- What is Investment Banking?

- How Does Investment Banking Work?

- What Does an Investment Banker Do?

- What is M&A in Investment Banking?

- What is Corporate Restructuring and Divestiture Advisory?

- M&A Investment Banking Example

- What is the Purpose of M&A?

- What is Underwriting in Investment Banking?

- Product Groups vs. Industry Groups: What is the Difference?

- What is the Investment Banking Career Path?

- What is the Salary of an Investment Banker?

- Is Investment Banking Challenging?

- What are the Hours in Investment Banking?

- Why Investment Banking?

- What are the Exit Opportunities from Investment Banking?

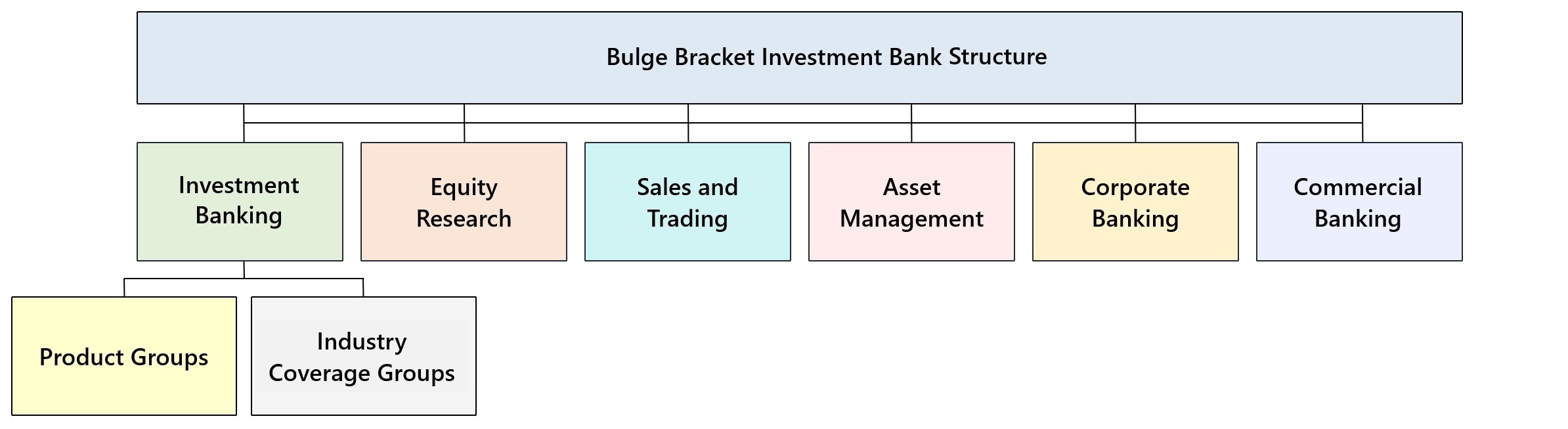

- How is an Investment Bank Structured?

- Bulge Bracket vs. Elite Boutique Banks: Which is Better?

- Who are the Most Prestigious Investment Banks?

- Front Office vs. Back Office: What is the Difference?

- Investment Banking vs. Commercial Banking: What is the Difference?

- Buy Side vs. Sell Side: What is the Difference?

- Investment Banking vs. Private Equity: What is the Difference?

What is Investment Banking?

Investment Banking is a segment of the financial services industry that offers strategic advisory services to corporate and institutional clients on mergers and acquisitions (M&A) and underwriting in the capital markets.

The core function of an investment banking firm—stated in simple terms—is to provide advisory services on behalf of a client, akin to that of a real estate broker. In short, the role of an investment banker is to connect buyers and sellers with coinciding interests, negotiate the terms of the transaction structure, and manage the deal process.

- The investment banking function provides advisory services on mergers and acquisitions (M&A) and securities underwriting on behalf of corporations and institutional clients.

- The investment bank serves as a financial intermediary between clients and corporations (or institutional investors) to ensure proper guidance is delivered based on the firm's expertise, network, and past transactions.

- The skills required to work in investment banking are a combination of technical skills (e.g., financial modeling, valuation, market research) and soft skills (e.g., time management, effective communication).

- The top investment banks are divisions within large full-service banks referred to as "bulge brackets", like JPMorgan, Morgan Stanley, Goldman Sachs, and Citigroup.

- The "elite boutiques" are independent advisory firms that specialize in financial and strategic advisory services, with the most prestigious firms being Evercore, Moelis, Lazard, Centerview, PJT, and Qatalyst.

How Does Investment Banking Work?

Investment banking is oriented around providing advisory services to companies, institutional firms, and governmental entities.

The role of an investment banker is two-fold, with each function—raising capital in the capital markets (i.e., underwriting) and mergers and acquisitions (M&A)—reflecting a form of matchmaking.

Investment banks serve as financial intermediaries by managing the deal process and negotiating the terms on behalf of a client to ensure the outcome is in the client’s “best interests”.

The clients of an investment banking firm are most often corporations or institutional investors, such as private equity firms, mutual funds, hedge funds, pension funds, and sovereign wealth funds (SWF).

