- What is Dow Jones?

- What Does the Dow Jones Index Indicate?

- Dow Jones Industrial Average (DJIA): Index Methodology

- Who were the “Original 12” Companies?

- Dow Jones Index (DJIA): List of 30 Companies

- Dow Jones Structure (DJIA): Price-Weighted Index

- What is the Dow Divisor?

- Dow Jones (DJIA) vs. S&P 500 Index: What is the Difference?

- What is the Dow Jones Index at Today?

What is Dow Jones?

The Dow Jones Industrial Average (DJIA) is a price-weighted stock market index tracking the share price movements of 30 publicly traded, blue-chip companies.

What Does the Dow Jones Index Indicate?

Established in 1896, the Dow Jones Industrial Average (DJIA), or simply the “Dow Jones”, was one of the first stock indices created to serve as a performance indicator of the stock market.

Currently, the Dow Jones Index ($DJIA) has remained one of the most widely followed indicators of stock market performance.

- Structure → Price-Weighted Index

- Constituents → 30 Companies

- Index Quote → DJIA

- Bloomberg Ticker Symbol → $INDU.DJI

In practice, the Dow Jones (DJIA) functions as a “barometer” to grasp the conditions in the U.S. stock market (and economy) at present, which in turn, is used to form an opinion on the outlook of the markets.

The Dow Jones index (DJIA) tracks thirty large-cap, public U.S. companies and is used as a proxy to measure the current state of the broader financial market as a whole (and economy).

Despite the fact that the Dow Jones only tracks publicly-traded equities, the performance of the index has broad implications across practically all asset classes, such as the bonds, real estate, and commodities.

Why? Most participants in the stock market are not constrained to investing in publicly-traded equities.

For the sake of managing risk, most investors – especially institutional investors, such as a hedge fund – diversify their portfolio holdings across different asset classes.

Hence, there tends to be a significant flow of capital into gold (i.e. negative beta) and risk-free securities (i.e. government issued bonds) if the near-term outlook on the public markets implies an economic contraction, or recession, could perhaps be on the horizon.

Dow Jones Industrial Average (DJIA): Index Methodology

The Dow Jones (DJIA) is a price-weighted index, contrary to the S&P 500, which is capitalization weighted, i.e. the contribution of an individual security is in proportion to their market capitalization (or “market cap”).

In effect, the stocks with higher share prices can have a disproportionate impact on the performance of the index relative to those with lower share prices.

That attribute, coupled with the fact that the only 30 companies comprise the index, is a common source of criticism, since the overall performance can be concentrated on a select few companies.

For that reason, the sole reliance on the Dow Jones (DJIA) index by itself to gauge the broader market is not recommended – however, that rule applies to all indices, not just the Dow.

Learn More → Dow Jones Fact Sheet (Source: S&P Global)

Who were the “Original 12” Companies?

Originally, the Dow Jones Industrial Average index (DJIA) was composed of merely twelve companies in the industrials sector.

Established by Charles Dow, Edward Davis Jones, and Charles Bergstresser, the “Original 12” that comprised the Dow Jones index were the following companies – which we’ve listed here in alphabetical order:

The “Original 12” Companies

- American Cotton Oil

- American Sugar

- American Tobacco

- Chicago Gas

- Distilling & Cattle Feeding

- General Electric

- Laclede Gas

- National Lead

- North American

- Tennessee Coal and Iron

- U.S. Leather

- U.S. Rubber

Around the period in which the Dow Jones index was created – i.e. post-recession – the Original 12 companies in the Dow were market leaders and considered the most influential companies in their respective fields (e.g. coal, gas, rubber, leather).

However, note the pattern in the fields, where each of the companies operated in the industrial sector.

From the perspective of the founders, tracking the DJIA index was intended to serve as a useful measure of not only the stock market but also the U.S. economy.

Considering the widespread use of the Dow Index across mainstream media today in 2023 – such as Bloomberg, CNBC, Financial Times, and the Wall Street Journal (WSJ) – that objective at inception seems to have been achieved.

