What is an Activist Investor?

An Activist Investor seeks to be the catalyst of a turnaround of an underperforming publicly-traded company to profit from share price appreciation.

How Does Activist Investing Work

In activist investing, the catalyst for change and turnaround is, in fact, the entrance of an activist investor.

Activist investing is an investment strategy where an investor pursues poorly run companies with share prices that have declined in recent times.

The activist investor identifies a target and then obtains a sizeable stake in the company’s equity, which often signals to the market that changes are soon to come.

Hence, after the news gets around that an activist firm has become a shareholder, the company’s share price can rise in anticipation of a turnaround.

The activist investor can soon be expected to push for changes that they believe are in the best interests of the company’s shareholders post-investment to cause share price appreciation.

- Strategic Redirection and Changes in Operational Decisions

- Capital Structure Restructuring (i.e. Sub-Par Capital Allocation)

- Divestitures of Non-Core Divisions and Spin-Offs

- Changes in Management Practices

- Corporate Governance “Shake-Up” (e.g. Management Team Replacement)

What is the Strategy of an Activist Investor?

From a high-level, the aim of an activist investor is to be the catalyst for change that can create more shareholder value within the target (and share price appreciation).

In the U.S., activist investors such as hedge funds must disclose their stake by filing a Schedule 13D with the U.S. Securities and Exchange Commission (SEC).

The filing requirement is conditional on acquiring an ownership stake exceeding a 5% threshold in voting class shares.

The equity ownership of activist investors is typically not a controlling stake, so part of their strategy is to gain the support of other investors, especially the more influential institutional investors with larger stakes (and more shareholder votes).

Still, despite having a minority stake, activist investors can impact the company’s trajectory and exert influence over an underperforming (and vulnerable) company.

Certain management teams, upon learning about an activist investor’s stake, decide to cater to the investor and express their openness to their recommendations — whereas others see them as threats, occasionally resulting in a proxy fight.