For a high-level conceptual overview of investment banking, the services offered as part of the two core functions are each defined in the following table:

| Function | Description |

|---|---|

| M&A Advisory |

|

| Underwriting |

|

What Does an Investment Banker Do?

While the terms “mergers” and “acquisitions” are often used interchangeably, there is a distinction between the two:

- Merger ➝ A merger is the consolidation of two companies of comparable size. For instance, the T-Mobile and Sprint merger, which was approved upon receipt of significant regulatory scrutiny from the Federal Trade Commission (FTC) pertaining to anti-trust laws.

- Acquisition ➝ In contrast, an acquisition is the purchase of company, where the acquirer is of larger size than the target of the purchase. One recent example is the acquisition of Activision Blizzard by Microsoft (NASDAQ: MSFT), which also faced challenges from the Federal Trade Commission (FTC).

If the investment banking firm advises a potential acquirer—termed a “buy side” engagement—the investment bankers identifies potential sellers, collects a list of suitable candidates to target, and later on manages the deal process, including negotiating the structure of the transaction.

On the other side of the table, an investment bank can advise the seller—formally called a “sell side” engagement—where on behalf of the seller, the investment banking firm builds a list of potential buyers (or buyer list) to manage the sale process until the deal closure.

For securities underwriting, the purpose of an investment banker is to raise the necessary amount of capital raised with favorable terms. But there is a trade-off that must be balanced, since in order to obtain something (i.e., capital), something of equivalent “value” must be given up.

Capital raises can take the form of equity issued by the company (e.g., initial public offering, or “IPO”) or debt issued by a corporation (e.g., bond issuance).

The trade-off in raising capital via equity issuances requires giving up a percentage of ownership (and risk of dilution to existing shareholders), while debt issuances require a contractual commitment to pay the lender interest and repay the principal in-full at maturity.

Microsoft Completes Acquisition of Activision Blizzard (Source: Microsoft News Center)

What is M&A in Investment Banking?

The core function of an investment banker in M&A is to provide financial and strategic advisory services to guide corporate clients through the complexities of M&A deals.

- Buy-Side M&A ➝ On a “buy-side mandate”, investment bankers serve as advisors to the acquirer (i.e. the buyer) and must determine if the client’s proposed transaction is reasonable. The priority is to ensure the offer price is justified to reduce the risk of overpaying for the underlying asset (e.g., an entire company or individual business segment).

- Sell-Side M&A ➝ In contrast, investment bankers on a “sell-side mandate” are hired by the seller to advise on the deal and ensure the offer price is fair, without “money left on the table”.

For example, when Microsoft (NASDAQ: MSFT) acquired LinkedIn (NYSE: LNKD) in 2016, Morgan Stanley advised Microsoft (i.e., buy-side advisor), while Qatalyst Partners and Allen & Company advised LinkedIn (i.e., sell-side advisor).

