What is a Trade Surplus?

A Trade Surplus means a country’s trade balance is positive, i.e. the value of the country’s net exports is greater than the value of its imports from other countries.

How Does a Trade Surplus Work in Economics?

The trade balance of a country is determined by comparing the sum of all its imports (i.e. the total value of the products it purchases from other countries) and its exports (i.e. the value of all the products it distributes to other countries).

Often called the “balance of trade”, the trade balance is the difference between the value of a company’s exports relative to its imports.

Where:

- Exports → Goods and services sent to other countries

- Imports → Goods and services brought into the country

If the balance of trade is positive, the total value of the country’s exports is greater than its imports.

The effects of a trade surplus tend to be positive, such as more economic output, higher employment rates, and a more favorable outlook on near-term economic growth.

Trade Surplus vs. Trade Deficit: What is the Difference?

The inverse of a trade surplus is termed a “trade deficit”, which occurs when the balance of trade is negative, meaning that the total value of the country’s imports exceeds that of its exports.

- Trade Surplus → Exports > Imports (Positive Trade Balance)

- Trade Deficit → Imports > Exports (Negative Trade Balance)

If imports exceed exports over the long term, a country with a trade deficit is prone to currency devaluation because of the reduced demand in terms of international trade among different countries.

Contrary to a trade surplus, a lower demand for a country’s currency in a trade deficit causes the currency to become less valuable relative to other currencies.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayWhat are the Negative Effects of Trade Surplus?

However, potential drawbacks include higher interest rates and higher prices from inflation within the country’s economy — thus, context must also be taken into account before deciding whether the trade surplus is truly a positive signal.

In addition, the trade balance of a country can impact the value of its currency in the global markets.

Generally, a trade surplus is associated with increased demand for the country’s currency, resulting in the value of the country’s currency strengthening relative to the currencies of other countries.

Trade Surplus Real-Life Example: Economy of China

In recent times, the economy of China has become more developed, and it is now the dominant exporter of goods in the global economy.

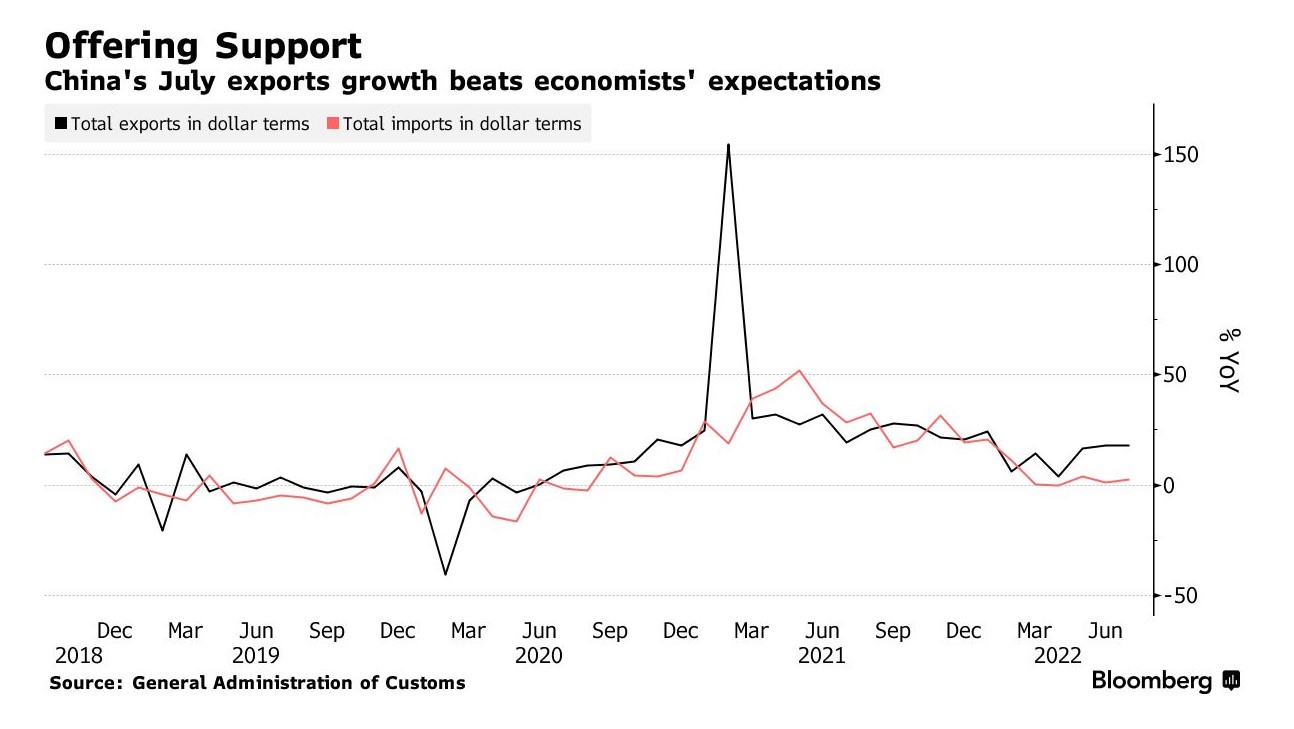

Per data released for July 2022, China’s trade balance has expanded to approximately $101 billion, which surpassed earlier estimates set by economists.

But to reiterate, a trade surplus does not necessarily mean that the country’s economy is thriving, as confirmed by the economic concerns and risks currently prevalent in China.

For instance, many economists are stating that China’s recent export strength is attributable to the lockdown phase and the country’s businesses (and international demand) are now finally “catching up”, but the strength might be temporary and eventually the global economic slowdown will also be reflected in China’s export volume.

“China’s Trade Surplus Hits Record But Slowdown Risks Remain” (Source: Bloomberg)