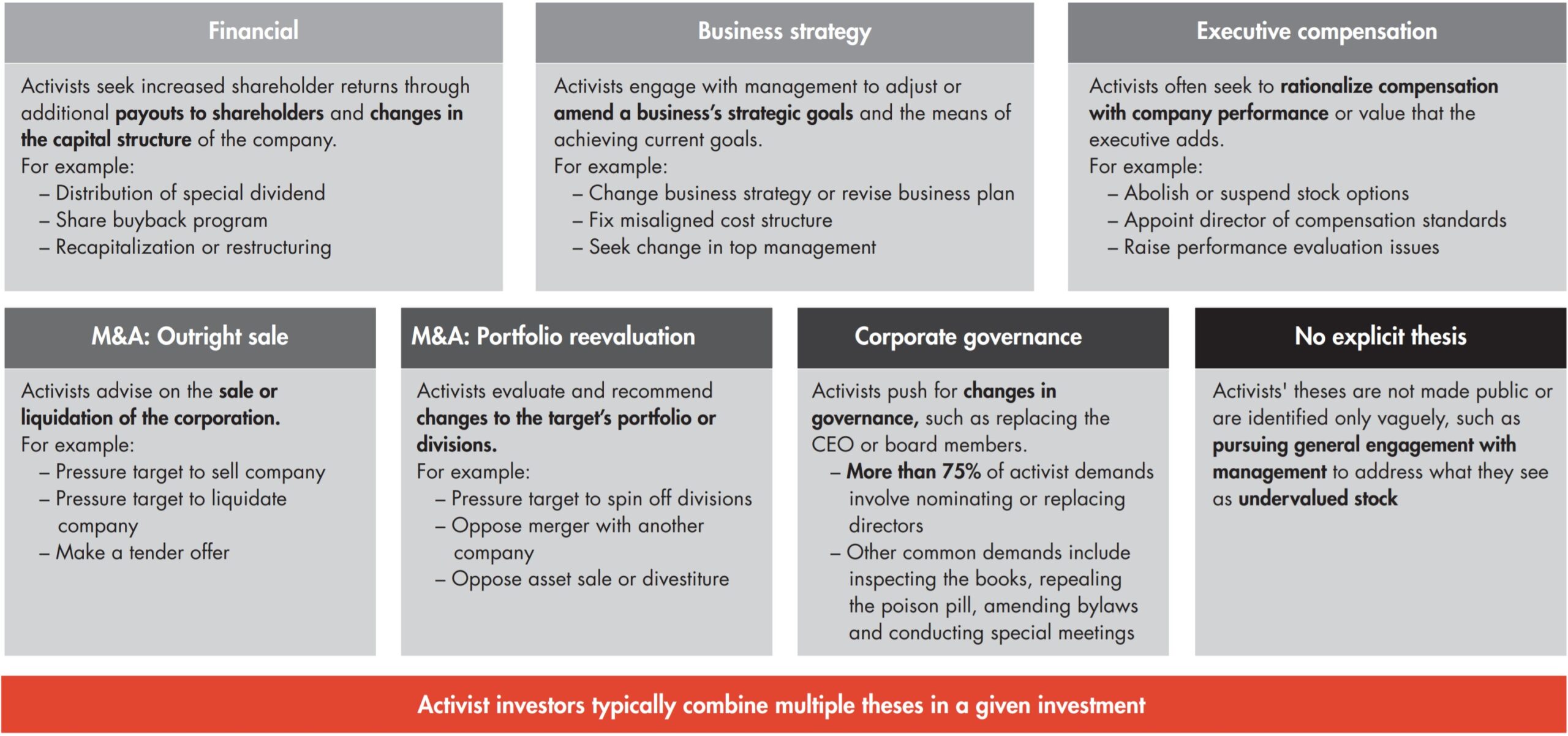

Value-Add Theses of Activist Investors (Source: Bain)

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayActivist Investing vs. Value Investing: What is the Difference?

Value investing is oriented around identifying undervalued equities and then placing a bet on one (or both) outcomes.

- Market Correction → The market will correct itself and reflect the fair value of the temporary mispricing of securities.

- Turnaround → The management team of a struggling company will figure out a method to steer the ship around in a positive direction.

Conceptually, activist investing is closely tied to value investing, because the activist perceives a target’s share price is trading far below its potential.

The distinction with activist investing is that once an undervalued company is identified, the activist takes a far more “hands-on” approach to force change.

Since management has likely fallen out of favor with shareholders, the firm attempts to convince shareholders that there is “hidden” value in the company that management is not capitalizing upon.

However, there must be value-creation opportunities – otherwise, influence without a tangible plan ends badly for all stakeholders.

Therefore, an activist must identify the root causes of a company’s recent underperformance and present their recommendations for driving strategic, financial, and operational changes.