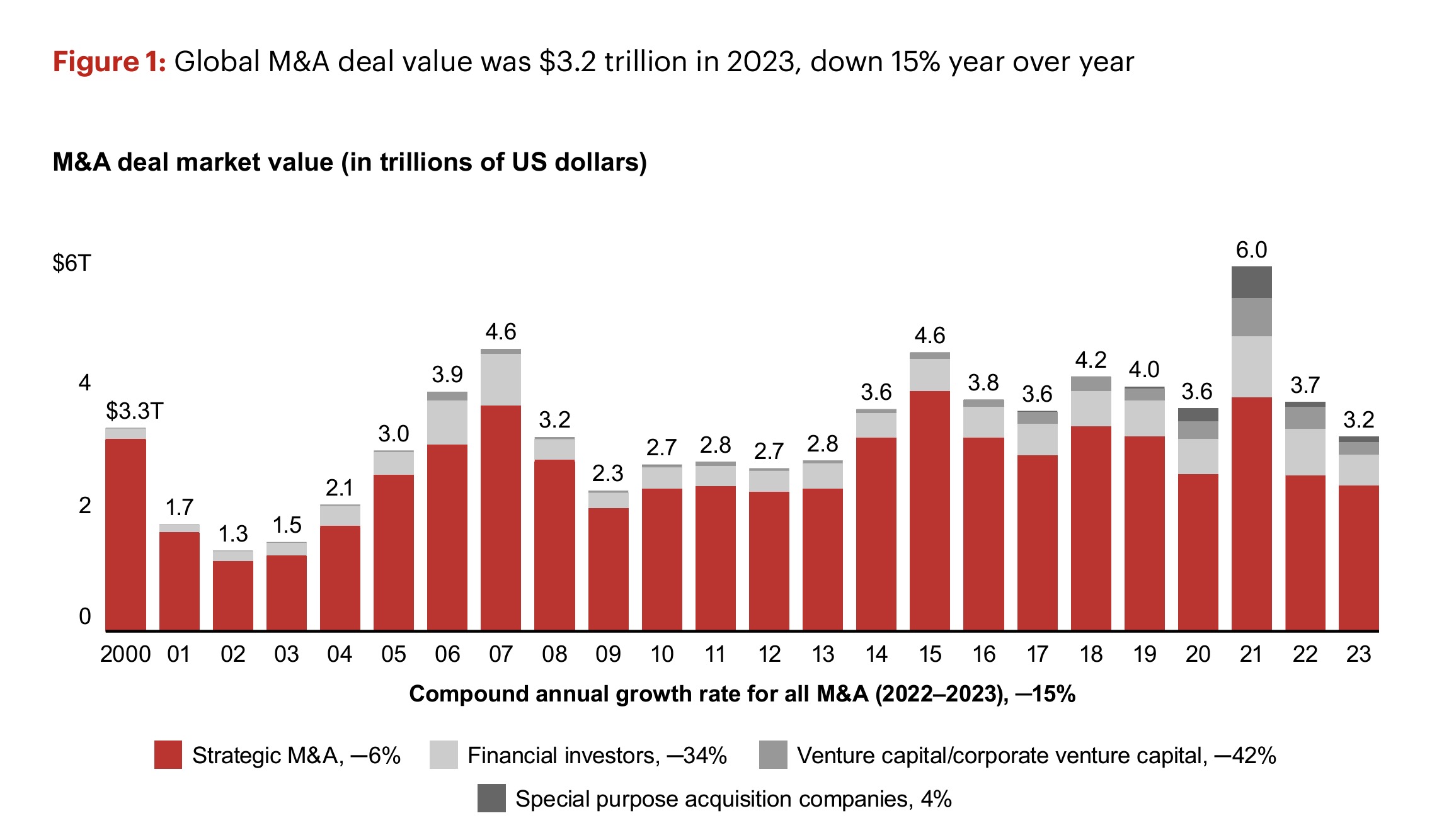

Generally, the volume of M&A activity—the number of deals closed—tends to rise substantially amid periods of economic expansion, which reverses amid periods of economic contraction.

The performance of the industry is thereby sensitive to the macroeconomic environment and the current state of the capital markets.

If the economy and credit markets are strong, the volume of M&A transactions tends to increase, resulting in more revenue for investment banks via the collection of fees.

Conversely, if financial markets and economic conditions are poor, investment banks experience much lower activity (and thus lower deal fees).

2024 M&A Deal Value Data (Source: Bain M&A Report)

What is Corporate Restructuring and Divestiture Advisory?

Besides advising on traditional mergers and acquisitions (M&A) deals, two other types of transactions fall under the broader umbrella of M&A advisory services offered by an investment bank:

- Corporate Restructuring ➝ The corporate client is at risk of insolvency and must urgently figure out a plan to return to a state of normalcy (i.e., operate as a “going concern”).

- Divestiture ➝ The corporate client requires guidance on a partial or outright sale of a business segment or division (e.g., spin-off).

Investment banks offer restructuring advisory services for struggling companies that are considering options like bankruptcy, distressed sales, and defaulting on their debt.

Historically, the demand for restructuring advisory services tends to pick up when the economy is weak, offsetting weaknesses across other parts of the IBD for banks that have this very specialized expertise.

Sometimes businesses decide to get rid of a certain business segment, most often after a period of underperformance—perhaps, the segment no longer fits within the overall strategy of the firm, the company requires capital (post-sale cash proceeds), or the segment is worth more operating as a standalone entity.

