is virtually identical – but “maturity” is changed to the first call date and “redemption” to the call price, which we’ll assume is set at “104”.

The call price assumption of “104” is the quoted bond price that the issuer must pay to redeem the debt issuance entirely or partially, earlier than the actual maturity date.

- Yield to Call (YTC) – Discount Bond = 16.33%

- Yield to Call (YTC) – Par Bond = 10.35%

- Yield to Call (YTC) – Premium Bond = 5.10%

5. Yield to Worst (YTW) Calculation Example

The final step is to calculate the yield to worst (YTW), which is the lower value between the yield to maturity (YTM) and the yield to call (YTC).

The “MIN” Excel function outputs the lower value between the two.

- Yield to Worst (YTW) – Discount Bond = 11.16%

- Yield to Worst (YTW) – Par Bond = 8.50%

- Yield to Worst (YTW) – Premium Bond = 5.10%

Aside from the premium bond, the yield to worst (YTW) is equal to the yield to call (YTM). The issuer of a premium bond is likely to redeem the bond earlier, especially if interest rates have declined.

Crash Course in Bonds and Debt: 8+ Hours of Step-By-Step Video

A step-by-step course designed for those pursuing a career in fixed income research, investments, sales and trading or investment banking (debt capital markets).

Enroll Today

great stuff