- What is Capitalization Ratio?

- How to Calculate Capitalization Ratio

- Capitalization Ratio Formula

- What is a Good Capitalization Ratio?

- What are the Limitations of the Debt to Capital Ratio?

- Capitalization Ratio vs. D/E Ratio: What is the Difference?

- Capitalization Ratio Calculator

- Capitalization Ratio Calculation Example

What is Capitalization Ratio?

The Capitalization Ratio measures the proportion of a company’s operations funded by debt, most often to analyze its credit risk profile.

How to Calculate Capitalization Ratio

The capitalization ratio determines the percent contribution of debt in the total capital structure of a company.

Often referred to as the “debt-to-capital ratio”, the capitalization ratio compares a company’s total debt to its total capitalization.

Therefore, the capitalization ratio is a credit metric that estimates the risk of default and insolvency based on a company’s reliance on debt relative to its other capital sources, namely equity.

Companies generate revenue from their asset base—such as inventory and fixed assets (PP&E)—which are purchased using financing from a source of capital.

In particular, there are two main sources of capital available to companies to fund their operations and acquire assets with positive economic utility.

- Total Equity ➝ Paid-in-Capital, Retained Earnings, Equity Issuances

- Total Debt ➝ Senior Debt, Corporate Bonds, Mezzanine Financing

The debt component consists of short-term and long-term borrowings, most notably senior secured loans provided by corporate bank lenders or issuances of investment-grade corporate bonds.

Compared to equity, debt capital is considered to be a “cheaper” form of financing because of two factors:

- Tax-Deductible Interest → The pre-tax income (EBT) is reduced by interest expense on the income statement, as interest is tax-deductible, creating the so-called “interest tax shield”.

- Higher Priority in Capital Structure → If the underlying company were to enter a state of financial distress and become insolvent, the claims held by debt holders are prioritized ahead of the claims held by equity holders. For example, the distribution of proceeds post-liquidation in a Chapter 7 bankruptcy must ensure debt lenders are made whole first before equity holders receive a portion of the recovery proceeds, assuming there are any left.

The drawback to debt financing, however, is that there are fixed financing costs, which can lead to a potential default (i.e. missed interest payment, mandatory principal amortization, covenant breach).

Furthermore, the downside to equity issuances is that the issuance of additional shares can cause dilution in the ownership of the company.

Capitalization Ratio Formula

The capitalization ratio formula consists of dividing a company’s total debt by its total capitalization, which is the sum of its total debt and total equity.

When attempting to identify the specific line items that qualify as debt, all interest-bearing securities with debt-like characteristics should be included.

However, most include only long-term debt in “Total Debt” based on the notion that the credit ratio is intended to measure solvency risk.

What is a Good Capitalization Ratio?

The higher a company’s capitalization ratio, the more its capital structure is implied to be comprised of debt rather than equity.

Therefore, the company is at a greater risk of defaulting and becoming distressed, since the company is riskier due to its reliance on financial leverage.

By contrast, a lower capitalization ratio – which is viewed more favorably from a credit risk perspective – indicates that the company is less dependent on debt.

The relationship between the capitalization ratio and default risk is as follows:

- Higher Capitalization Ratio → More Default Risk

- Lower Capitalization Ratio → Less Default Risk

What are the Limitations of the Debt to Capital Ratio?

The debt-to-capital ratio is insufficient as a standalone metric to understand a company’s true financial health.

For instance, a company can utilize minimal debt because of a lack of access to debt financing, rather than by choice.

A company could also possess a lower debt-to-capital ratio than its peers, yet soon file for bankruptcy later.

One critical consideration when comparing the debt-to-capital ratio among different companies is that the companies with the option to raise significant amounts of debt capital are typically the most financially sound.

Why? Lenders tend to be risk-averse and prioritize capital preservation above all else, especially senior lenders like corporate banks.

Therefore, high-risk companies tend to encounter more constraints from lenders if trying to raise a significant amount of debt capital.

Capitalization Ratio vs. D/E Ratio: What is the Difference?

Often, certain practitioners use the term “capitalization ratio” interchangeably with the debt-to-equity (D/E) ratio.

- D/E Ratio → Debt-to-Equity Ratio

- Capitalization Ratio → Debt-to-Capital Ratio

The two credit metrics share commonalities, since both ratios measure the financial risk attributable to a misaligned capital structure and an unmanageable debt burden, i.e. excessive reliance on leverage relative to its free cash flow (FCF) profile.

There is a distinction between the two metrics, however, as the denominator utilizes different metrics – albeit the insights obtained are likely to be mostly the same.

If you want to ensure there is no chance of a mishap, one option is to clarify the metric as the “total capitalization ratio”.

Capitalization Ratio Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Capitalization Ratio Calculation Example

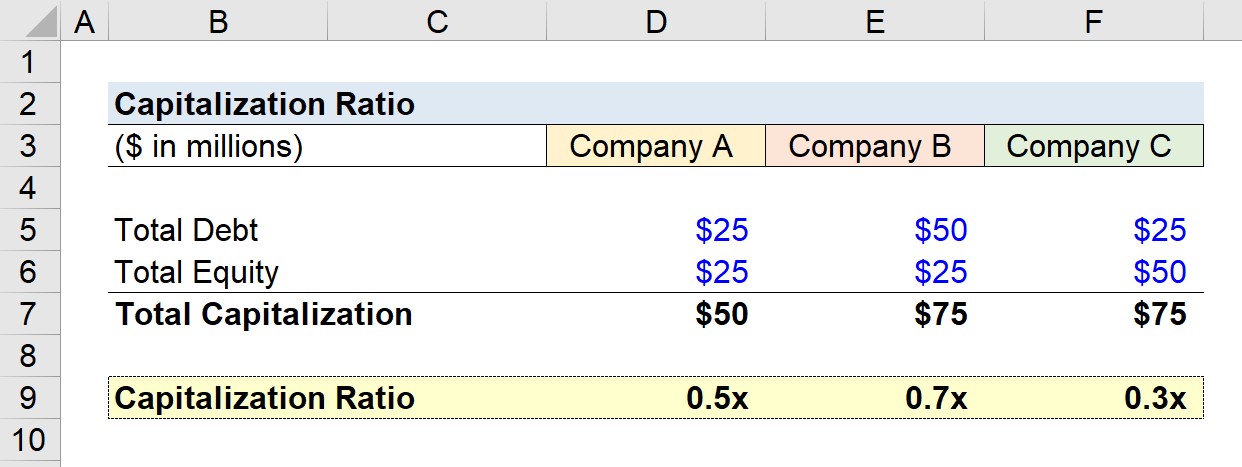

Suppose we have three companies with different capital structures, for which we are tasked with analyzing the credit risk of each.

Company A

- Debt = $25 million

- Equity = $25 million

Company B

- Debt = $50 million

- Equity = $25 million

Company C

- Debt = $25 million

- Equity = $50 million

Using those assumptions, the debt-to-capital ratio for each company can be calculated by dividing the total debt by the total capitalization (total debt + total equity).

We arrive at the following debt-to-capital ratios.

- Company A = $25 million ÷ ($25 million + $25 million) = 0.5x

- Company B = $50 million ÷ ($25 million + $50 million) = 0.7x

- Company C = $25 million ÷ ($50 million + $25 million) = 0.3x

Given the debt-to-capital ratios of the group, it appears Company C carries the least leverage risk, while Company B is the riskiest of the three.

Just as a general rule of thumb, if the cap ratio is less than 0.5x, then the company would be considered financially stable with minimal risk of default.

However, as mentioned earlier, the capitalization ratio must also be supported by other credit metrics to confirm the validity of the findings.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today