M&A Investment Banking Example

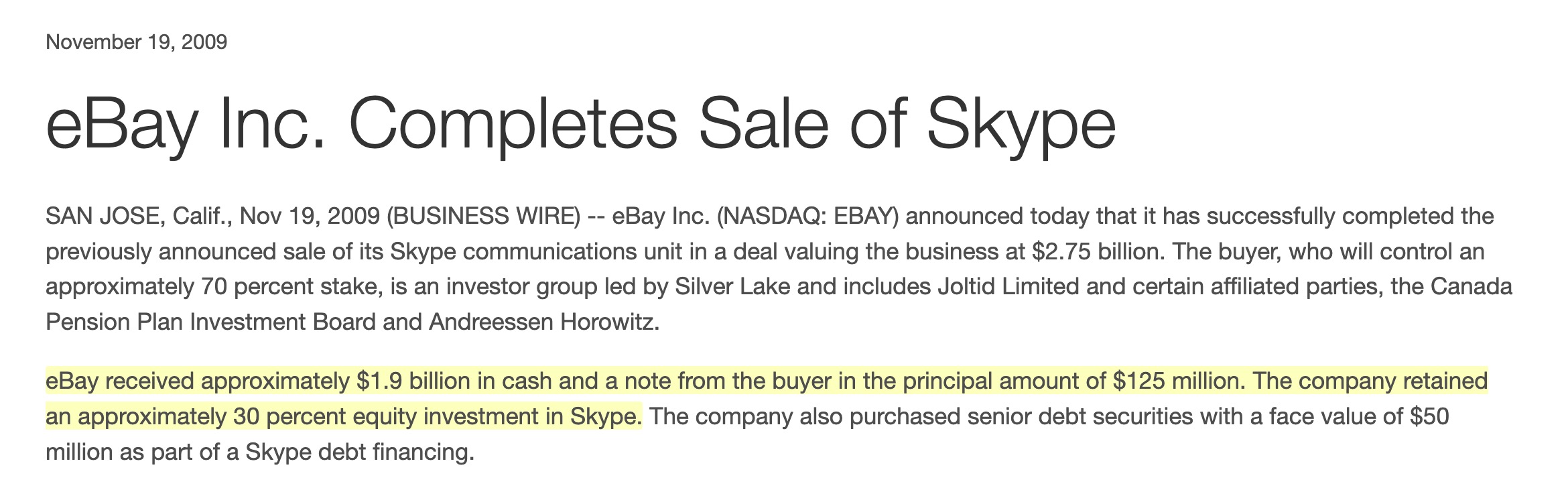

For a real-life example, eBay decided to sell its majority stake in Skype at a steep loss in 2009 to a group of private investors that included Silver Lake, the Canada Pension Plan (CPP), Index Ventures, and Andreessen Horowitz (a16z).

eBay had acquired the fast-growing VoIP communications platform Skype in 2005 for $2.6 billion to integrate the innovative technology into its e-commerce auction site.

However, eBay soon after acknowledged that the integration of Skype was a failure because buyers and sellers on the site were uninterested in building relationships or even communicating on a personal level.

The privacy aspect and post-acquisition cultural issues contributed to eBay’s decision to “cut their losses” by divesting Skype for $1.9 billion in cash while retaining approximately 30% of their initial investment.

The divestiture valued Skype at $2.75 billion, exceeding the original purchase price paid by eBay in 2005.

eBay hired Merrill Lynch as the investment bank advising on the acquisition of Skype back in 2005 and then later hired Goldman Sachs to advise on the divestiture in 2009.

The partial divestiture, where eBay retained a 30% stake to participate in the potential upside of Skype, proved to be a profitable decision after Microsoft’s buyout of Skype in 2011 for $8.5 billion.

The outcome: eBay obtained a net gain of $1.4 billion from the transaction, reflecting the inherent unpredictability of M&A in investment banking.

eBay Completes Sale of Skype (Source: eBay Investor Relations)

What is the Purpose of M&A?

Corporations engage in M&A for the sake of growth, and there are two methods to achieve that outcome:

- Organic Growth ➝ Companies can increase their revenue growth rate and profit margins through their internal initiatives, such as cost-cutting, to improve their operating efficiency.

- Inorganic Growth ➝ Growth can also be achieved by acquiring other companies to increase their collective market share and access to new end markets (i.e., customers).

The distinct benefit of M&A is termed “synergies”, which can be categorized as either revenue or cost synergies, albeit the projected benefits seldom materialize.

M&A is thus an avenue for companies to accelerate growth beyond what can be accomplished organically.

From the perspective of the seller (or target company), the benefits of engaging in M&A are straightforward.

The shareholders can sell their entire equity stake and cash out in full, or the shareholders can opt to “take some chips off the table” and participate in the potential upside of the newly formed entity.

The certainty of closure is conditional on a multitude of factors. But one critical skill in particular that investment bankers must master is to understand the incentive of both parties, not just the client, and negotiate accordingly.

The outcome of a merger or acquisition can be derailed by external factors, as exhibited by the terminated $20 billion acquisition of Figma by Adobe (NASDAQ: ADBE), after facing regulatory issues.

But in hindsight, one could make a fair case that the called-off acquisition—even with the $1 billion reverse termination fee paid in cash—was a favorable outcome to Adobe because of the deal terms (e.g. the stock price of Adobe rose substantially) and the exponential growth in generative AI.

Therefore, Adobe managed to avoid overpaying a substantial premium for Figma, which easily could’ve made the list on the worst acquisitions to date (and as the saying goes, “timing is everything”).

Adobe and Figma Failed Merger (Source: TechCrunch)

Adobe and Figma Failed Merger (Source: TechCrunch)

What is Underwriting in Investment Banking?

On the subject of underwriting, a company in need of funds will hire an investment bank to find potential investors in the capital markets to provide the funds needed and manage the capital raising process.

The other core function of investment banking is securities underwriting, which describes the advisory services related to helping clients with their capital raising needs.

If an investment bank wins an underwriting mandate – where the firm is hired by a client to help it raise capital – the investment bankers facilitate the financing in the form of either debt or equity.

- Debt Underwriting ➝ The client obtains the necessary funding by issuing loans and bonds to investors. Bonds come in a variety of shapes and sizes, but the basic idea is that the company obtains capital from investors on the present date in exchange for agreeing to meet periodic interest payments and return the original principal at maturity. Once the company raises the necessary capital, the investment bank collects its fees, and investors can either hold or trade the bonds in the open markets.