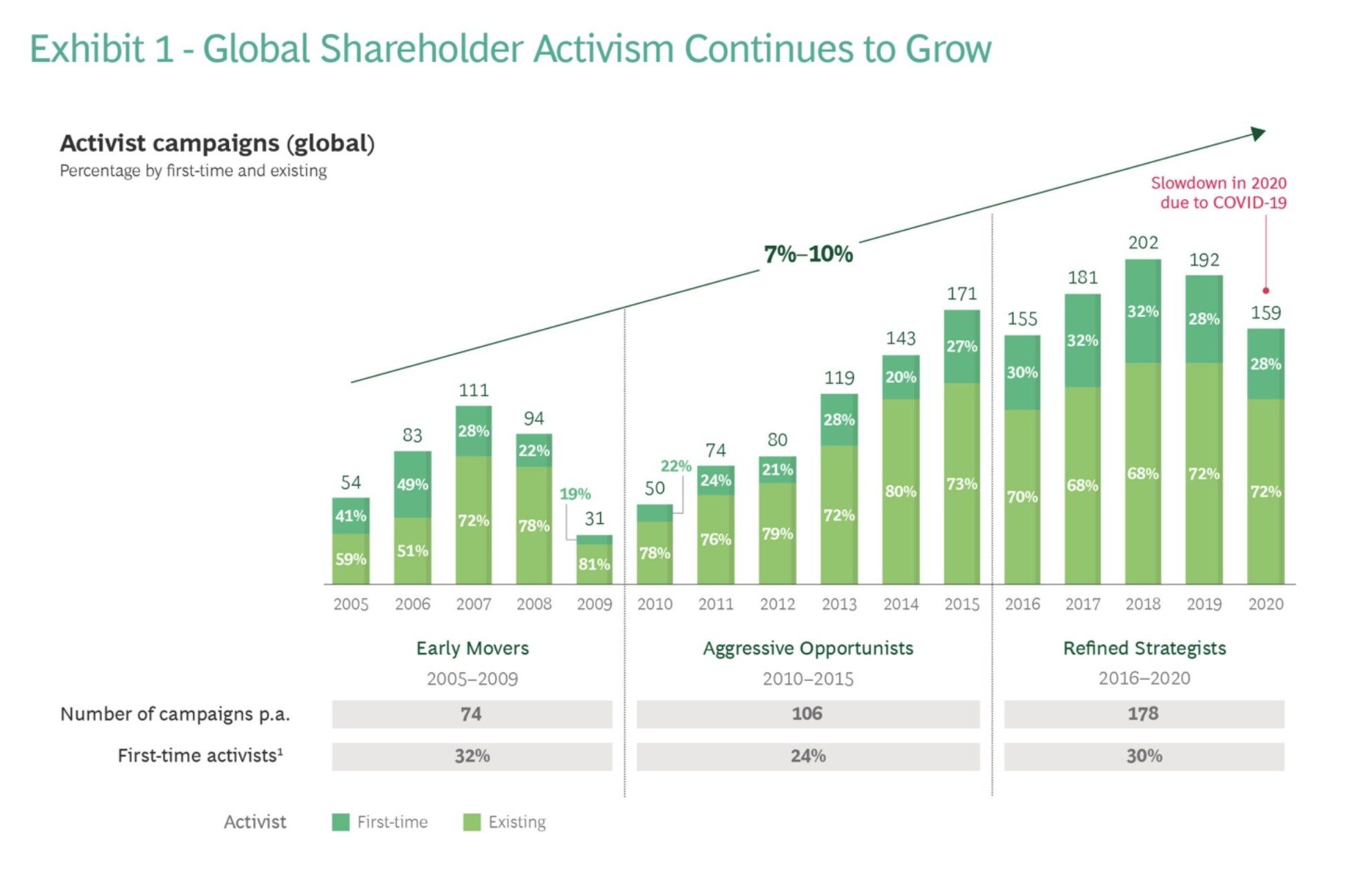

Trends in Global Activism Campaigns (Source: BCG)

Who are the Top Activist Investors?

| Activist Investor | Firm Name |

|---|---|

| Carl Icahn | Icahn Enterprises |

| Nelson Peltz | Trian Partners |

| Dan Loeb | Third Point |

| Jeff Smith | Starboard Value |

| Barry Rosenstein | JANA Partners |

| Paul Singer | Elliott Management |

| Bill Ackman | Pershing Square |

Given their past high-profile activist campaigns, Carl Icahn and Nelson Peltz are arguably the most well-known activist investors.

Interestingly, most of the top activist investment firms are public figures, whereas many successful, non-activist hedge funds attempt to stay out of the spotlight.

In particular, Icahn is renowned for his aggressive, often confrontational, tactics to pressure the management teams of public companies.

The success of an activist firm is contingent on their ability to gain shareholder trust (or, sometimes, the trust of the management team).

But one of the most important traits is of activist investing is, in fact, the ability of the activist to attract public attention and have a public platform to promote their recommendations.

Activist Investing Example: Starboard Value and Salesforce

For a real-life example, Starboard Value – one of the top activist funds – criticized Salesforce (CRM) in 2022 with most of the analysis centered on recent performance and a lack of strategic direction.

Starboard’s concerns are delineated in a comprehensive, in-depth analysis of Salesforce’s operational and reported financial metrics, including comparisons to its industry peers to better illustrate the risk at which the company’s current market positioning is in.

The underperformance of Salesforce is reflected in its share price and valuation set by the open markets – where Salesforce trailed benchmark indices and the broader market over the last three years.

On that note, Salesforce was trading at a steep discount relative to its peer group on forward-looking revenue and free cash flow (FCF) metrics, despite the leading market position and consistency in long-term growth.

The compression in Salesforce’s profit margins while exhibiting subpar growth trailing its industry comparables caught the attention of multiple activist investors, not just Starboard.

The underperformance of Salesforce cannot be attributed to merely one factor, but the fact of the matter is, the shortcomings of the CRM software provider in meeting its growth and expected margin targets is not sustainable.