Since then, the DJIA index has shifted to expand beyond just the industrial sector to more accurately gauge the health of the entire stock market, despite the name remaining unchanged (i.e. “Industrial Average”).

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 10 - Apr. 6 cohort.

Enroll TodayDow Jones Index (DJIA): List of 30 Companies

As of November 2023, the following list contains the companies that serve as the underlying components of the Dow Jones index (DJIA)

By tracking these 30 blue-chip companies – each prominent companies in their respective industries – investors can obtain insights into the performance of the stock market and U.S. economy, which is tied to the global economy, considering the rise in globalization since the date of the origination of the index.

The components of the DJIA are formally reviewed periodically by a committee, and a company can be replaced to ensure the composition of the index (and performance) reflects the current financial markets and economic landscape.

| Company Name | Ticker Symbol |

| 3M | NYSE: MMM |

| American Express | NYSE: AXP |

| Amgen | NASDAQ: AMGN |

| Apple | NASDAQ: AAPL |

| Boeing | NYSE: BA |

| Caterpillar | NYSE: CAT |

| Chevron | NYSE: CVX |

| Cisco Systems | NASDAQ: CSCO |

| Coca-Cola | NYSE: KO |

| Dow Inc | NYSE: DOW |

| Goldman Sachs Group | NYSE: GS |

| Home Depot | NYSE: HD |

| Honeywell International | NASDAQ: HON |

| Intel Corp | NASDAQ: INTC |

| International Business Machines (IBM) | NYSE: IBM |

| Johnson & Johnson | NYSE: JNJ |

| JPMorgan Chase & Co | NYSE: JPM |

| McDonald’s | NYSE: MCD |

| Merck & Co | NYSE: MRK |

| Microsoft | NYSE: MSFT |

| Nike | NYSE: NKE |

| Procter & Gamble | NYSE: PG |

| Salesforce.com | NYSE: CRM |

| Travelers Companies | NYSE: TRV |

| UnitedHealth Group | NYSE: UNH |

| Verizon Communications | NYSE: VZ |

| Visa | NYSE: V |

| Walgreens Boots Alliance | NASDAQ: WBA |

| Walmart | NYSE: WMT |

| Walt Disney Co | NYSE: DIS |

Dow Jones Structure (DJIA): Price-Weighted Index

The other prominent stock market indices, notably the S&P 500 and Nasdaq composite, are weighted by market capitalization (or “market cap”).

The market capitalization is calculated by multiplying the latest closing share price of a company by its total number of shares outstanding, which is a better approximation of relative size than share prices by themselves.

Conversely, the Dow Jones Industrial Average (DJIA) is price-weighted, meaning that the value of the DJIA is based on the average stock prices of the 30 companies tracked by the index.

Therefore, the average value of the Dow Jones index could be derived by simply adding together all the stock prices and then dividing by the total number of companies, which is 30 in total.

What is the Dow Divisor?

However, the method of computation for the Dow Jones index (DJIA) becomes less straightforward (and potentially misleading to investors) if certain corporate events that complicate the basic arithmetic are taken into consideration, such as the following:

- Mergers and Acquisitions (M&A)

- Stock Splits

- Reverse Stock Splits

- Shareholder Dividends

- Stock Buybacks

The aforementioned flaw in the Dow Jones index, which had received much criticism, is the reason for the “Dow Divisor”.

The “Dow Divisor” was formally introduced later to adjust for these complexities.

The divisor is the denominator by which the sum of the 30 share prices is divided, so the extra step is to divide the sum of all 30 share prices by the divisor.

Dow Jones (DJIA) vs. S&P 500 Index: What is the Difference?

The structure of the Dow Jones (DJIA) is on a price-weighted basis and therefore does not factor in market capitalization like other indices, which is one of the drawbacks that receives scrutiny.

While the Dow Divisor normalizes against corporate actions that could skew the index price, the calculation is still prone to placing “more weight” on the highest-priced stocks.

In effect, the share price movement of companies with higher stock prices has a greater impact on the index than those with lower prices – even if the total market capitalization of the companies is comparable.