- Equity Underwriting ➝ The client obtains the required funding by issuing new shares to investors. The shares represent partial ownership stakes in the equity of the issuer. Once a company undergoes an initial public offering (IPO), the company raises a significant amount of capital, the investment bank collects its fee, and the shares of the issuer are listed on a public exchange like the NYSE, and now start to trade freely in the stock market. Once a company goes public (post-IPO), the issuer can continue to raise capital via follow-on equity offerings, although the occurrence is less common. Equity issuances after the IPO are termed “secondary offerings” and must receive formal approval from the SEC.

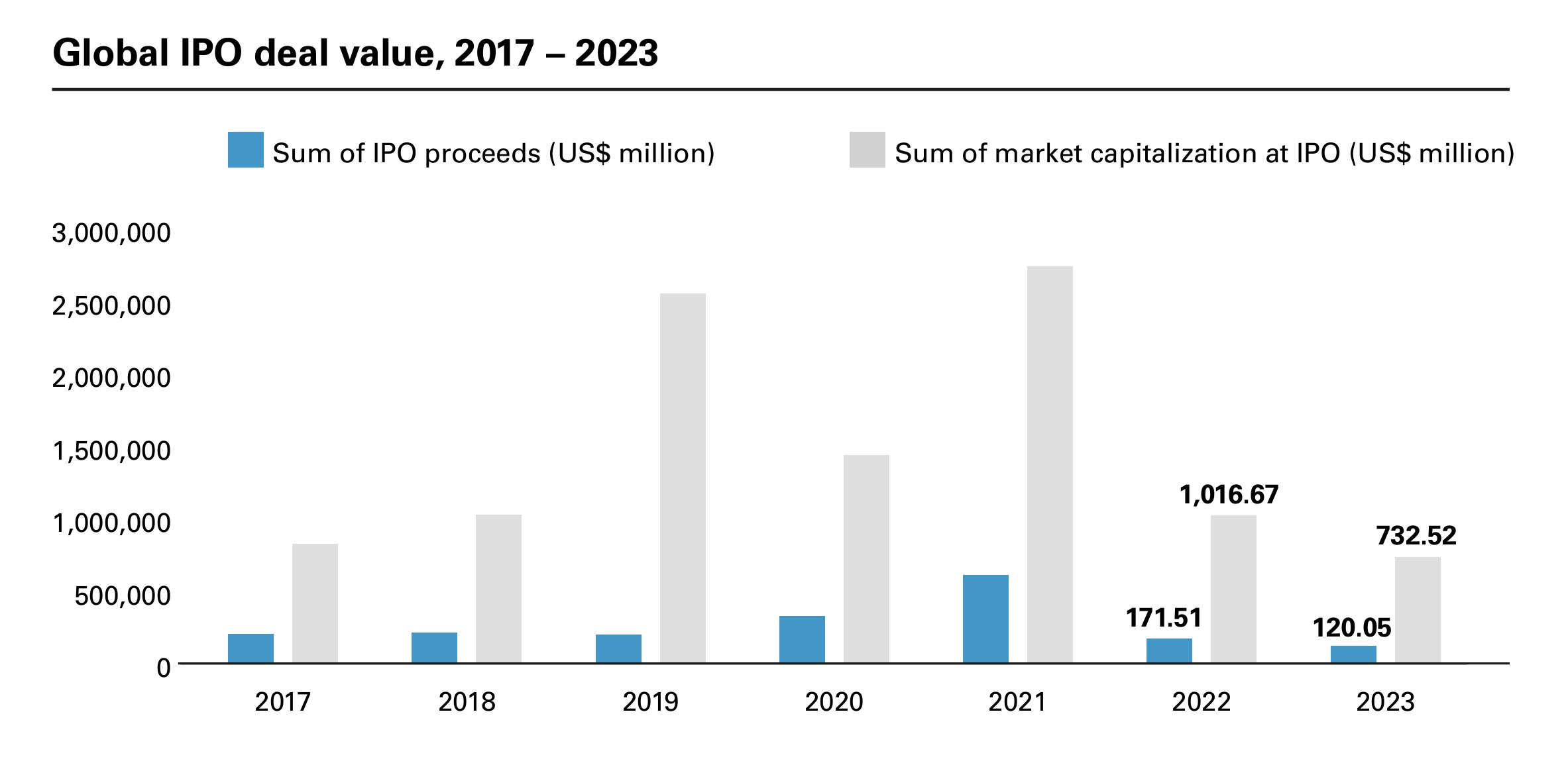

Similar to the pattern in M&A activity, an economic slowdown or expected recession usually causes the capital markets to “dry up,” which is reflected by the reduction in IPOs because of insufficient interest from institutional investors.

A dim economic outlook among investors and corporations results in a more conservative approach to raising capital and participating in M&A across all sectors, albeit there are certain firms like distressed funds that strive to capitalize on (and profit) from mispriced securities in the capital markets.

2024 Global IPO Deal Value (Source: Dealogic)

Product Groups vs. Industry Groups: What is the Difference?

The investment banking division (IBD) at most firms are organized into product groups and industry coverage groups:

- Product Groups ➝ Product groups specialize in a particular product offered to clients, such as a specific deal type (e.g., M&A advisory, restructuring, leveraged finance). Usually, a product group is industry-agnostic, meaning that the services are offered across all industries.

