What is the Salary for Investment Bankers?

In 2021, major investment banks announced pay raises for junior bankers amid criticism regarding increasing workloads during the work-from-home (WFM) period, as well as the increased focus on analyst retention.

Investment Banker Base Salary and Bonuses (2021 Update)

Before we discuss the recent developing trends, note the following article focuses specifically on the changing landscape of the investment banking industry entering 2022.

For our comprehensive guide on the average IB salaries starting from the analyst level to managing directors (MDs), see the linked post below:

The data shown in the chart are approximations for bulge bracket banks (BBs) and elite boutiques (EBs), so regional banks and boutiques should expect lower amounts.

For bonuses, the standard rate is between 50% to 100% of the base salary, but the amount is contingent on the specific group/investment bank.

Investment Banking Firm: Compensation Structure

To preface our updated data on investment banking salaries, we’ll start by briefly explaining the compensation structure at investment banks.

Investment banks generate revenue primarily through advising on financial transactions, such as:

At the analyst level – the lowest ranking in the investment banking hierarchy – hires are made directly out of undergraduate schools.

The compensation in investment banking consists of two parts:

- Base Salary: The guaranteed compensation received.

- Bonus: The extra compensation received – which depends on firm/group deal flow and individual performance (i.e. “bottom-bucket” vs. “top-bucket”).

The higher up the investment banking hierarchy, the more bonuses are received, which are ultimately contingent on the amount of deal flow directly brought in by the individual.

Investment Banker Salary: New Developments and Industry Outlook

The sharp economic rebound in deal activity in 2021 following the initial breakout of COVID has turned into unprecedented workloads for investment bankers, which is coupled with a competitive job market as firms attempt to retain top talent while making new hires.

One catalyst for the trend to increase salaries was leaked complaints by junior analysts regarding 100+ hour work weeks, which brought up concerns regarding the physical and mental health of these recent graduates during COVID-19 amidst remote working conditions.

The major takeaway for 2021 is that the base salary for first-year investment banking analysts is now set at $100,000 minimum across most firms, with further hikes expected in 2022.

Moreover, most firms have announced that bonuses will be higher than the prior-year – ranging from 20% to 50% higher compared to 2020 – as our next section shows.

Bulge Bracket Banks Pay: Goldman Sachs and JP Morgan Bonuses

Goldman and JP Morgan 2021 Bonuses (Source: Financial Times)

Investment Banking Associate: Compensation Changes?

To date, it is not yet clear if the higher base salaries will materially impact year-end bonuses – but the outlook for 2021 seems positive.

As for compensation changes for associates and beyond, increased associate base salaries should also be expected.

However, to reiterate from the earlier section, the core issue has been on analyst retention and addressing the problems related to the increased workload (i.e. that is potentially unsustainable) for these fresh university graduates.

Bulge Bracket (BBs) vs. Elite Boutique (EBs) Salaries

Generally, bulge bracket banks (BBs) compensate their newer analysts with pay on-par (or even below) the average rate.

The reason that bulge bracket banks are able to pay relatively lower salaries yet continue to attract top-tier talent is due to the fact that their branding directly leads to better exit opportunities.

Historically, elite boutiques have been known for paying their analysts classes slightly more than bulge brackets.

The primary reason why elite boutiques can afford to pay slightly higher salaries is because of their reduced overhead expense structure, meaning that more of the revenue generated flows directly to the deal team.

Investment Banking vs. Buy-Side Compensation (Private Equity, Hedge Fund)

For analysts seeking to exit into buy-side roles – e.g. private equity or hedge funds – the previous employer matters significantly, but the difference between having been at a bulge bracket vs elite boutique is unlikely to be the main determining factor of whether you receive an offer or not.

Instead, the reputation of the IB group, deal experience, and the overall interview takes precedence over the bulge bracket vs elite boutique distinction itself – as most on the buy-side are familiar with the banking industry broadly.

But for those seeking exits into corporate finance or start-ups, a name like Goldman Sachs and J.P. Morgan is far more likely to be recognized to people outside corporate finance than an elite boutique such as Moelis – despite the fact that all three firms are clearly prestigious, top firms.

In particular, Centerview Partners has obtained a reputation for consistently paying above the rest of the market, with salaries for analysts often rivaling that of private equity and hedge fund firms – i.e. a top-bucket 3rd-year analyst at Centerview can make in excess of $250k.

Investment Banking Industry: Compensation Outlook in 2022

In recent years, the gap between bulge-bracket and elite boutique salaries has been closing to attract top talent in recruiting – not to mention, the growing interest in pursuing non-investment banking careers paths among university students (e.g. technology).

The ongoing efforts to retain analyst classes amid increased competition remain a key driver of salaries for investment bankers, which will likely continue to increase in the coming years.

Investment banking salaries – especially the bonus portion – fluctuate based on the overall deal volume of the firm and industry.

Regardless, the fact remains that investment banking is still one of the highest paying occupations out of undergraduate.

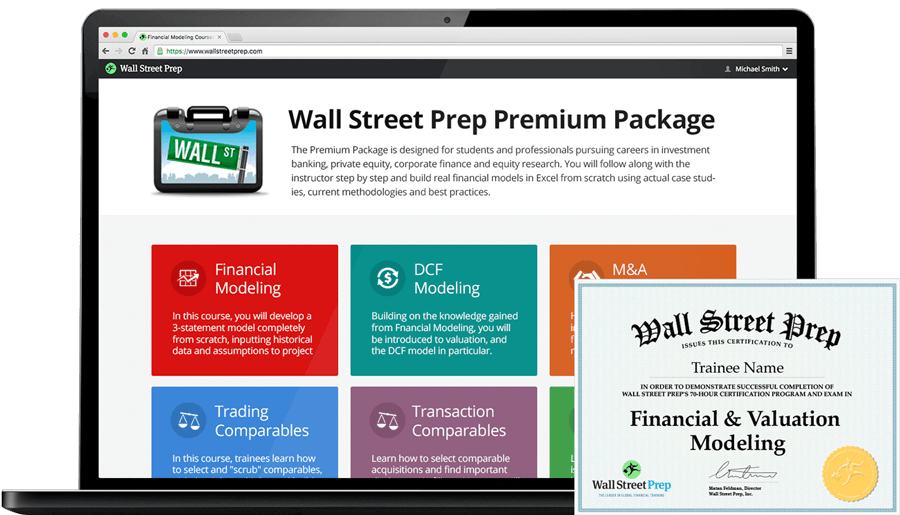

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today