- What is Market Share?

- What is the Definition of Market Share?

- How to Calculate Market Share

- Market Share Formula

- How to Analyze Market Share

- Market Share Calculator

- 1. Market Share Calculation Example

- 2. Market Share Analysis Example

- How Does Market Share Impact Profitability

- How to Forecast Revenue Using Market Share

- How to Increase Market Share

- How to Protect Market Share

What is Market Share?

The Market Share is the percentage of revenue attributable to a particular company relative to the total revenue generated within a given industry.

Simply put, the market share of a company quantifies its percent contribution towards the total sales produced in a specific industry over a specified time frame.

- The market share is the proportion of the total sales in a specific industry attributable to a particular company.

- The formula to calculate market share divides a company's sales by the total sales of the industry across a given period.

- The relative market share compares a company's market share to its market leader, expressed as a percentage.

- The methods to increase market share include offering differentiated products, building customer loyalty to reduce churn, setting pricing rates efficiently, and utilizing effective customer acquisition strategies.

What is the Definition of Market Share?

The market share of a company illustrates its size relative to the rest of the industry it operates in and its competitive positioning at present.

The process of estimating a company’s market share can be useful for estimating the revenue opportunity within a specific market.

- Low Market Share → There is likely more upside remaining in growth and scalability for the company.

- High Market Share → The company is likely a market leader, which might need to shift its priority to defending its existing share and profit margins from new entrants.

If established market-leading companies seek additional growth, the best course of action could be to implement one or more of the following strategies:

- Entering New or Adjacent Markets

- Introducing Products and Services into Current Mix of Offerings

- Engaging in M&A for Inorganic Growth (e.g. Add-On Acquisitions)

How to Calculate Market Share

The market share of a company can be calculated using the following three-step process.

- Determine the Sales Generated by the Company Over a Specified Period

- Calculate the Sum of Total Sales by All Industry Participants Over the Same Time Frame

- Divide the Company’s Sales by the Total Market Sales

Conversely, the market share of a given company can be determined using the unit sales (i.e. number of product units sold), as opposed to revenue figures.

- Determine the Number of Product Unit Sales by a Company Over a Given Period

- Calculate the Total Number of Unit Sales by All Industry Participants in the Corresponding Period

- Divide the Company’s Unit Sales by the Total Unit Sales in the Market

Market Share Formula

The formula for calculating the market share of a company divides a company’s sales by the total sales of all companies operating within the respective industry over a specified period.

Where:

- Company Sales → The revenue reported by a particular company over a pre-defined period.

- Total Market Sales → The total revenue generated within a specific industry.

An alternative approach to compute a company’s market share is by using unit sales rather than monetary figures (i.e. revenue).

Using the unit sales approach, the market share formula divides the number of product units sold by a particular company by the total product unit sales in the entire industry.

Where:

- Company Unit Sales → The total number of product units sold by a particular company over a specified period.

- Total Unit Sales in Market → The total number of product units sold in a given market among all industry participants.

Note that it is critical that the time frame covered must match in the numerator and denominator for the metric to be practical.

How to Analyze Market Share

The most straightforward method to analyze a company’s market share is to calculate the percentage of the market captured by a given company and determine if the company is positioned as a market leader with a substantial percentage of the market.

Further, tracking the historical trajectory in the company’s market share is useful for gauging its growth trends.

While market share growth is perceived favorably by practically all equity analysts and market participants, the retention of the prior market share – i.e. constant percentage – can also be a positive signal, particularly in a high-growth market.

Another closely related metric, the “relative market share,” is calculated by dividing a company’s market share by the market share belonging to its top competitor.

To estimate the relative market share, we take the market share of the company in question and then divide it by the market share of its top competitor.

The formula to calculate the relative market share is as follows.

