What is Additional Paid-In Capital?

Additional Paid-In Capital (APIC) represents the value received in excess of the par value from issuances of preferred or common shares.

How to Calculate Additional Paid-In Capital (APIC)?

The additional paid-in capital (APIC) represents the excess amount paid in total by investors above the par value of a company’s shares.

In other words, the additional paid-in capital is the amount that investors are willing to pay over the par value of the company’s shares.

On the balance sheet, the additional paid-in capital line item is shown separately in the shareholders equity section below common stock, with the par value stated near it for reference.

The par value of stock is normally set very low (e.g. $0.01), so the majority of the value received from investors for a capital raise will be recorded in the additional paid-in capital (APIC) account, rather than the common stock account.

The additional paid-in capital is often used interchangeably with several terms, such as:

- Contributed Surplus

- Contributed Capital in Excess of Par

- Capital in Excess of Par Value

- Paid-In Capital in Excess of Stated Value

When a private company decides to go public in an initial public offering (IPO), its equity is offered to the public for the first time.

As part of the IPO process, the company must set an appropriate price per each share within its charter – and that price is called the “par value” of the shares.

The paid-in capital metric equals the sum of the par value and APIC, meaning APIC is intended to capture the “premium” paid by investors.

Calculating the additional paid-in capital (APIC) is a two-step process:

- Step 1: The par value of the shares is subtracted from the issuance price at which the shares were sold.

- Step 2: The excess of the sale price and par value is then multiplied by the number of shares issued.

APIC Formula

The additional paid-in capital formula (APIC) is as follows.

For purposes of financial modeling, APIC is consolidated with the common stock line item and then projected with a roll-forward schedule.

APIC vs. Market Value of Shares: What is the Difference?

One common misconception is that the sale price on the date of issuance represents the market value of the shares, i.e. the current share price of the company determined by the secondary trading in the open markets.

The additional paid-in capital is instead based on the initial “offering price” of the shares on the date of issuance, such as the date of the IPO or the secondary offering.

To reiterate, the APIC account can only increase if the issuer were to sell more shares to investors, in which the issuance price exceeds the par value of the shares.

So movements in the company’s share price – whether upward or downward – have no effect on the stated APIC amount on the balance sheet because these transactions do not directly involve the issuer.

Additional Paid-In Capital Calculator (APIC)

We’ll now move to a modeling exercise, which you can access by filling out the form below.

APIC Calculation Example

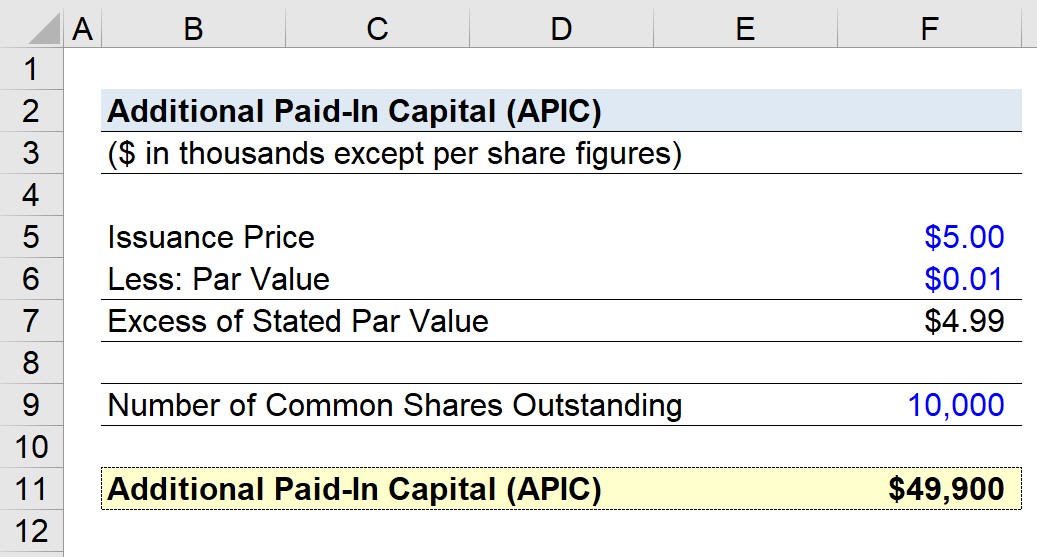

Suppose a private company recently went public via an initial public offering (IPO), where its shares were issued at a sale price of $5.00 each at a par value of $0.01 per share.

- Issuance Price = $5.00

- Par Value = $0.01

The excess of the issuance price over the stated par value is $4.99.

- Excess of Stated Par Value = $5.00 – $0.01 = $4.99

If the total number of common shares outstanding is assumed to be 10 million, how much in APIC would be recorded on the balance sheet?

Upon multiplying the excess spread over the stated par value by the number of common shares outstanding, we arrive at an additional paid-in capital (APIC) value of $49.9 million.

- Additional Paid-In Capital (APIC) = $4.99 × 10 million = $49.9 million

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

Hello Sir/Madam Please explain, For example, the company filed S-1 IPO Form. IPO share price and shares offering N&A, but in Statements of Stockholders Equity I see that the company sold part of the shares at 10 $ price. The question is, is the price in Statements of Stockholders Equity at… Read more »