What is the Accounting Equation?

The Accounting Equation is a fundamental principle that states assets must equal the sum of liabilities and shareholders equity at all times.

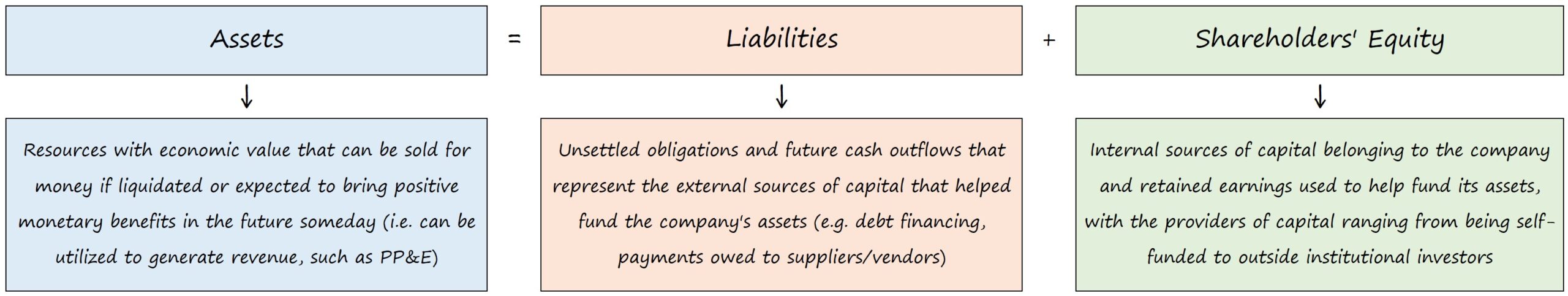

On the balance sheet, the assets side represents a company’s resources with positive economic utility, while the liabilities and shareholders equity side reflects the funding sources.

Basic Accounting Equation: Assets = Liabilities + Equity

The accounting equation states that a company’s assets must be equal to the sum of its liabilities and equity on the balance sheet, at all times.

The accounting equation is a core principle in the double-entry bookkeeping system, wherein each transaction must affect at a bare minimum two of the three accounts, i.e. a debit and credit entry.

There are three components to the accounting equation, otherwise referred to as the “balance sheet equation”:

- Assets → An asset is a resource owned by a company with positive economic value, which either possesses monetary value (i.e. can be sold for a net gain) or is expected to produce future benefits, such as PP&E. Assets can either be tangible, like fixed assets (e.g. equipment and machinery) or intangible (e.g. patents, trademarks, intellectual property and copyrights).

- Liabilities → A liability represents a company’s obligations that represent future outflows of cash, i.e. unmet payments. For instance, common liabilities include debt securities such as loans, accounts payable (A/P), accrued expenses and deferred revenue.

- Equity → The equity section of the balance sheet, often called “Shareholders’ Equity”, is the net assets of a company (i.e. the remaining value of a company’s assets after subtracting liabilities). The equity component is composed of items such as paid-in capital, retained earnings and treasury stock (or share repurchases).

What are the Components of the Accounting Equation?

The balance sheet is one of the three main financial statements that depicts a company’s assets, liabilities, and equity sections at a specific point in time (i.e. a “snapshot”).

Typically reported quarterly or annually, the balance sheet consists of three components:

| Balance Sheet | Description |

|---|---|

| Assets Section |

|

| Liabilities Section |

|

| Shareholders Equity Section |

|

Accounting Equation Formula

The fundamental accounting equation, as mentioned earlier, states that total assets are equal to the sum of the total liabilities and total shareholders equity.

Simply put, the rationale is that the assets belonging to a company must have been funded somehow, i.e. the money used to purchase the assets did not just appear out of thin air to state the obvious.

If a company’s assets were hypothetically liquidated (i.e. the difference between assets and liabilities), the remaining value is the shareholders’ equity account.

Therefore, the assets side must always be equivalent to the sum of the liabilities and equity, the company’s two funding sources:

- Liabilities → e.g. Accounts Payable, Accrued Expenses, Debt Financing

- Shareholders Equity → e.g. Common Stock and APIC, Retained Earnings

How Does the Double Entry Accounting System Work?

The accounting equation sets the foundation of “double-entry” accounting, since it shows a company’s asset purchases and how they were financed (i.e. the off-setting entries).

A company’s “uses” of capital (i.e. the purchase of its assets) should be equivalent to its “sources” of capital (i.e. debt, equity).

In all financial statements, the balance sheet should always remain in balance.

Under the double-entry accounting system, each recorded financial transaction results in adjustments to a minimum of two different accounts.

On the accounting ledger, there are two entries recorded for bookkeeping purposes:

- Debits → An entry on the left side of the ledger

- Credits → An entry on the right side of the ledger

Each entry on the debit side must have a corresponding entry on the credit side (and vice versa), which ensures the accounting equation remains true.

For all recorded transactions, if the total debits and credits for a transaction are equal, then the result is that the company’s assets are equal to the sum of its liabilities and equity.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today