- Industry Groups ➝ Industry groups, or “coverage groups”, are specialists in a particular industry, like healthcare, tech (TMT), industrials, and energy. Industry coverage groups normally “quarterback” client relationships, often resorting to the relevant product group on a need-basis once the necessity for deeper expertise within a subject matter arises.

| Product Groups | Industry Groups |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

What is the Investment Banking Career Path?

The traditional career path in investment banking and the structural hierarchy have remained rigid.

The seniority structure from most junior to most senior can deviate by firm, but the differences (and the pace of promotions) are marginal, for the most part.

- Investment Banking Analyst ➝ The analyst is the entry-level position in the industry and, therefore, must handle the most mundane tasks, such as performing company research, analyzing financial statements (i.e., deal room), creating financial models, and preparing presentation material.

- Investment Banking Associate ➝ The responsibilities of an associate are relatively similar to an analyst, aside from marginally reduced hours and the added task of reviewing an analyst’s work. While the associate is more actively involved in discussions about deal engagements and pitches, the role is not client-facing.

- Investment Banking Vice President (VP) ➝ The vice president (VP) manages the firm’s teams of analysts and associates to oversee the workflow and ensure the material’s quality meets the managing director’s standards (and ensure all deadlines are met).

- Investment Banking Managing Director (MD) ➝ The managing directors (MDs) are the foundation of the firm’s deal origination process, as their responsibilities include managing the pitch to the client and ensuring the closure of deals. The deal flow of an investment bank is a byproduct of the existing connections of its senior bankers with corporate executives and institutional investors (and their ability to build their networks).

What is the Salary of an Investment Banker?

The compensation structure in the investment banking industry is two-fold:

- Base Salary ➝ The base salary component is the fixed portion of the analyst’s salary guaranteed to be received, assuming the analyst is not laid off by the firm.

- Bonuses ➝ The bonus component, however, is variable and contingent on various factors, namely individual performance.

The performance of the firm and group, aside from the individual performance review, is also a critical determinant in the size of bonuses (i.e., the “top-bucket” analysts receive the highest bonuses).

The average salary for investment bankers—updated to reflect 2024 industry data—is compiled in the following table:

| 2024 Salary Data | Base ($) | Bonus (%) | Bonus ($) | All-In Comp |

|---|---|---|---|---|

| Investment Banking Analyst | $100k ➝ $120k | 20% ➝ 75% | $20k ➝ $102k | $120k ➝ $210k |

| Investment Banking Associate | $160k ➝ $200k | 25% ➝ 100% | $40k ➝ $200k | $200k ➝ $400k |

| Investment Banking Vice President (VP) | $225k ➝ $320k | 40% ➝ 125% | $90k ➝ $400k | $315k ➝ $720k |

By far, the most notable trend in the compensation of investment bankers was the increase in the base salary of investment banking analysts, an industry-wide shift to retain the top performing analysts.

The state of the M&A market and the firm’s performance can cause the bonus (and “all-in comp”) to fluctuate substantially, a function of the economic conditions and current state of the credit markets.

The bonuses issued by investment banks can easily exceed the base salary of their analysts.

Unfortunately, the reduction in M&A deal activity and lack of IPOs caused industry-wide bonuses to drop. Hence, the bonus received by investment banking analysts was lower than the standard rate.

Is Investment Banking Challenging?

Investment banking analysts are assigned a wide range of tasks to support the team of senior bankers, which include but are not limited to creating pitch books, performing preliminary diligence, managing conference calls (i.e., scheduling meetings via email), and organizing client material.

So, attention to detail and performing tasks efficiently are two of the most necessary skills to perform well. But the caveat to completing tasks quickly is that mistakes become inevitable.

The efficiency at which an analyst works at stems from constant repetition over time (i.e. deliberate practice) and prioritizing tasks by urgency, which are each transferrable skills required for practically all fields.

The junior bankers provide all the support to ensure the deal process remains on track, with the most common tasks being the following:

- Perform Financial Analysis (e.g., Profitability and Credit Risk Analysis)

- Compile Operating Metrics and Analyze Fundamentals

- Financial Modeling in Excel with Valuation Analyses (e.g., DCF Analysis, Trading Comps, and Transaction Comps)

- Build a Merger Model (Accretion/Dilution Analysis)

- Update Pitchbooks and Marketing Materials

- Conduct Due Diligence for Client-Specific Research

To advise on a deal, an investment bank must convince the client to hire them based on their past transactions, credentials, and industry expertise, among other factors.

The ability to sell, or “sales” is a crucial yet often overlooked skill required to be promoted in the industry, since the role of an banker becomes increasingly more client-facing the higher up one “climbs the ladder”.

Senior investment bankers, particularly coverage bankers, are responsible for maintaining relationships, pitching ideas, and staying in the mix to win new business, which are tasks collectively referred to as deal origination (or “sourcing”).