Another shortcoming of the Dow Jones (DJIA) is its limited scope as the index is only composed of 30 stocks, significantly lower than other indices:

- S&P 500 Index → Tracks ~500 Large-Cap Companies

- Nasdaq Index → All Stocks Listed on Nasdaq Stock Exchange (~2,500 Companies)

- Nasdaq-100 → ~100 Non-Financial Large, Cap Companies

The S&P 500 and the Nasdaq are also more concentrated around technology stocks relative to the Dow Jones (DJIA) – which, in comparison, has far less exposure to the tech sector.

For instance, companies such as Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), and Meta (NASDAQ: FB) are excluded from the Dow Jones Index, yet comprise major components of rival indices.

The DJIA is often criticized for under-weighting the technology sector while placing too much weight on cyclical sectors such as financial institutions (e.g. J.P. Morgan) and industrials (e.g. 3M, Caterpillar).

In spite of the aforementioned shortcomings, the Dow Jones index (DJIA) still remains one of the most frequently tracked stock market indices among market participants and equity analysts.

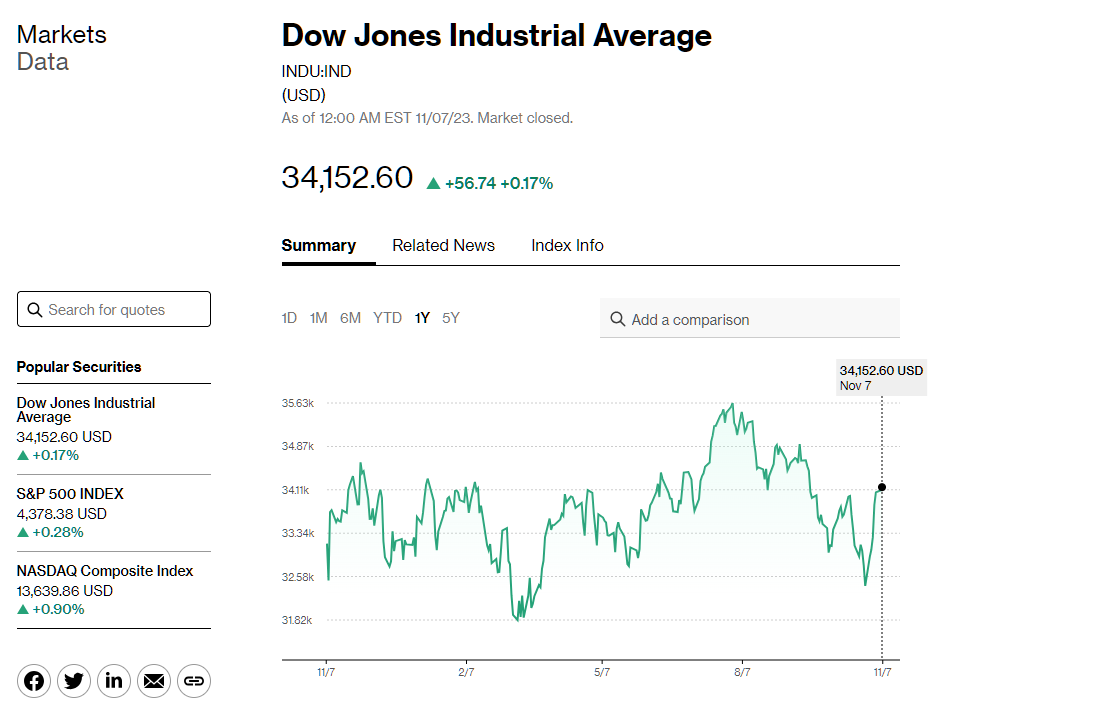

What is the Dow Jones Index at Today?

The Dow Jones (DJIA) index now tracks the performance of 30 companies in real-time, with a more diverse distribution of industries represented.

Combined, the index helps investors grasp the prevailing stock pricing trends and general market performance, with the index readily available on sites such as the following financial resources:

From any of the resources listed above (and more financial sites online), one can easily check the performance of the Dow Jones (DJIA) index on any given trading day.

DJIA 2023 Year-to-Date Performance (Source: Bloomberg)

How to see the trend line of a particular stock