What is a Black Swan Event?

A Black Swan Event is a metaphor describing a rare, unexpected phenomenon with a low probability of occurrence yet has a significant impact on society as a whole.

In finance, a black swan event carries a negative connotation because the term refers to a rare, unpredictable, and random event that poses significant downside risk in terms of the economic impact and stock market.

What is the Black Swan Event Theory?

The term “Black Swan Event”—popularized by Nassim Nicholas Taleb—refers to unpredictable occurrences, often with catastrophic consequences.

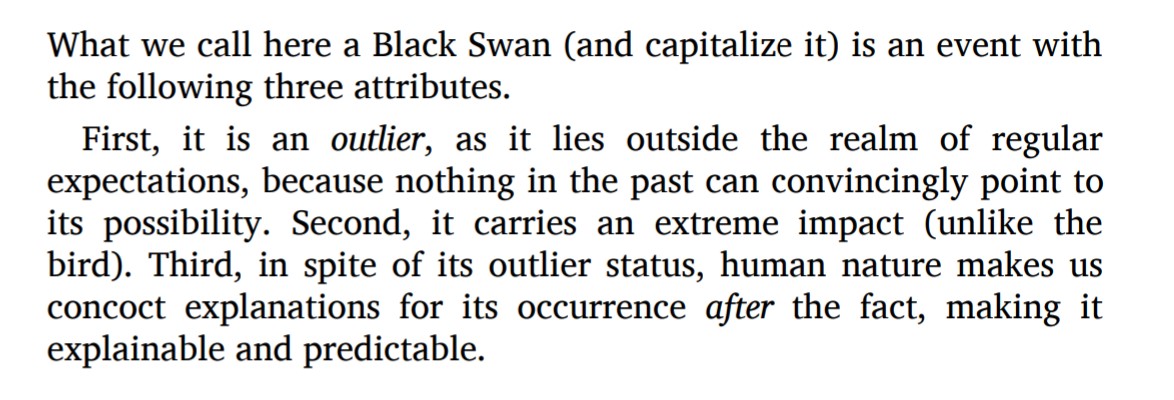

According to Taleb, the three traits of a black swan event are:

- Rarity (Unpredictable Outlier)

- Results in Severe Consequences

- Rationalized Post-Occurrence (i.e. Retrospective Bias)

Excerpt from The Black Swan by Nassim Taleb (Source: The Black Swan)

How Does a Black Swan Event Work?

In the context of the stock market, the underlying idea behind the so-called “Black Swan Theory” is not to predict such improbable events but rather to be more strategic in terms of capital allocation and risk mitigation.

Even if such events can occur, there must be measures already set in place to limit possible losses and the downside risk, or perhaps even profit from the events, if well-positioned (i.e. tail risk hedging).

Therefore, the investment strategy entails minimizing losses while placing bets to capitalize on irregular events, akin to a venture capitalist in pursuit of “home runs” to offset potential losses.

In the case of investing and trading in the financial markets, a few examples of risk measures include:

- Portfolio Diversification (e.g. Industry, Geography)

- Avoidance of Portfolio Concentration (e.g. Portfolio Diversification)

- Hedges (e.g. Options, Derivatives)

What are Examples of Black Swan Events in the Stock Market?

Despite the association with events with significantly negative impacts, black swan events are not all crises, per se.

The following list contains examples of notable black swan events:

- Digital Age (or “Dot Com” Era)

- Terrorist Attacks on September 11, 2001

- 2008 Global Financial Crisis (e.g. the “Great Recession”)

The “dot com” era consisted of a recession once the bubble popped (i.e. market crash)

Still, despite the initial sell-off, the U.S. eventually emerged with prominent companies, most notably Amazon. The development of the eCommerce sector led by Amazon is one example of a “positive” black swan event.

In other words, the interpretation depends on the perspective and information on hand for whether an event is classified as a “Black Swan” event or not – i.e. one person’s loss is another’s gain.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayWas the COVID-19 Pandemic a Black Swan Event?

The classification of an occurrence as a black swan event is relatively subjective. For instance, Taleb has criticized that the COVID-19 pandemic was not actually a Black Swan event.

Statistically, the possibility of a highly transmissible pathogenic virus targeting the respiratory system was well-known and even documented internally by the U.S. government – yet somehow, the outbreak was exacerbated by mask shortages, lack of hospital beds, and delayed responses.

While COVID-19 itself was unpredictable, more measures could have been put in place to prevent the spread of a potential virus.

Hence, the COVID-19 virus exhibited exponential growth as countries scrambled to contain the spread via lockdowns.

Pandemics are clearly not predictable on an individual basis. However, the potential breakout of one and the negative effects post-emergence could be anticipated (i.e. unlikely to happen, but could still be prepared for).

But at a bare minimum, most observers can likely agree that the U.S. and other countries could have been better prepared for something like COVID-19.

Ultimately, one cannot completely predict and understand the cause of a Black Swan event, or how the event will play out – but the point is that protective measures should be taken for downside protection in anticipation of unexpected events.