Once an investment bank wins a client mandate, deal execution work begins thereafter.

The senior bankers lay out the strategy, manage the negotiations, and step in at critical points to keep the deal from veering off course.

What are the Hours in Investment Banking?

The investment banking industry is notorious for its long hours and challenging workload.

At its worst, junior investment banking analysts can expect to face work weeks of 80 to 100 hours.

In recent times, investment banks have attempted to reduce the workload with “protected weekends” and other measures. However, the culture of long hours is deeply rooted in investment banking.

At many firms, old habits die hard, particularly on live deals, which often means junior bankers are “on call” at all times.

Unfortunately, the long hours are often also notoriously caused by idle time spent awaiting deliverables from a client or their advisors; that trait has historically been and will continue to be a routine part of the business model.

The investment banking profession is a challenging role that requires working long hours with a high-stress tolerance, yet the career path is certainly rewarding in terms of the “upside” potential in compensation over the long run and attractive exit opportunities.

Why Investment Banking?

Given the hours and demanding workload, many undergraduate students (and MBA candidates) at the top educational institutions continue to pursue investment banking post-graduation.

One of the most cited reasons—for why investment banking is worth it—is the doors that open from working at a prestigious investment bank.

Most junior analysts work a one-to-two-year stint in investment banking as a “stepping stone” to a different, often more prestigious, career path.

There is also the wide range of skills gained on the job to consider, where analysts “drink from a firehose” in investment banking.

Soon after joining the firm, analysts learn financial modeling in Excel, create client presentation material, perform industry analysis, and grasp the “ins and outs” of different business models.

The skills gained are also broadly transferable across a variety of future endeavors as analysts quickly learn to become reliable, detail-oriented, and work efficiently in high-pressure situations.

Therefore, a career in investment banking is a short-term trade-off that presents the opportunity to reap long-term benefits further down the line.

What are the Exit Opportunities from Investment Banking?

The most common exit opportunities for investment banking analysts are outlined in the following table:

- Private Equity (LBO) ➝ Private equity firms specialize in leveraged buyouts (LBOs), which refer to transactions where a majority stake is obtained in a private or public company. The purchase price is funded using substantial debt capital from lenders, such as corporate banks and institutional investors.

- Hedge Fund ➝ Hedge funds invest in public securities, such as stocks and bonds, to achieve stable risk-adjusted returns with minimal correlation to the broader market. There is no shortage of investment strategies and tactics to mitigate risk in the hedge fund industry, including long-short investing (L/S), short-only investing, market neutral, and relative value strategies (i.e., arbitrage).

- Venture Capital (VC) ➝ Venture capital firms obtain minority stakes in high-risk, early-stage startups that are seldom profitable yet aim to disrupt an existing market through a differentiated offering. Early-stage investors contribute capital to start-ups with the expectation of losing the original capital on most investments in their respective portfolios. However, one successful investment, termed a “home run” in VC investing, can return the value of the fund multiple times (i.e., the “power law of returns”).

- Growth Equity ➝ Growth equity firms acquire minority interests in late-stage companies exhibiting high growth with proven market traction. The growth investing strategy focuses on providing expansion capital to a high-growth company on track to “go public” via an initial public offering (IPO).

- Real Estate Private Equity (REPE) ➝ REPE firms specialize in acquiring, developing, and implementing operational improvements to properties, such as buildings, on behalf of their limited partners (LPs).

Note: Other exit opportunities available to investment bankers—other than on the buy-side—include roles in corporate development, startups, entrepreneurship, FP&A, and more.

How is an Investment Bank Structured?

While the core functions of investment banks are relatively similar for the most part—i.e., M&A advisory and capital markets advisory services—the organizational structure and divisions of the bank itself can differ substantially based on its categorization.

Before getting into the structure of investment banks, let’s first distinguish between a full-service “bulge bracket” investment bank and a “pure play” advisory boutique.

Full-service investment banks provide a comprehensive suite of offerings to their clientele, including:

- Investment Banking (IBD)

- Sales and Trading (S&T)

- Equity Research (ER)

- Asset Management

- Corporate Banking

- Commercial Banking

Insiders often refer to full-service banks, like JPMorgan and Morgan Stanley, broadly as “investment banks”, despite the fact that those firms have other divisions such as commercial banking, corporate banking and asset management. Hence, the necessity to understand the aforementioned distinction.

For instance, neither the sales and trading division nor the equity research division are considered to be part of the investment banking function.

Bulge Bracket vs. Elite Boutique Banks: Which is Better?

Contrary to full-service investment banks, or bulge brackets, elite boutiques are independent advisors that specialize in a particular product group or industry.

From a client perspective, the biggest practical difference between bulge bracket investment banks (BBs) and elite boutique investment banks (EBs) is that full-service bulge brackets “have a balance sheet”.

Having a balance sheet means the bank advising a client has direct access to capital. That means, for example, that the bank can serve as both an advisor on an M&A deal as well as provide the financing for the acquirer to fund the deal (if needed).