The metric can gauge how a company fares against the current market leader, i.e. the market leader’s market share is used as the benchmark.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayMarket Share Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

1. Market Share Calculation Example

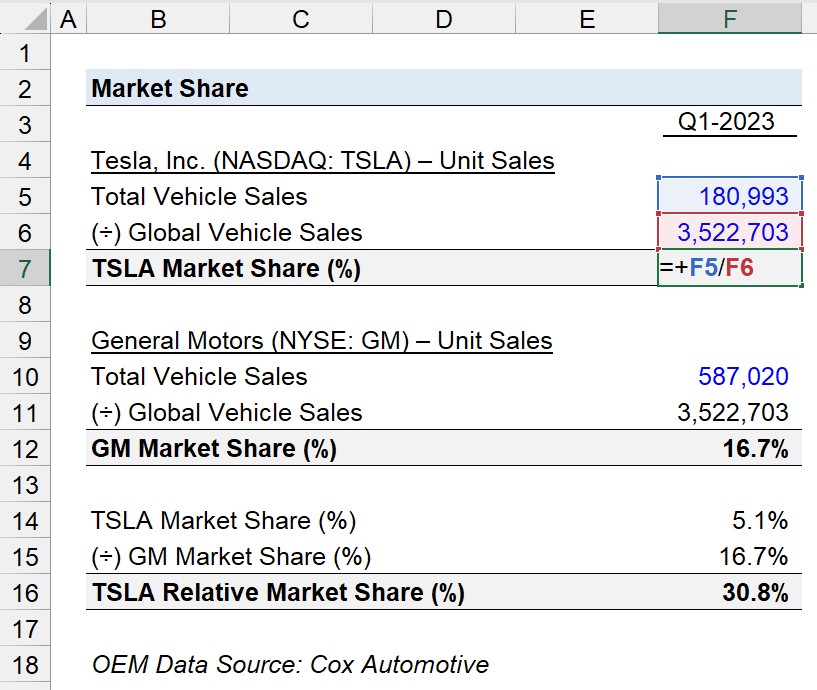

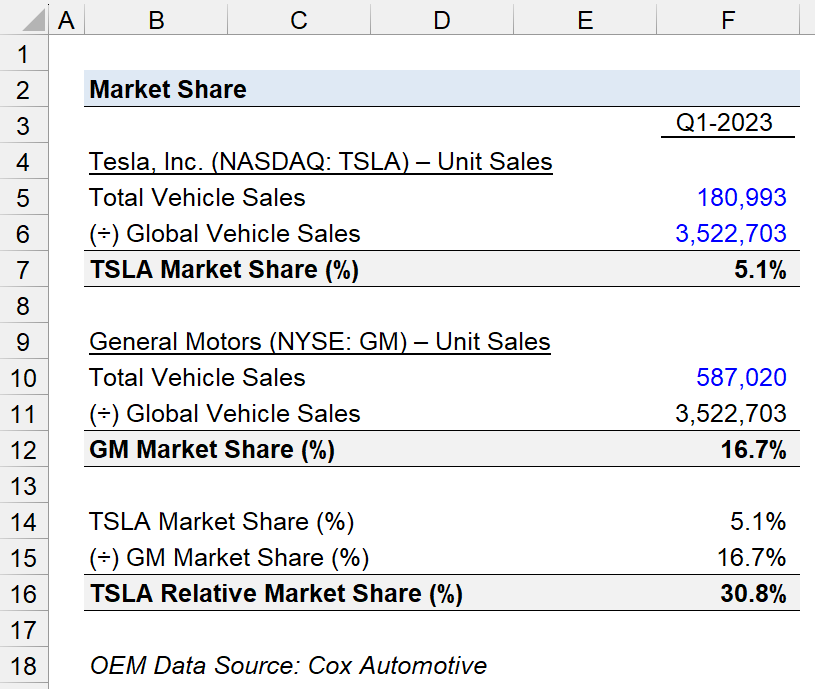

Suppose we’re tasked with calculating the market share of Tesla (NASDAQ: TSLA) in the global automotive market.

While Tesla is a market leader in the electric vehicles (EV) market by a substantial margin, especially in the U.S. market, its share is on the lower end in terms of global vehicle sales.

Per automobile sales figures reported by Cox Automotive, the total vehicle sales globally in Q-1 of 2023 was 3.5 million.

- Global Vehicle Sales = 3,522,703

The estimated number of vehicle sales by Tesla in Q1 of 2023 was approximately 181k, while General Motors (NYSE: GM) sold an estimated 587k vehicles.

- Tesla (TSLA) – Total Vehicle Sales = 180,993

- General Motors (GM) – Total Vehicle Sales = 587,020

By dividing the total vehicle sales by each automobile manufacturer by the global vehicle sales figure, we arrive at 5.1% and 16.7% in market share for Tesla and General Motors, respectively.

