What is Deleveraging?

Deleveraging refers to the reduction of debt by a company in order to lessen the degree of financial leverage.

In the specific context of a leveraged buyout (LBO), deleveraging describes the incremental reduction in the acquired company’s net debt balance (i.e. total debt minus cash) across an investment firm’s holding period.

How Does Deleveraging Work in LBOs

The value of the financial sponsor’s initial equity contribution (and returns) increases in tandem with the reduction of debt.

In leveraged buyout (LBO) transactions, deleveraging is one of the positive levers that drive strong returns.

In a traditional LBO, a significant portion of the purchase price was funded using debt financing, i.e. borrowed capital that must be repaid on a future date.

Throughout the holding period of the LBO — i.e. the time horizon in which the target remains a portfolio company under the ownership of the private equity firm (PE) — the cash flows of the company are used to pay down its outstanding debt balance.

The repayment of outstanding debt to lenders that had provided debt capital by the post-LBO company represents the concept of “deleveraging”.

But while deleveraging creates value by reducing the original leverage from the transaction, this approach requires the portfolio company to generate stable cash flows (i.e. be non-cyclical and non-seasonal).

Why Does Deleveraging Create Value in an LBO

The primary drivers of returns in LBOs are the following three items:

- Deleveraging → The gradual pay down of the original debt raised to fund the buyout.

- EBITDA Growth → Growth in EBITDA stemming from implementing operational improvements that improve the company’s margin profile (e.g. cost-cutting) and new growth strategies (e.g. entering new markets, introducing new products/services, upselling / cross-selling, raising prices).

- Multiple Expansion → The private equity firm (i.e. financial sponsor) exits the investment at a higher multiple than the entry multiple on the date of the original purchase.

As the company’s carrying debt balance decreases, the equity contribution of the sponsor increases in value as more debt principal is repaid using the acquired LBO target’s free cash flows (FCFs).

From the process of decreasing the amount of debt on the target’s balance sheet, the value of the sponsor’s equity grows.

The Wharton Online and Wall Street Prep Private Equity Certificate Program

Level up your career with the world's most recognized private equity investing program. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayHow Does Deleveraging Impact Taxes?

The benefits of relying on leverage to fund a buyout diminish as more debt is paid off.

For that reason, many financial sponsors actually try to restrict the amount of debt repaid, i.e. to no more than the mandatory repayment of debt required per the loan agreement.

- Access to “Cheap” Capital → One major benefit to using debt is that debt is widely viewed as carrying a lower cost of capital, i.e. a cheaper source of financing.

- Interest Tax Shield → Additionally, the interest expense owed on debt is tax-deductible, meaning that earnings before taxes (EBT) are reduced by interest (and the income taxes recorded are lower). The favorable outcome of having less taxes owed is known as the “interest tax shield”.

Given those benefits, many sponsors would rather use cheap debt capital to fund growth plans and expansion strategies, or even make add-on acquisitions (i.e. “roll-up investing”) — and benefit from the tax shield mentioned earlier.

If a private equity firm is aggressively deleveraging the amount of debt on a portfolio company, that typically is not a positive sign, as it tends to imply that there are no (or limited) opportunities to invest the capital elsewhere.

Alternatively, the company might be at risk of default or close to breaching a loan covenant.

Deleveraging Calculator — Excel Template

We’ll now move to a modeling exercise, which you can access by filling out the form below.

1. Entry LBO Model Transaction and Operating Assumptions

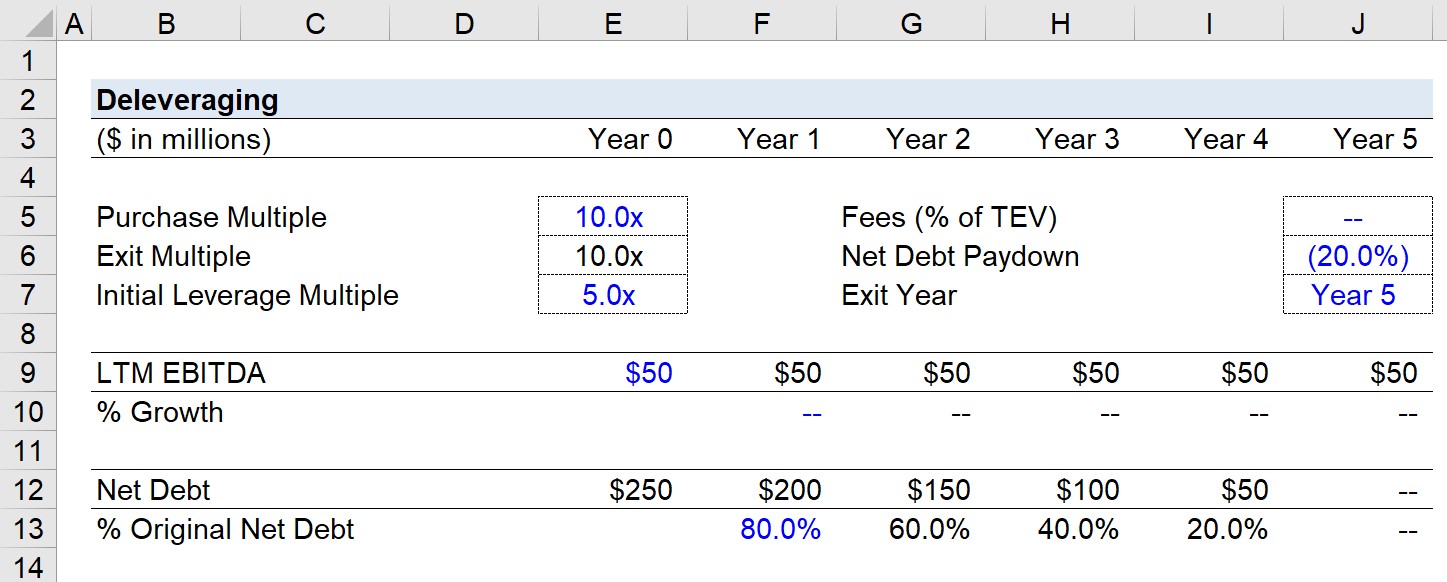

Suppose a private equity acquired a company at a purchase multiple of 10.0x LTM EBITDA, where the leveraged buyout (LBO) was funded using a leverage multiple (Net Debt-to-EBITDA) of 5.0x.