The pure-play boutiques can only provide advisory services, although certain EBs have started to diversify their revenue sources, such as Evercore’s acquisition of ISI Group.

One flawed presumption is that the bulge bracket firms have a significant edge over elite boutiques. However, the transaction dynamics are far more trickier than what meets to eye in actuality.

While the bulge brackets will certainly tout this advantage, yet the boutiques can counter that statement by arguing that this is, in fact, a disadvantage.

From the perspective of clients, the risk to consider is that bulge brackets might be incentivized to push their firm’s financing solutions to the detriment of securing the option in their “best interest” (i.e., conflict of interest).

The elite boutiques, having no such conflict, can thus help the client secure the “cheapest” financing by helping the client solicit a broad range of potential financing options.

Who are the Most Prestigious Investment Banks?

The following table lists the top bulge brackets and elite boutiques at the forefront of the investment banking industry, considered the most prestigious firms as of 2024.

| Bulge Brackets (BBs) | Elite Boutiques (EB) |

|---|---|

There are also up-and-coming firms such as LionTree (TMT) and FT Partners (FinTech) held in high esteem in their respective niches, as well as prestigious firms such as Allen & Co. and M. Klein & Co. that intentionally maintain a low profile.

Front Office vs. Back Office: What is the Difference?

Thus far, we’ve discussed the core functions of an investment bank and the role of an investment banker.

However, the distinction between various roles within the bank must also be understood.

In most cases, an investment bank is separated into three sections:

- Front Office ➝ The front office is the client-facing segment of the investment bank that generates revenue, such as the M&A advisory, capital markets, and sales and trading (S&T) divisions.

- Middle Office ➝ The middle office is intended to support the front office, particularly in risk management and ensuring the firm complies with regulations.

- Back Office ➝ The back office refers to roles that support firm-wide operations, such as the human resources (HR) department, accounting staff, and information technology (IT).

The prestige of a career in investment banking is namely focused on front-office roles. However, the contribution of middle office and back office roles is an integral part of the business model.

Investment Banking vs. Commercial Banking: What is the Difference?

The investment banking and commercial banking functions provide entirely different services and serve different clients, contrary to a common misconception.

- Investment Banking ➝ Investment banks offer advisory services that pertain to mergers and acquisitions (M&A) and securities underwriting. For example, the firm could raise capital in the form of debt or equity financing on behalf of a client in need of funding. The clients served by investment banks are normally institutional investors, such as private equity firms and corporations.

- Commercial Banking ➝ Commercial banks offer services related to managing deposit accounts, such as checking and savings accounts, besides underwriting smaller-sized loans (i.e., lending) and processing transactions. The clients that commercial banks serve are small to mid-sized businesses (SMBs) and large enterprises.

Buy Side vs. Sell Side: What is the Difference?

The term “sell side” refers to investment banking, while the “buy side” is an all-encompassing term composed of institutional investors, from private equity firms, hedge funds, mutual funds, insurance companies, and pension funds to university endowments.

The difference between a career on the sell-side and the buy-side is primarily the business model:

- Sell-Side ➝ Investment banks, or the “sell side,” attempt to provide their clients with sound advice given their situation, such as considering a tender offer or strategic acquisition. The revenue model in investment banking is structured around the collection of fees for providing advisory services to clients.

- Buy-Side ➝ In contrast, the “buy side” prioritizes generating profitable returns on behalf of their limited partners (LPs). For instance, the LPs of a private equity firm contribute capital to the fund, which the general partners (GPs) intend to deploy into profitable investments to exceed the minimum target return set in the initial stages of raising capital. The private equity industry specializes in LBOs and realizes a profit from the investment post-exit, which could be a sale to a strategic buyer, a secondary buyout (SBO), or an initial public offering (IPO). The financial sponsor earns an annual management fee over the holding period to cover overhead costs, and an agreed-upon split on the excess profits earned from the fund’s investments (“2 and 20” fee structure).

Investment Banking vs. Private Equity: What is the Difference?

The private equity industry (PE) is the most sought-after exit for investment bankers, upon working on the sell side for one or two years.

In fact, the interest in securing a buy-side role among junior investment bankers—and the competition among private equity firms to recruit the top talent—has become competitive to where the recruiting cycle now kicks off in mid-July, before the analyst class can be staffed on a live deal (or even complete new hire training).

- Investment Banking ➝ The rationale for investment bankers to exit to the buy-side, aside from higher compensation, is most often tied to the type of work performed daily (i.e., advisor vs. investor). As a first-year investment banking analyst, a substantial proportion of the work is related to following instructions and performing menial tasks, like editing client marketing deliverables, whereas the tasks completed by buy side investment professionals tend to be more intellectually engaging, which many perceive as necessary to a long-term career.

- Private Equity ➝ The hours and workload on the buy side are more manageable with an improved work-life balance (and compensation). Yet, the statement that working on the buy-side is “easier” per se is a misinformed notion. The hours and workload on the buy-side are comparable to investment banking (i.e., marginal improvement relative to the sell-side), especially right after exiting investment banking into an associate role at a private equity firm.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today