- Tesla (TSLA) – Market Share (%) = 180,993 ÷ 3,522,703 = 5.1%

- General Motors (GM) – Market Share (%) = 587,020 ÷ 3,522,703 = 16.7%

2. Market Share Analysis Example

From the prior section, we’ve determined that the market share of General Motors (GM) in the global automobile industry is over 3.0x that of Tesla (TSLA) as of the start of 2023.

The relative market share of Tesla (TSLA), compared to General Motors (GM), is 30.8%, which represents the proportion of market share belonging to Tesla in relation to the market leader, General Motors.

- Tesla (TSLA) – Relative Market Share (%) = 5.1% ÷ 16.7% = 30.8%

How Does Market Share Impact Profitability

Growing market share is directly tied to achieving scalability, which in turn improves profitability, i.e. economies of scale and network effects.

In short, market leadership and sustainable long-term profits go hand in hand, as both attributes stem from the same underlying drivers.

There is a clear connection between market share and profitability, as market leaders tend to be more profitable than those with low market shares.

Companies attempting to obtain more market share are, more often than not, spending cash at a rapid pace – whereas mature companies possess more established business models and operate with greater efficiency.

Often, companies with stable, long-term market leadership that have been able to maintain their position consistently are perceived to have an “economic moat.”

How to Forecast Revenue Using Market Share

The current market share of a company and the market size are important pieces of top-down forecasting, which is an approach used to project sales using a company’s total addressable market (TAM) and a market share assumption.

The formula to forecast revenue using the top-down method multiplies the estimated market size (i.e. total addressable market, or “TAM”) by a market share assumption.

Where:

- Market Size ($) → The total revenue opportunity in a particular market at present.

- Market Share Assumption (%) → The projected percentage of the total market assumed to be obtained by a given company.

If a company’s market share has been growing in recent years, its current and projected growth rate is likely outpacing its industry peers.

Conversely, if a company’s goal is to maintain its existing market share, it must continue to grow at the same rate as the total market.

How to Increase Market Share

The notion that offering the most innovative products and services mix can increase market share certainly has its merits.

Generally, capturing more market share arises from delivering the most value to customers and providing the leading user experience available in the market.

But there are exceptions, such as marketing-oriented industries, where competition is based on intangible factors such as reputation and branding, rather than product quality.

Still, strategizing around methods to offer distinct value propositions that satisfy unmet customer needs in the target end market is a reliable route toward obtaining market leadership.

Companies with differentiated, innovative offerings can grab a higher percentage of a market more easily as customers migrate from their competitors that might lack technical capabilities.

How to Protect Market Share

The common methods employed by companies to protect their market share are as follows.

- Improve Customer Retention → Customer retention is arguably more important than new customer acquisitions when it comes to protecting market leadership, especially over the long run. A loyal customer base means recurring revenue and opportunities for upselling and cross-selling tactics. In short, an existing customer is easier to sell and convert than a new customer (and cheaper).

- Reduce Customer Churn Rate → On a similar note, companies must strive to reduce customer churn, which is a function of understanding their customers’ specific needs – i.e. insights enabling companies to serve those customers better. More specifically, the causes of past churn in customers must be identified and improved, or else the issue will only compound with time.

- Prioritize “Word of Mouth” Marketing → After building trust and loyalty with their customer base, companies can benefit from more reliable sales, as well as more organic growth and “word of mouth” marketing.

- Reinvest in Product and Service Capabilities → Companies must also continuously reinvest (e.g. capital expenditures, research and development) and be prepared to adapt to unexpected developments in the market, especially for those operating in markets at risk of disruption.

- Strategic Acquisitions → Another common defensive tactic is to acquire high-growth companies, which nowadays are usually technology-oriented. Instead of fending off the threat using internal resources, the decision by an incumbent to engage in M&A to acquire a smaller-sized company and integrate its technological capabilities into its current offerings can often be more profitable over the long term.

If market leaders become complacent and stop improving, it is only a matter of time before a different company disrupts the market to capitalize on the opportunity.

The downfall of Blockbuster (and the rise of Netflix) is one frequently used real-world case study of an incumbent refusing to adapt to changing consumer trends until it was far too late.