- Purchase Multiple = 10.0x

- Leverage Multiple = 5.0x

The transaction was thus financed using 50% debt—half of the purchase price—with the remaining capital required contributed by the financial sponsor.

On the date of entry, the purchase enterprise value was $500 million with $250 million in net debt, meaning the sponsor contributed the residual amount, or $250 million.

- Net Debt = $250 million

- Initial Sponsor Equity = $250 million

The LBO target’s LTM EBITDA in Year 0 was $50 million, which we’ll assume remains unchanged the entire holding period.

- LTM EBITDA = $50 million

- EBITDA Growth = 0%

Each year of the holding period, the company repays 20% of the total net debt balance, i.e. 80% of the original balance is remaining by the end of Year 1, 60% is remaining in Year 2, and so on.

The financial sponsor exits the investment in Year 5 at the same multiple as entry, and the net debt balance declined to zero.

- Exit Year = Year 5

- Exit Multiple = 10.0x

While it is unrealistic for a portfolio company to pay down all of its debt, we’ll assume that for illustrative purposes. Further, we’ll also ignore any transaction or financing fees in our exercise.

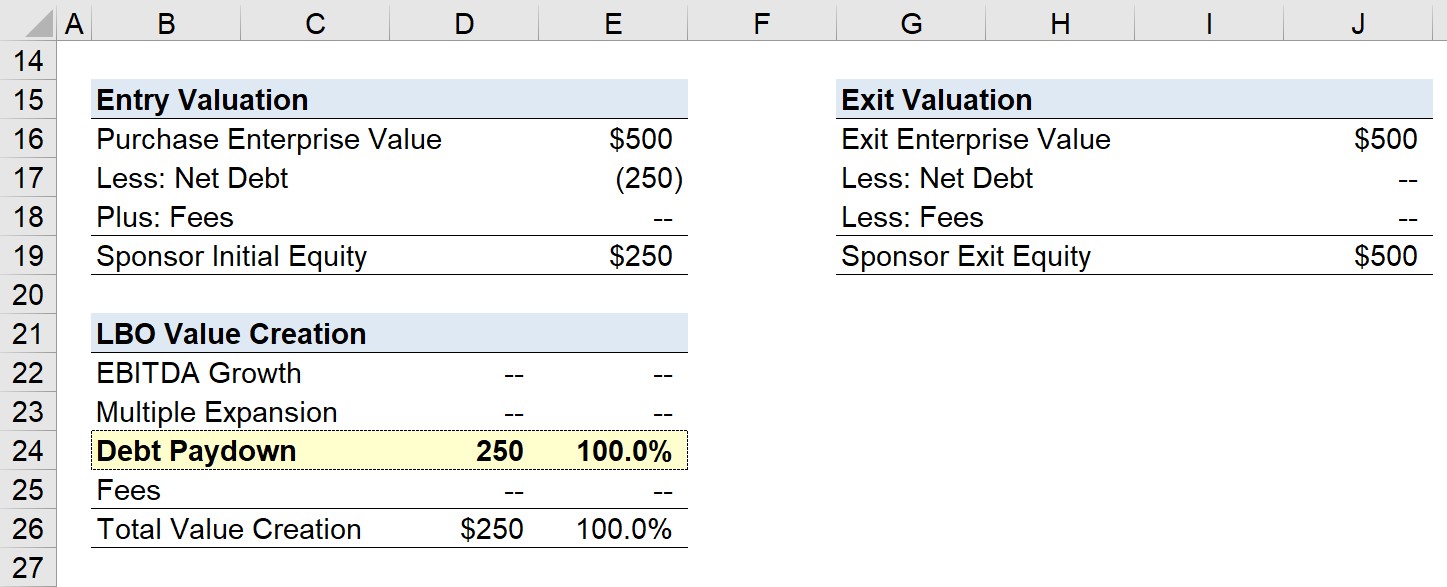

2. LBO Deleveraging Value Creation Analysis

Skipping ahead five years from the initial buyout date, the firm exits the investment at the same 10.0x multiple as the entry multiple, so the exit enterprise value is also $500 million.

Regarding the LBO value creation drivers, there was zero EBITDA growth and no multiple expansion, i.e. purchase multiple = exit multiple.

- EBITDA Growth = 0%

- Multiple Expansion = NA (Entry @ 10.0x; Exit @ 10.0x)

The only driver left is the repayment of the debt, in which $250 million—the entirety of the original amount raised—was paid down, as confirmed by how the leverage ratio from Year 0 to Year 5 declines from 5.0x to 0.0x.

Therefore, 100% of the total value creation is contributed by deleveraging, where the sponsor’s initial equity contribution grew 2.0x from $250 million to $500 million since all the debt claims were wiped out from the capital structure.